Way4 Buy-Now-Pay-Later software

Experience unparalleled flexibility with Way4 BNPL

The Way4 BNPL solution is flexible enough to support diverse local requirements and unique visions of banks, processors, and fintech innovators. Whether you need a standard or personalized solution, the Way4 platform empowers you to build, modify, and test various BNPL models tailored to your unique business cases and customer needs.

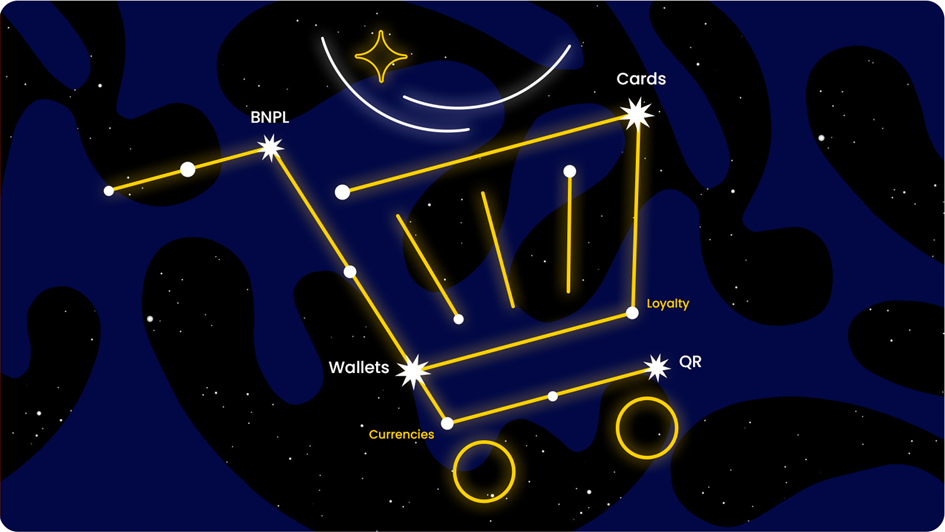

The Way4 platform facilitates customization and personalization of BNPL products, providing a fully online payment functionality, high scalability, and over 100 configurable parameters. It supports BNPL card or non-card products and accounts, flexible installment schedules with weekly options, multi-currency offerings, tokenized payments, data analytics, and reporting. Whether operating in closed or open-loop systems, Way4 adapts effortlessly to your needs.

Beyond retail, the Way4 platform configurable capabilities extend to high-growth verticals such as automotive, healthcare, and travel. It supports an omnichannel experience, ensuring seamless services for merchants and customers across various channels.

