<New option, subject to project service fees>

<Configuration requires a separate service agreement>

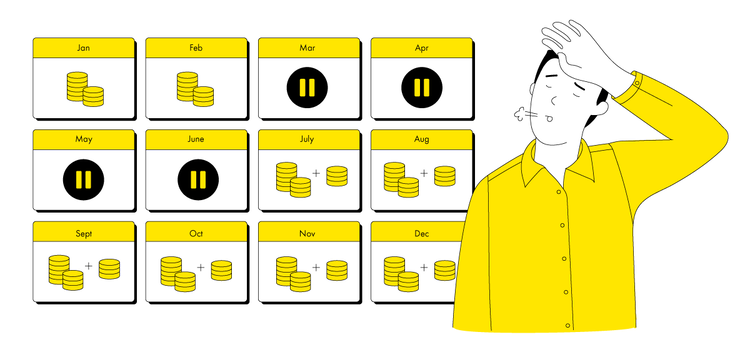

Now card issuers using Way4 can offer payment holidays to credit card holders who cannot make their payments due to force majeure situations. A new feature simplifies the setup of payment holidays, so there is no need to reconfigure each and every credit card or loan product. Customers can request to temporarily stop monthly repayments for a specified period of time, and the issuer will recalculate their debt accordingly once the payment holiday is over.

To enable this, we have introduced a new parameter on the product level. It allows a product status to be changed with no need to modify the accounting scheme or tariff plan.

How emergency payment holidays work

When a customer asks for payment holidays, the issuer can send a specific API request from CRM, core banking or any third-party customer data management system to the Way4 card management system. The request changes the corresponding contract parameter and activates the emergency payment holidays mode.

-

The system stays in this mode for a set period of time and applies new rules to the interest calculation. These rules override the standard rules defined for the credit product. During the payment holidays, the interest rate may differ from the standard interest rate.

-

During the payment holidays, the customer does not have to pay late fees or the MTP (minimum-to-pay) amount.

-

Way4 continues calculating interest using the regular or specific rate, and accumulates it on a dedicated account instead of charging the customer immediately.

If a customer has loans or credit accounts in different currencies, Way4 will calculate the payment holiday terms separately for each currency.

Once the emergency payment holidays are over:

-

Way4 recalculates the new debt amount and monthly payments. The accrued interest and unpaid principal amounts will be split across the coming months (the duration can be defined by the issuer) and deducted from the card’s credit line. The decreased credit limit remains in place every month until the new debt amount is fully paid off.

-

The Way4 card product returns to its standard settings automatically.

Since every issuer of credit cards or loans would use its own product configuration and tariff calculation rules on Way4, the implementation of this new feature requires an additional review of your system configurations. Please contact your BRM for more details.