mVisa Issuer SDK

<A new set of product options, separately licensed>

Issuers can now add mVisa QR-code payments to their mobile apps, by integrating our WAY4 mVisa Issuer SDK. Despite its name, our solution works with cards of Visa, Mastercard and any other payment system.

When using the new functionality, buyers either scan the merchant’s QR code or manually enter the merchant ID. Manual entry is crucial in countries where feature phones are more common than smartphones, such as Kenya, Indonesia or Venezuela. Then the buyer chooses the preferred card for this payment. It can be a card issued by their mobile app provider or a linked card from another issuer. The last step is to type in the payment amount and confirm the transaction.

WAY4 can also process payments that involve closed-loop QR codes.

Sample screens of an mVisa payment process

For issuers this functionality is part of WAY4 Consumer Wallet. For acquirers, the acceptance of QR-code payments is part of WAY4 Merchant Wallet. This acquiring solution works with mVisa, closed-loop and Alipay QR codes.

Direct Debit for Payment Subscriptions

<A new set of product options, separately licensed>

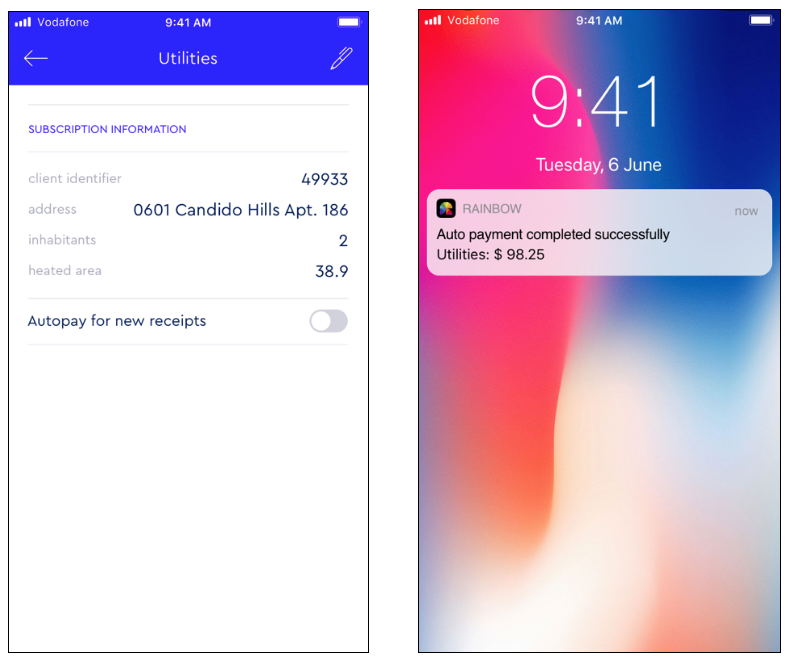

Sample screens of direct debit enablement

WAY4 digital channels now support the direct debit functionality, also known as pre-authorized debit or automatic bill payments.

The banking menu provides the list of possible payees – utility providers, tax or traffic authorities, insurance companies, etc. The user selects which bills to pay automatically and which card or account to use for each company. When a bill or payment request arrives, WAY4 automatically debits the selected account for the requested amount and sends a push or SMS notification to the user.

If the transaction fails (for instance, because of insufficient funds), WAY4 repeats the attempt and then notifies the customer via push message or SMS.

Online Request and Delivery of Statements from CBS

<A new set of product options, separately licensed>

Sample screens of the statement request

Cardholders can now request and receive statements from core banking systems via WAY4 web and mobile banking apps. This helps to relieve the pressure on bank branches to produce paper statements and perform routine customer requests. And frees up branch staff to focus on high-margin products and premium customer segments.

The cardholder can choose to receive the documents via e-mail or download them straight from the app.

Integration with Money Remittance Services

Sample screens of a transfer receiving

Users can now accept cross-border P2P money transfers via web and mobile banking. It covers Western Union, RIA, MoneyGram, IntelExpress and similar systems. This functionality means that customers do not need to visit physical agent locations, remember opening hours or wait in line. It may also decrease the workload and costs associated with in-branch customer service.

The feature allows you to integrate with the money transfer systems directly or through an aggregator/PSP. For example, one of our clients has launched remittance acceptance by integrating with a large PSP present in 29 countries.

A future WAY4 release will enable users to not just accept but also initiate remittances via web and mobile.