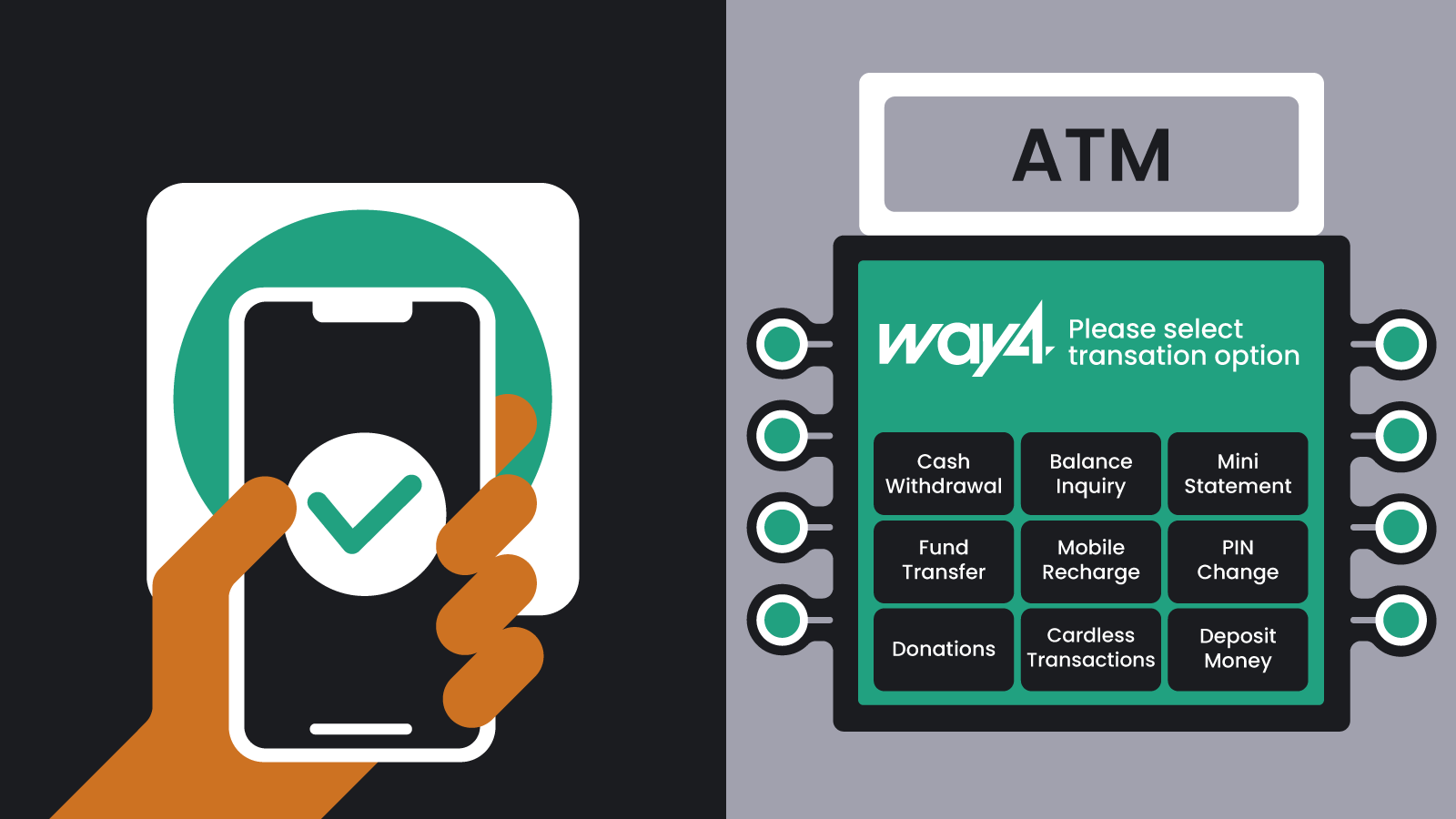

While many banks with ATM networks offer cash withdrawal services and access to balance information, they may also give customers extended functionalities, such as money deposit, fund transfer or other proprietary services. When the customer inserts their card into an ATM, Way4 sends card data to the bank, which provides the user with access to an expanded menu on the ATM screen with various service options. Cardholders can also access these broader services through tokenization, for example, by tapping their mobile phone on the ATM as with Apple Pay, Google Pay, Samsung Pay, and other services. In this scenario, a unique identifier, or token, is used instead of the confidential bank card data.

Before, Way4 supported extended functionalities only through on-us cards. Now, since digital wallets are fast overtaking plastic cards as the main method of payment, Way4 is now supporting additional services for on-us transactions that use tokens.

To grant access to services, the bank must recognize this token as its own card. Way4 sends the token to Visa VTEX and Mastercard DSA systems, to verify the token’s status and transform it into card data. The bank receives the card data and grants the user access to an expanded menu on the ATM screen.

Visa VTEX and Mastercard DSA services enable large banks and processors to process on-us transactions using tokens, following the same flow as transactions with their own cards. The expanded menu is available only for on-us transactions; in cases where the customer uses a card from another bank (plastic or token) the ATM provides access only to basic functions.