<New option, separately licensed>

Last year, we announced support for merchant instalments within open-loop consumer finance schemes in Way4 Acquiring. Cardholders can choose the instalment option at checkout with financing by the merchant or acquirer. Usually, such schemes work in countries where acquirers and issuers have agreed on eligible BINs and applicable conditions. Merchant instalments are interest-free for buyers and increase credit card turnover for issuers.

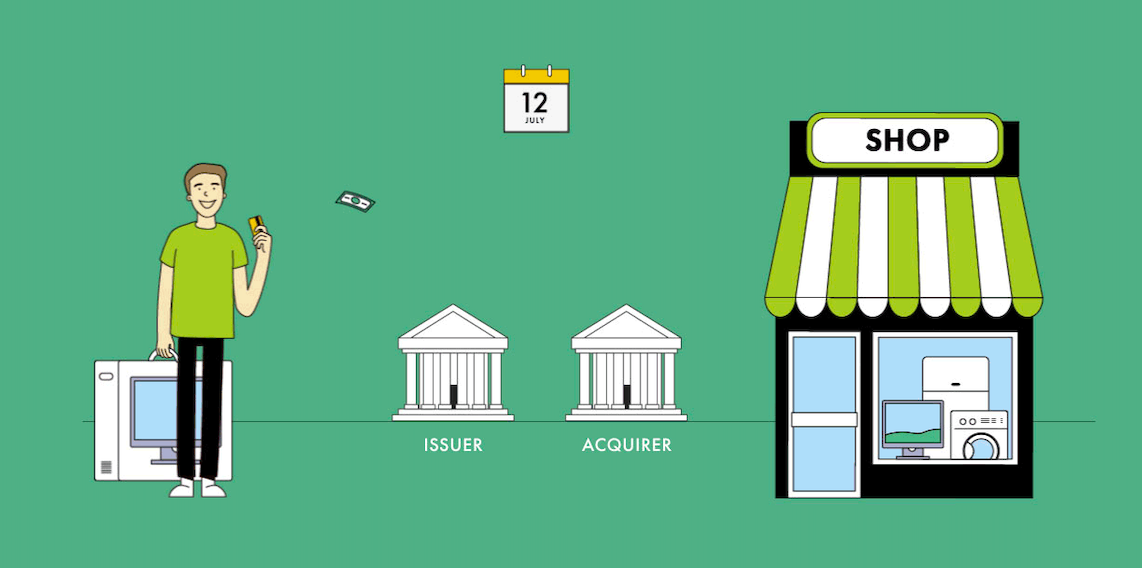

With this release, instalments are also available from the issuer side with Way4 Issuing. Here is how they are processed:

-

A partner acquirer sends a request to create an instalment plan. Way4 checks if the cardholder’s account has sufficient funds to cover the full purchase.

-

Way4 blocks these funds on the cardholder’s account and sends approval to the acquirer.

-

According to the instalment plan, every month Way4 will receive a payment request from the acquirer and debit the instalment amount from the blocked amount.

-

Using Way4 web services, the issuer’s staff can pull up information about the customer’s instalment plans and push it to third-party systems such as CRMs or digital banking apps.

-

In the event of a refund, Way4 Issuing receives a credit transaction and presentment portions from the merchant via the acquirer and processes them accordingly.

More information about support for merchant financing and merchant instalments on the acquirer side is provided in the release notes for the previous Way4 version.