Accelerating cross-border commerce and the financial integration of Africa with the rest of the world is part of Agenda 2063, a set of initiatives by the African Union. To reach these goals, payments digitalization and the harmonization of regional payment systems is essential. Even with local payment solutions in place, many Africans are still struggling to find a low-cost and simple way to make cross-border P2P and P2M payments.

The OpenWay’s webinar covered:

-

Cross-border payments and commerce in Africa: why is it still a challenge and how to overcome it

-

Lessons learned from successful and failed cross-border payment initiatives in Africa and globally

-

Technologies that enable payments interoperability and efficiency: multi-currency wallets, cloudification, instant P2P and P2M payments, open APIs

Please note that the webinar was held in French. In this article, we have reproduced the webinar content in English for those who want to be up to speed with in the state of cross-border payments in Africa.

Speakers

-

Jean-Philippe Wolyniec, Regional Sales Manager of OpenWay, France. OpenWay is a top-ranked provider of digital banking and payments software for cloud and on-premise deployment.

-

Luc Edmon Adjaho, Director of Studies and Projects at GIM-UEMOA (Interbank Electronic Banking Group of the Economic and Monetary Union of West Africa). GIM-UEMOA is an interbank organization comprised of 80 banks in 8 countries in West Africa, promoting the use of bank cards throughout the region.

-

Jean-Marie Benoît Mani, Board of Directors at Afreximbank, Cameroon, a pan-African bank financing and promoting intra- and extra-African trade with 50 member countries in Africa.

-

Hakima El Alami, Director of Bank-Al-Maghrib, the central bank of the Kingdom of Morocco.

The discussion moderated by:

-

Jean-Noël Georges, CEO of JNGExpert, France, a consultancy advising organizations on digital transformation, strategies, and technologies.

Fast access to the content

Overview of the West and Central African banking ecosystem

Jean-Noël Georges: Welcome, everyone, to this new APIDE Talk regarding cross-border payments. In the publication of its 2021 report, the United Nations Economic Commission for Africa, the ECA, named intensified promotion of electronic commerce the essential part of the implementation of the African Continental Free Trade Area. The official launch of the African Continental Free Trade Area was delayed by COVID-19 but was carried out in January 2021 for countries that have ratified it. With intra-African trade increasing to 16.1% in 2018, there is still a long way to go, but the potential is huge and promising.

At the end of 2020, the Economic Commission for Africa introduced an e-commerce platform to facilitate exchanges between buyers and suppliers, known as African Trade Exchange (ATEX). According to the latest information from the African Alliance for Electronic Commerce (AACE), the project was to be delivered in January 2021 before COVID spiked again. Mr. Stephen Karingi, Director of the Regional Integration and Trade Division at the ECA, recalled that digitalization was essential to maintain African trade competitiveness and enable effective participation in cross-border e-commerce. As payments remain the backbone of this initiative, it is necessary to harmonize payment systems by making them interoperable and optimized in terms of cost.

Finally, the African Union in its Agenda 2063 in its Proposal 25 has positioned trade and its development as particularly linked to IT infrastructures and future technologies. As you can see, this is an exciting subject and I invite you to discuss it with us today!

Mr. Adjaho, to ask you the first question as a member of GIM-UEMOA, and as a privileged player in this region for the harmonization of payment systems. What is the current state of payments and payment systems in West Africa?

LUC EDMON ADJAHO, DIRECTOR OF STUDIES AND PROJECTS, GIM-UEMOA: Briefly, we can say that the UEMOA (West African Economic and Monetary Union) zone is 148 banks and financial establishments, and a dozen more of what we call electronic money institutions. Less than 20% of population is banked, that must be compared to the overall use of financial services, which is currently around 55%. In terms of interoperability, the UEMOA Initiative has included the creation of a regional interbanking project, and since 2003, the establishment of a regional electronic payment interbanking platform which started operations in 2007. Under the GIM-UEMOA label, we can say that almost all the banks in the region have joined this project and we can count about 130 banks interconnected through the regional platform today. For about 3 years, we have worked on a project to integrate to this platform all the new players such as e-money institutions who are driving the payment market. It is the digital financial services interoperability project commissioned by the Central Bank, with the support of the African Development Bank and the Bill and Melinda Gates Foundation. This aims to broaden the banking-specific payment ecosystem with the implementation of a new infrastructure extended to all players, in all types of accounts and all channels and electronic payment tools. And so, in this context, there is a new draft instruction which is in progress to harmonize and update the regulatory framework of interoperability and which targets the different positions of the players and methods participation in this new ecosystem.

