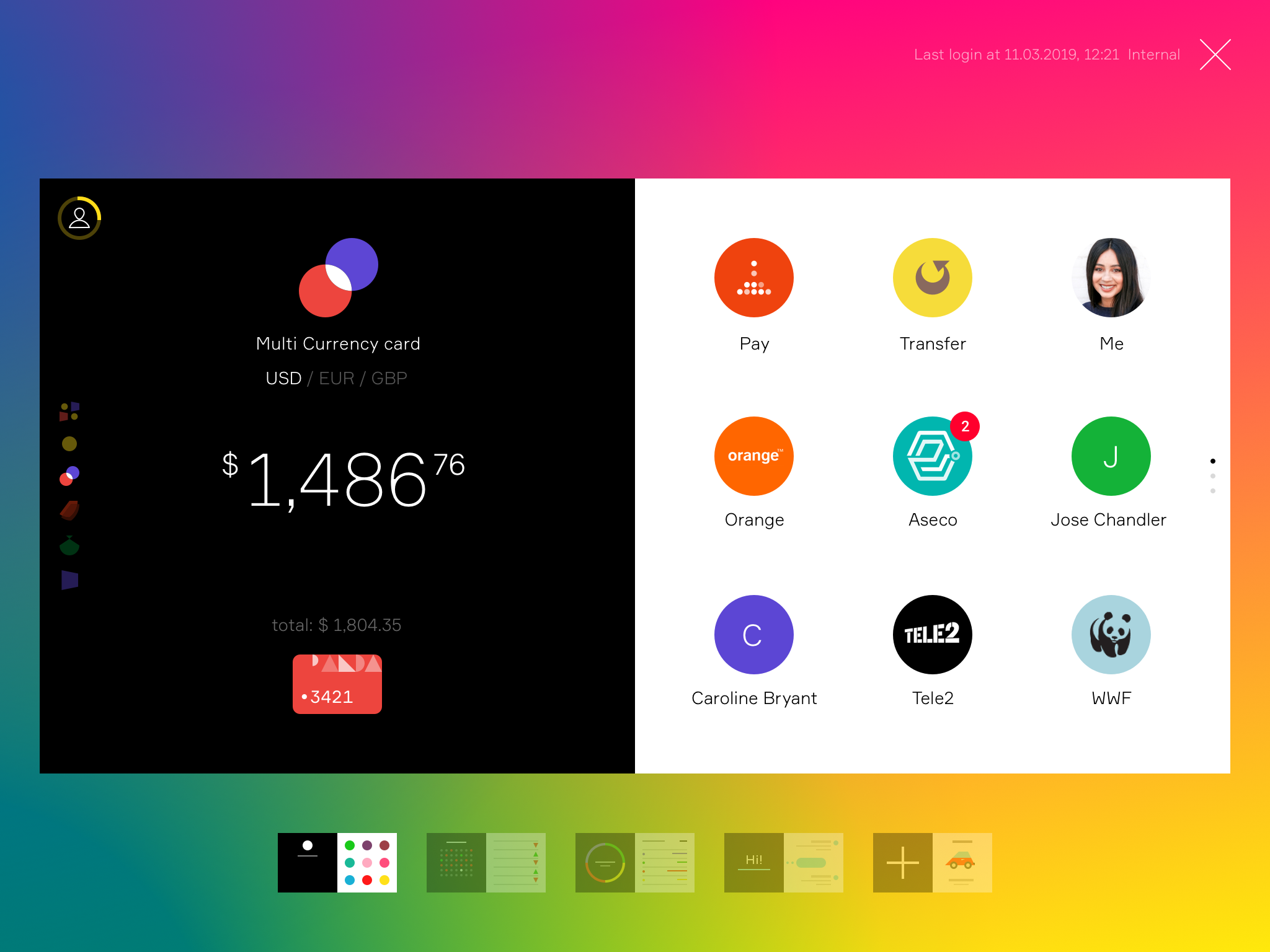

Enhanced view of Multi-Currency Cards

A sample screen of a multi-currency card view

Users can now manage multi-currency cards in a more transparent and flexible way following developments to WAY Lifestyle Banking. The banking menu shows all linked accounts in their respective currencies and the total balance in the main currency. It is also possible to filter transactions by account.

Users can also choose the preferred account for a fund transfer or bill payment. If the operation amount exceeds the balance of the chosen account, the app suggests a linked account in another currency. WAY4 will process the currency conversions due before completing the operation. The transaction history will show two separate entries, one for each account involved.

We continue enhancing this stand-alone channel solution, built on an innovative platform and featuring a unique design.

Invoice Bulk Payments

Users can now pay for more than one bill at a time, confirming them all with a single OTP.

Push Notifications from External Systems

WAY4 Lifestyle Banking can now instantly capture messages from external systems (CRM, Core Banking, etc.) and pass them to the app user as push notifications. It includes alerts about processed transactions, outstanding bills and upcoming loan payments, new product promotions, special offers and other messages. Thus, you can serve useful information to customers more frequently.

Push notifications are much cheaper than traditional SMS and can save on operational costs. If the mobile device is turned off or not connected to the Internet, or its settings forbid push notifications, WAY4 can send the same message via alternative channels, such as email or SMS.

A sample screen of push notifications

Upcoming Payments

A sample screen of a calendar with upcoming payments

WAY4 Lifestyle Banking now shows upcoming payments and other messages (e.g. recurrent payment, monthly loan repayment, deposit interest accrual, upcoming card expiration dates, SMS fee collection) in a special section of the transaction history. They are usually displayed at the top of the list, and their dates are highlighted in the calendar. There you can also display marketing notifications or personal offers to a targeted customer segment in this way.