Maximize ROI and minimize TCO

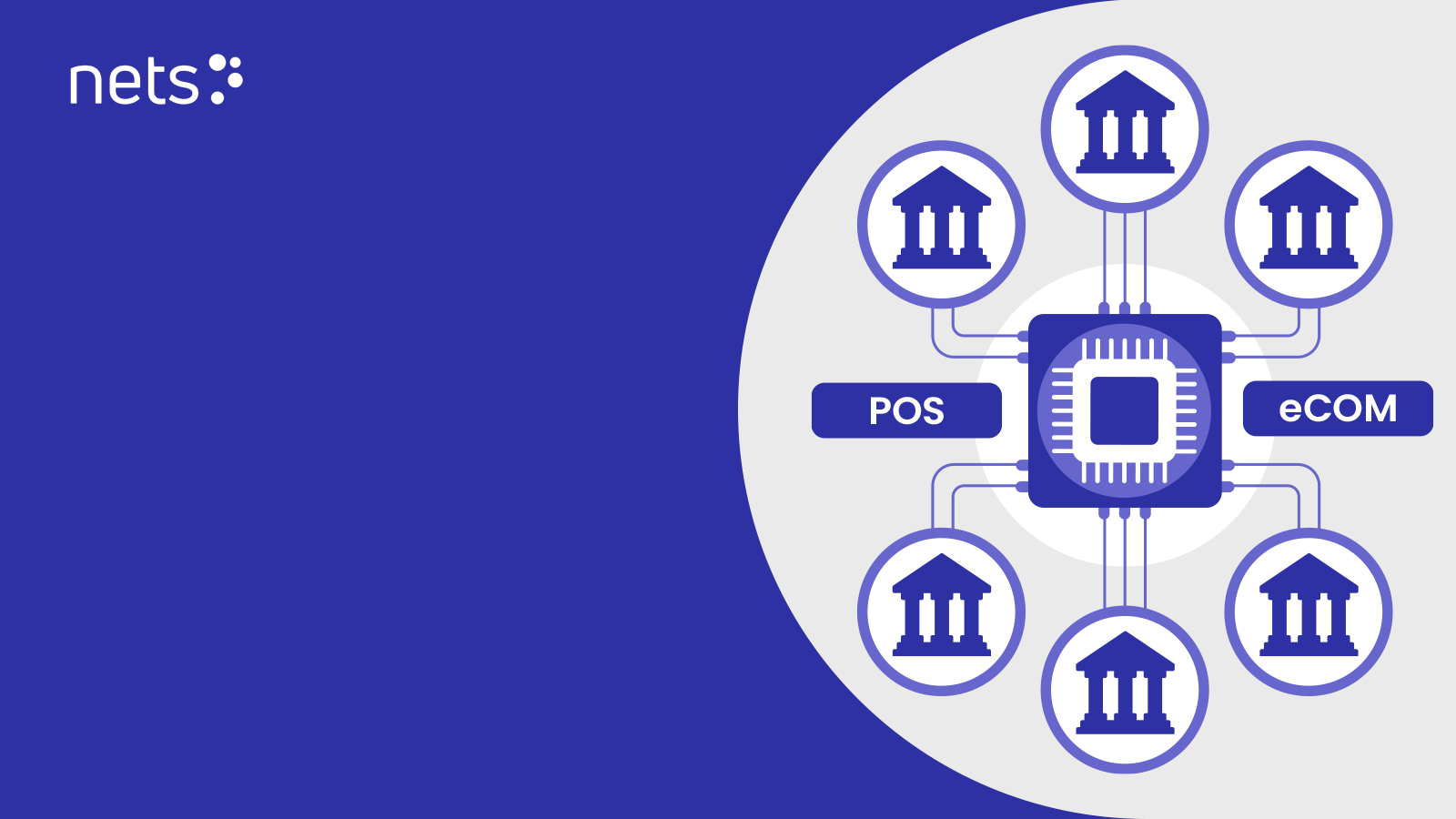

OpenWay clients save significantly with Way4 BNPL, as it eliminates the need to invest in a new payment system or multiple platforms. It offers a cost-effective and streamlined way to integrate BNPL solutions through APIs with banks, vendors, merchants, and channel partners, cutting down on implementation costs and minimizes Total Cost of Ownership (TCO) while boosting operational efficiency. The platform boasts 99.99% uptime and meets all IPS requirements. It also maintains high-security standards with 3DS, and is PCI SSF certified.

Way4 BNPL also increases profitability and growth by eliminating costs associated with establishing merchant acceptance partnerships. Merchants are automatically enrolled into the BNPL program through integrations with Mastercard BNPL and Visa (VIS) programs. It works in both open-loop systems with IPS and closed-loop configurations.

The Way4 platform enhances cost-effectiveness by offering virtual instalment cards instead of physical cards. These virtual payment methods are instantly available via mobile wallets, ensuring a convenient, seamless, and secure payment experience for both merchants and customers, whether in-store, e-commerce, or in-app.

“We believe that to become a leader on a new market and keep your leadership, we need to work with trusted leaders. We have chosen OpenWay because it was critical for us the high quality of the Way4 platform, fast time to market, successful experience of OpenWay globally and locally, excellent client service, and high operational efficiency. Moreover, the OpenWay team has demonstrated deep technological knowledge and advanced expertise that will help us to grow our credit finance business and respond to the high demand for credit products from our customers in Vietnam.”

Accelerate the launch of new products and services

The Way4 BNPL solution is built on the highly configurable Way4 digital software platform, offering over 100 customization parameters for rapid deployment of new products and services. Developed in close collaboration with our clients, our innovative solutions are crafted by OpenWay’s team of experts.

Way4 stands out as one of the few platforms for card issuing and loan management that features a 24/7 online back and front office, real-time front-to-back reconciliation, and online accounting. This enables customer onboarding and plan activation in seconds instead of minutes, dramatically streamlining operations and boosting efficiency. For payment processors, this capability means unique BNPL programs can be launched in just a few months.

Leading processor in the Nordics

Winner of the "Best Consumer Payments Initiative" award from PayTech

“Our main goal is to make financing as easy and intuitive as possible for consumers. We’ve designed the solution for financial institutions with this in mind, focusing on easy availability of products. Financial institutions can connect to UDLP easily and start offering lending products within 2-3 months. They can easily onboard both brick-and-mortar and e-commerce partner merchants to the solution, as well as offer direct lending products to consumers, like the possibility of retrospectively converting a transaction as an instalment.”