We want to ensure interoperability of cards and a number of payment methods through a regional payment scheme, build bridges between non-banking and banking players, and truly reposition the institution at the heart of the regional ecosystem through the construction of infrastructure payment regions that support evolution, new means, new use cases of payments. So it's really a set of initiatives that aim to give the GIM the role of a catalyst and facilitator of payments within the regional ecosystem. So here is, overall, without going into details, where we are at the level of the UEMOA zone.

JEAN-NOËL GEORGES: We understood that the GIM, for almost twenty years in fact, had been launching a regional switch project and it took time to set up just in West Africa. Mr. Mani, as a banking player in Central Africa, can you share with us what is happening there and what are the expectations towards banking institutions?

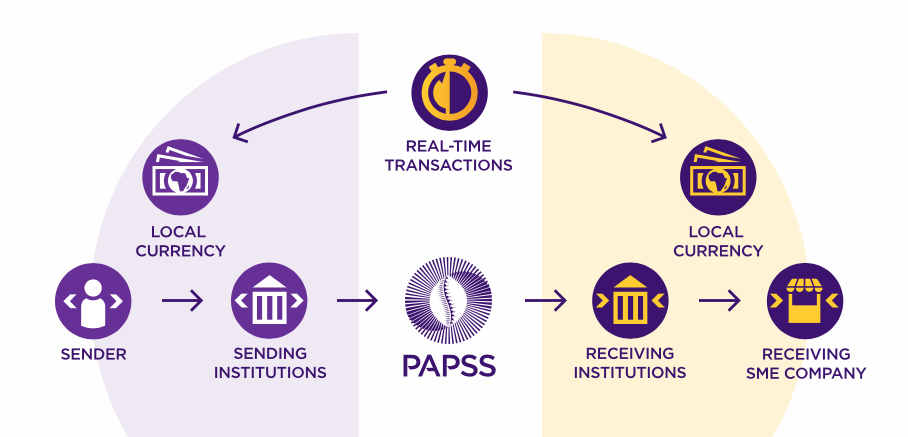

JEAN-MARIE BENOÎT MANI, BOARD OF DIRECTORS AT AFREXIMBANK: Generally on the pan-African level, cross-border payments pose a problem in Africa because it is very difficult to pay from one country to another. At the level of Afreximbank, a great deal of work is being done to have a pan-African payment system which I think will be called the PAPSS, namely Pan-African Payment Settlement System. The project is well advanced, six countries take part now to see how payments can work, and the goal is to gradually expand to all African countries. It is a very important initiative and if it succeeds, and I think it will succeed, it will revolutionize payments in Africa. When the African Free Trade Area is launched, we will absolutely need a payment tool that must be able to accompany all the trade that we would like to see established between our countries, because if people circulate, goods circulate, but capital, payments and money do not circulate, we will not be able to have a truly functional free trade area. If you look now, most cross-border payments in Africa are done informally. Currencies are transported from one country to another, and often in dollars or euros. Now you must use foreign currencies to be able to make cross-border payments. All that that entails risk for those who transport money and for economic systems, payment systems in general, because there is no traceability or control for all this capital which circulates haphazardly. And we really need Africa to have a payment system, or payment systems, that are functional and that can support this free trade area and allow cross-border payments in local currencies, without having to go through foreign equivalents.

Overview of Morocco’s banking system and intra-African trade

JEAN-NOËL GEORGES: Ms. Hakima El Alami, can you also give us a quick overview of what is happening in Morocco?

HAKIMA EL ALAMI, DIRECTOR OF BANK-AL-MAGHRIB: The topic of reducing transaction costs both in the national framework and in the inter-regional framework is very important to Morocco, as well as to any other country in Africa.

Because before talking about an interconnected, interregional payment system, national payment systems should already be modernized. This was directed by the Central Bank of Morocco, but of course in consultation with all players both banking and non-banking, such as payment institutions. The goal was to set up systems which can enable secure and fast settlement for the benefit of the end consumer. We have been talking about this since 2003, with the introduction of the GSIMT which replaced physical clearing houses.

We have set up a payment switch to ensure card interoperability, because interoperability for us is fundamental. When we grant approval to a banking or payment institution, interoperability is a sine qua non condition for this. Since mobile payment interoperability was very important to us, we put in place a mobile switch that enables it not just for payment institution players, but on the level of the whole ecosystem, because we consider that market fragmentation can lead to an increase in costs, which is detrimental to the customer. We also need modernization and the improvement of structural payments to lessen cash dependency. That's the domestic point of view.

Internationally, Africa is a huge internal market, with significant economic opportunities which, unfortunately remains untapped. Untapped, first because the role of an informal sector in each country is strong. This must be decreased, which means that access must be improved to the banking system and the payment account, because it is essential to financial inclusion. It is also necessary that, whether it is a payment or transfers, that the cost of these transactions be reduced. A certain number of things have been done; many regional payment systems implemented. But they are still fragmented systems.

Within the framework of the African Union, in its 2063 agenda, there is a commitment to increasing intra-African trade from 15% in 2013 to 50% by 2045, thanks to a certain number of measures. One of the measures is the development of an integrated payment infrastructure. The ABCA, the Association of African Central Banks in 2014 during a meeting in Algiers had expressed the wish to set up an infrastructure for the integration of the payment system on the continent. At the time, because a certain number of factors were not met, the Board of Governors had requested some studies before implementation of this structure, and in 2018, after a number of improvements, we considered that it was perhaps time to move forward. Hence the establishment in 2018 of a project group to pursue a dual objective, both to develop an inter-regional integration framework for the payment system and an inter-regional integration strategy for mobile payments. We are present in two groups that deal with both the integration of payment systems and the integration of mobile payments. The work is in progress and the idea is perhaps to come out with a deliverable or with an effective start of an inter-regional system in production by 2023.

Cross-border payment systems around the globe

JEAN-NOËL GEORGES: Jean-Philippe, as you represent a payment software vendor who works with banks in different regions, could you please share your view of the current state of payments in Africa and it is different from other regions globally?

JEAN-PHILIPPE WOLYNIEC, REGIONAL SALES MANAGER OF OPENWAY: The subject of cross-border payments is extremely important for the development of trade in Africa and more generally for the digital transformation of Africa as a whole. One of the challenges will be the modernization of local banks. There are initiatives that exist in Africa to try to aggregate a little bit and finally to fight the fragmentation of different payment platforms, but in any case, it will certainly go through a phase of modernization.

We see that today it is possible to make cross-border payments in Africa, but these do not always meet expectations in terms of transaction costs, traceability, security, or even in terms of regulations, or quite simply in terms of speed and simplicity. It is not something that we only see in Africa, we find it in all regions of the world. At OpenWay, we have been developing and deploying payment platforms for more than 25 years. We work with banks, payment schemes, clearing houses, processors and fintechs, and we work with all these players to develop greater interoperability and more innovative services. We have 160 clients spread over 80 countries with a head office based in Belgium, and with a presence on African continent.

Together with our clients, we also have initiatives underway to develop cross-border payment solutions and thus contribute to better commercial competitiveness and better cross-border trade. The essential parts of this projects are infrastructure modernization or collaboration between the various players in the industry. That is extremely important. When I say "the various players in the industry", it is banks, central banks, clearing platforms, fintechs, but also regulators and political powers. So it required a real effort to start a movement that will make it possible to standardize payments in a given region.

Perhaps I can give you first an overview of what has been done in recent years, given that we already have some initiatives that date back more than 40 years. We have players like SWIFT, for example, which is a truly global player and based on a network of correspondent banks. SWIFT provides connection between banks via a dedicated messaging service which allows account-to-account transfers in multiple currencies, regardless of the connected bank. The problem with SWIFT that a transfer can takes time because the transaction message should go through several banks before being completely carried out, and that will have an impact in terms of delays, and especially in terms of costs, since transfers can be quite expensive.

We have other models that are based on slightly more centralized approaches. For example, Nacha (National Automated Clearing House Association) in the United States. It is a network of American regional clearing houses. It provides good connectivity and efficiency. It represents an inexpensive alternative to the other means of payment present in the United States. On the other hand, it is a system that is a bit old and that does not currently allow instant payments, it is limited to the United States and, obviously, to the US dollar.

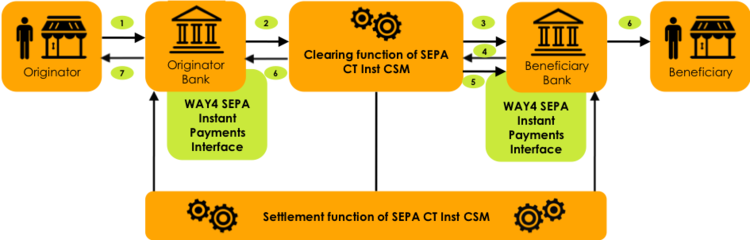

In Europe, we have the example of the SEPA project, enabling the harmonization of payments and a reduction in payment costs and delays throughout the European euro zone. We are witnessing a harmonization with the launch of instant transfers, so it is a project which evolves over time, which adapts to the constraints and demands of the market. We are working on SEPA Inst formats that will allow instant money transfers between accounts via SEPA. We also have initiatives that will take us a little further with the arrival of a project called EPI, for European Payment Initiative, which is intended to become the future European card payment system based on the SEPA protocol and which will compete with Visa and Mastercard. Starting from a need to interconnect banks with each other, we came to the need to modernize the whole bank infrastructure and the payment infrastructures of the private banks.

JEAN-NOËL GEORGES: Jean-Philippe, just a comment from Mr. Taher Moulahi, who says that “we could build a system like Visa/Mastercard which could have a monopoly on transaction processing by card. If necessary, such a cross-border ecosystem can be based on wallets”. What do you think about that? Also in Europe, the payment system is based on a single currency. Could one of the first steps, apart from the harmonization that you just mentioned, might be a single currency in Africa. We talked about the euro, but I may bet on digital currencies, what do you think?

JEAN-PHILIPPE WOLYNIEC, OPENWAY: We have examples of regional platforms that allow you to transact in different currencies without necessarily having to go through Visa/Mastercard. In Europe, not everyone is on the euro. Scandinavian countries – including Sweden, Denmark and Norway – have their own currencies and decided to replace their existing system, which was a very fragmented clearing system, with a unified, modern infrastructure that allows instant payments, domestic payments, but also international and multi-currency. This project is called P27. The idea is to lower transaction costs as much as possible and make payments instant. It is not only a system that will allow multi-currency exchanges between these countries, but it is also a gateway to the rest of the world. So we can go through this centralized platform to be able to transact with the rest of the world.

In the Middle East, there is a recent example, which is called Buna Payment Platform, which is intended to become a multi-currency payment platform, and which will offer clearing and settlement services between Arab currencies to financial institutions, banks, central banks and all banks, in fact, who are members of the Arab Monetary Fund.

So there are many local initiatives that are emerging to fight the monopoly of the international payment giants. All these projects and initiatives are indeed aimed at lowering transaction costs and ensuring security while simplifying and reducing payment times, and what I can tell you say is that for SEPA, we are talking about economies of scale of the order of hundreds of billions of euros over 6 years for European companies. So there is a real interest and a leverage effect in wanting to standardize and consolidate, or in any case to interconnect clearing and settlement systems with each other.

JEAN-NOËL GEORGES: It's really exciting! All the examples you told us, we can see that there are different initiatives. We have seen private initiatives, you have spoken about Visa and MasterCard, states, single currencies. In what order do you feel that Africa should position itself first? First the single currency, first harmonization, first an infrastructure? Maybe all three at the same time?

JEAN-PHILIPPE WOLYNIEC, OPENWAY: Well, the single currency seems complicated to me, even if we look at digital currencies that are managed by central banks. Each of the central banks will want to have its own currency. I am not sure that the single currency for a continent like Africa is a possible short- or medium-term solution. On the other hand, today we have the technologies, standards, and norms to allow this interoperability between countries, between currencies, and there is an important role played by political powers, and in particular by the central banks. There is a big effort to be made there.

Payment interoperability. The role of PAPSS

JEAN-NOËL GEORGES: Mr. Adjaho, we mentioned different types of payments. You mentioned at the start, as a regional switch, the bank card. Then we switched very quickly from the card to the mobile, which was mentioned by Hakima. And then, very quickly, to digital currencies. What is your vision? Have you already implemented alternatives to these payment solutions, and what is your vision for expanding in the region?

LUC EDMON ADJAHO, GIM-UEMOA: Before answering your specific question, I would like to highlight the key things that determine our current situation. Today we are not starting from nothing, there are initiatives. There are national payment systems in place. From my point of view, the best approach is integration through these systems. The emphasis must be on the harmonization of legal and regulatory frameworks through these existing systems. At the heart of the subject is the question of interoperability, standardization of systems for exchanges, we must have exchange protocols that are standard and build open systems to facilitate this integration and put in place an operational governance framework for this new initiative that solves the problems. There is the question of the reference currency, even more concerning the settlement and dispute management. So those are the things I would like to address. At the GIM-UEMOA level, we are working more for a convergence and not a dichotomy between the card and alternative means of payment. It is particularly in West Africa, mobile payments are driving the development of digital payments in other areas, but the card is also important. Today through various payment schemes, different payment methods are converging.

JEAN-NOËL GEORGES: Mr Mani, you mentioned PAPSS (Pan-African Payment Settlement System) earlier. What is happening with PAPSS now and what has been already developed?

JEAN-MARIE BENOÎT MANI, AFREXIMBANK: The PAPSS is an initiative of Afreximbank, the African Import-Export Bank, a public multinational institution created by African countries. The bank was established in the 90’s, 1993-1994 more precisely, to deal with the big international banks leaving Africa following the crisis. Currently, we have 51 member countries. After the establishment of the African Free Trade Area, it was necessary to establish a tool that could make it possible to streamline transfers relating to this free trade area. The PAPSS project has been launched. We are in a pilot phase, and the system has been adopted by the African Union. The African Union is now sponsoring the PAPSS. And we hope that as soon as the pilot phase is over, we will gradually integrate the other countries. As Jean-Philippe was saying earlier, the involvement of central banks is absolutely necessary for the implementation of payment systems. In all countries at the national level, it is the central banks that supervise the payment systems, that issue approvals, that control everything, that ensure that risks are controlled. If we want to create a system at the regional level, we absolutely have to go through the central banks. We were talking about what's being done in Europe, I think it's more or less the same pattern, and I believe that if we have to follow an example, it is really the European area that should serve as a compass for us to be able to set up our payment systems.

JEAN-NOËL GEORGES: Can I be a little provocative, Mr. Mani, because, earlier, when Jean-Philippe presented the solutions that there were in the world and in Europe, we as users, and even as companies, we dream of a global system with a single payment system. We see that even in Europe, where there would be a large part of the single currency, a few regions still have their particularity, so we see that there are still multiple systems being put in place. If things are progressing, we will go from national to be regional. Then we would like to become continental, but it will take many more years. Africa is relying on the initiatives in each African region. It will take many more years before we have an organization on the continent.

JEAN-MARIE BENOÎT MANI, AFREXIMBANK: I think, inevitably, the countries are obliged to gradually abandon part of their sovereignty to entrust it to regional institutions, and I think that we will finally arrive at a global system with coexistence of regional systems, too. We want to have our local systems but will have to leave the door open to be able to exchange with the rest of the world. It is logical, it requires work, because many states are jealous of their sovereignty, but necessity and evolution are forcing them to abandon it. In Africa, it has delayed, precisely because we didn't have a leadership that could make it possible to federate all the countries, to bring them around the table to think about a system that could encompass the entire African continent.

JEAN-NOËL GEORGES: Thank you very much for these clarifications, Mr. Mani. I teased you on purpose. There is a comment from Sandra Djokomoyo: “Indeed, the single currency is not mandatory, it is interoperability of systems that is necessary.”

HAKIMA EL ALAMI, BANK-AL-MAGHRIB: In sub-Saharan Africa, there are many challenges for the modernization of payment systems and the establishment of this interoperability at the level of national systems. A single currency is not a prerequisite, it is not fundamental.

There are standards that are there at the international level which allow instant payment, for example the ISO 20022 standard. We have to think about reducing costs, because that's what will allow us to multiply inter-African payments and transfers. There is also the management of things that will increase public confidence in the payment tool they use. First of all, dispute management, complaints management, and the processing times for all that. It must be well defined, well set out at the national level. That's really what will make the consumer confident to use any means of payment, be it the card, mobile payment, something else later, instant transfer. These rules must be clear and the processing time for complaints must be as optimal as possible. Look at the example of Visa/Mastercard, each chargeback can take up to 45 days, processing times are costly for both issuers and acquirers. So these are things that if we want to do very quickly, we have to be able to harmonize these things, at the regulatory level, in a charter or whatever, in order to be able to make these payments.

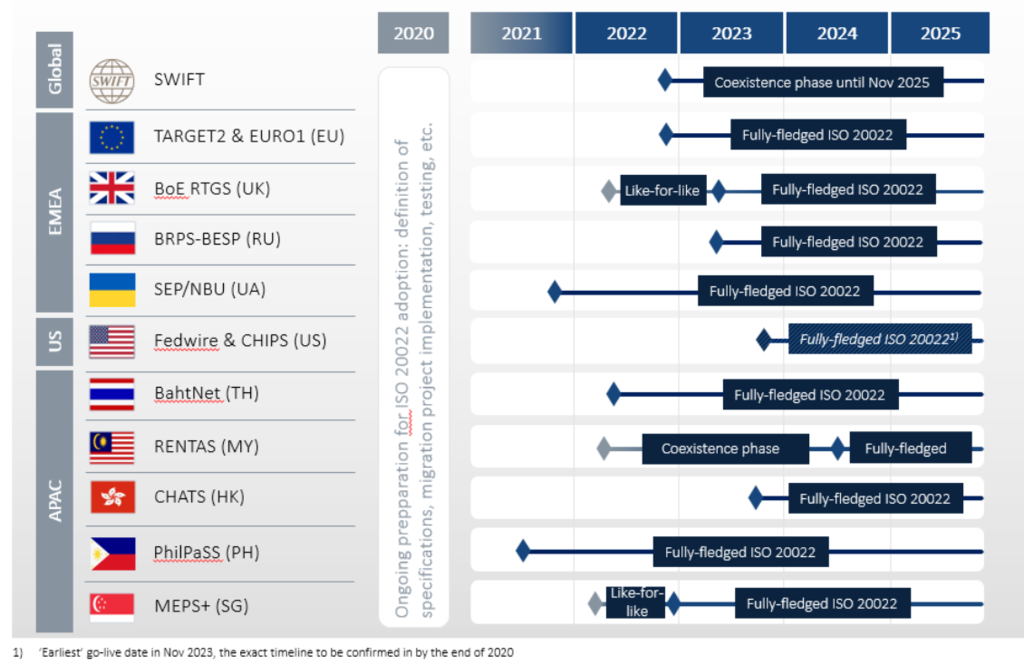

JEAN-PHILIPPE WOLYNIEC, OPENWAY: I think that the challenge lies well below, on the implementation of the layers of regulation and in particular of standardization which are really necessary to make the different systems which are emerging, or that have already been in place for a few years, and to make them truly interconnected and interoperable. The regulatory part, indeed, it can take time. On the standardization part, on the other hand, today we have a certain number of standards which make it possible to develop standards much more quickly than before. In particular, we have the ISO 20022 standard, which Hakima mentioned, which is an extremely interesting working basis and which all banks, clearing platforms and central banks must be able to put in place. Because it is a standard which is flexible, scalable and which makes it possible to cover all the use cases that we have been able to mention so far, in terms of immediacy, message data, security, etc. So today, at least from a standardization point of view, I think we have the ISO 20022 format which is one of the keys that will be able to speed up this type of development. Then, there are the regulations, and policies between different countries and different regions, where it will also probably be necessary to harmonize the discussions.

JEAN-NOËL GEORGES: Luc Edmond, we talked about cross-border payments for end customers, but also for companies. A startup told me that it was hell to make cross-border payments, that they spent half days making these payments. Do you see a single solution for cross-border payments, or do you see different systems depending on the end user, like a company or an end customer?

LUC EDMON ADJAHO, GIM-UEMOA: I think that you have to have a mixed approach within the same payment system depending on the use case, since basically the construction and the procedures remain the same. So today, globally, the implementation of cross-border payment systems is truly to facilitate exchanges, both at the level of individuals and at the enterprise level. You have to be able to integrate these different use cases within the same payment system, knowing that the requirements and expectations are different, and that, for individuals, depending on a certain number of restrictions and limitations, we should be careful not to discriminate between the solutions to be made available to African companies.

JEAN-NOËL GEORGES: Jean Clary, may I suggest to you that you share some ideas from the BEAC (Bank of Central African States) on cross-border payment.

JEAN CLARY OTOMOU: Cross-border payments, they have always existed. In my opinion, as long as there are states that trade, cross-border payments have always existed. The novelty today is perhaps that things will go faster. We are trying to make things go faster, cost less. We already have cross-border payment systems in each of the states. They are not always interconnected. There is bilateral interoperability in general, but there is no global interoperability. We are talking of cross-border payments. And again there is nothing new under heaven. It may seem surprising. You have Western Union, you have Money Gram, you have Visa, you have Mastercard, it already exists. With different characteristics, but it already exists. We know how to make cross-border payments, in more or less slow architectures, they can even be digital. What we have now is a new actor, the one who brought about this evolution, it's telcos. The one that forces everyone to review their classics. When you talk about cross-border payments in Africa, it will be necessary to reckon with telcos. I know the PAPSS initiative, which I find very well technically designed, but I also know the Mowani MTN Orange initiative. And I want to say, we already have two big continental competitors in Africa. They are very well equipped technically.

Do we need a single legal framework? I'm not sure that's the real solution. Because each of the states will have its own legislation and will defend it. And so far, we haven't needed a single global law to use Visa, Mastercard, or even Western Union. Western Union, Visa, Mastercard have come to comply with national regulations, with their own internal rules, but they complied with national regulations. So I'm not fundamentally convinced that we need a single law, a single regulation. That's the first thing. I am rather convinced that these systems, whether it is Mastercard, Visa, today, Mowani or PAPSS, these systems must have their internal rules which allow exchanges, which all those who adhere will respect.

In Africa today, the obstacle is that we have not yet interconnected the systems, whether that of PAPSS or that of Mowani. But when you look today at the countries or subsidiaries that are connected, it is increasing day by day. It is these interconnection rules that are going to be important, these agreements. Do we need a global and unique framework? I am not convinced. I am even tempted to think that, in reality, the zones will organize themselves with internal regulations and operations, and will only leave space for cross-border and international transactions. Perhaps it will be necessary to think of creating, agreements, alliances, between the different systems, national, regional, continental, and with the central banks.

Role of central banks and fintechs

JEAN-NOËL GEORGES: So, to tease you a little, Hakima. Aren't you afraid that, if the financial institutions, the central banks, are very slow to react, at some point there may be players, which Jean-Philippe has already spoken about, private, IT giants, which will offer payment solutions that users will eventually use, because they will find it practical, inexpensive and, ultimately, in complete confidence, since they are already using their services? Do we sometimes think about including fintech challengers in the discussion of new initiatives?

HAKIMA EL ALAMI, BANK-AL-MAGHRIB: First of all, I don't agree about central banks being slow. Central banks are the driving force behind the development of payment systems. That is undeniable. And central banks are not there to do things on their own, because we must not forget that when we want to set up and modernize a payment system, it is not the central bank that operates it, except for certain large-value payment systems like RTGS, but that's truly on a global scale for monetary policy issues that shouldn't be forgotten. But for the other systems, the central banks are really there to modernize, whether it is the driving force behind the modernization of payment systems, and this is done in consultation with all the players. We cannot come and impose things when the main stakeholders are outside the round table.

I'll take the example of Morocco. When we set up the GSIMT, the central bank was there to steer the work with the association that was set up at the time, and with the banks and a certain number of monitoring committees, strategic committees, because the key to success is truly consultation. Sometimes the players need implementation deadlines. The central bank is there to ensure security, that is our mission, so that the consumer has confidence in the currency and the cashless means of payment. We are here to set the prerequisites for the developments, but that is done in consultation and the implementation deadlines, sometimes with the players, because there are certain adaptations at the system level. There is a certain protocol that will have to be reviewed, a certain number of things, and that causes delays. We can’t have implementation deadlines where we say "no, I want the end of 2021, that's how it is". Players need certain lead times. Consultation is very important in the modernization of these systems.

JEAN-MARIE BENOÎT MANI, AFREXIMBANK: I think what Hakima has just said is very important, it's consultation, but there's also the fact that it's not always the central banks that take the initiative. E-money has imposed itself, and in most cases, central banks have only followed to set up regulations, for risk control, everyone's safety. But e-money or mobile money, as we call it here was already launched. So there is an interaction between the central banks, the operators and the very responsiveness of the public. If the public likes the payment products that are offered to them, the central bank is then obliged to follow. But in this case, it can also take the lead, and can put itself forward to change the system.

HAKIMA EL ALAMI, BANK-AL-MAGHRIB: About fintechs. The central bank should be there to take a look at these fintech initiatives and to see what it can do, because we are not there to just follow the initiatives. We are also there to be catalysts for a number of things and to set up an environment that is conducive to innovation, of course, while respecting consumer security. I take the example of Morocco, we have set up an entity which is there to facilitate listening to the fintech market, to look at what fintechs offer, to see if it is in line with the regulations, but also to look at what we can develop from a regulatory point of view to move forward and facilitate the development of payments. So we're not here just as a follower. No, we're here to promote the development of these fintechs.

JEAN-NOËL GEORGES: That's good, thank you, Hakima. Just to make the micro conclusion, fintechs have the merit of waking up the banking ecosystem and the financial ecosystem of central banks.

LUC EDMON ADJAHO, GIM-UEMOA: We need a real framework for cooperation between public policies and regulation supported by central banks and private players, including fintechs in particular. As we have said, the role of regulators is to ensure the security of payment systems and give users confidence in using payment tools and in turn, in payment systems in general. Fintechs have to facilitate innovation, so we're talking about low-cost, fast systems. It involves the implementation of new technologies, hence the deployment of fintechs within this project to build a cross-border payment system in Africa.

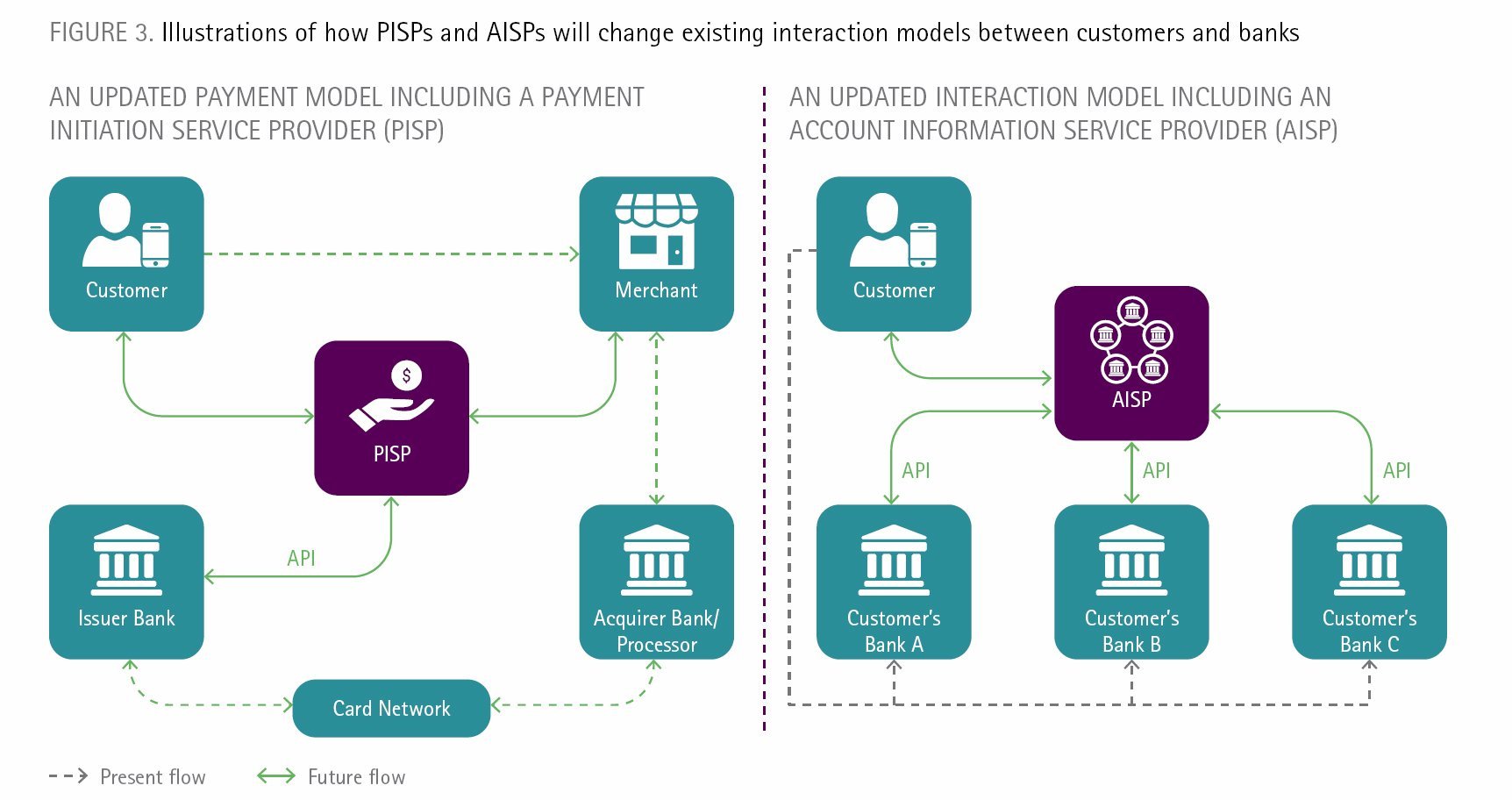

We have to be open to technologies that facilitate the redefinition, the reassessment of economic models to provide users with innovative and inexpensive systems. The initiatives on which we are working today really aim to establish a bridge between banking and non-banking players, in particular fintechs, in order to be able to move towards value propositions around VAS in open banking and open payments.

JEAN-PHILIPPE WOLYNIEC, OPENWAY: Just a small comment, by giving the example of what is being done in Europe by the European Central Bank. One of the roles of the central bank is really to allow all industry players, banks and fintechs, to develop new use cases, with a framework and in compliance with the regulations. And what has been done in Europe, thanks to PSD and PSD2, is precisely the establishment of a framework that allows this whole ecosystem to work together. We do not favor banks or fintechs, it is really a payment ecosystem that is emerging. And that's why the central bank’s role is not to replace industry. It is not going to innovate, it is not the one who will invent use cases. But it does have the role of supervising so that these new use cases and new entrants can evolve in compliance with regulations and what must be done in the regions in question.

Cryptocurrency in the future of cross-border payments

JEAN-NOËL GEORGES: Jean-Philippe, from the start of our discussions, we had questions about the role of cryptocurrency in the future of cross-border payments. And I'm going to expand the question a little bit, because you made reference to the CBDC, we just talked about central banks, so maybe we could make the connection between cryptocurrencies and central bank initiatives regarding CBDCs.

JEAN-PHILIPPE WOLYNIEC, OPENWAY: That's a very good question, indeed cryptocurrencies, today, as we know them, are a simple way, to make cross-border payments or send money from one country to another. But these means of payment are not necessarily within everyone's reach. There is still a risk of using services that may be less secure, or less reassuring, perhaps less transparent, unsecured and generally of fairly high volatility unlike fiat currencies. Some will say "Well no, on the contrary, it's transparent, it's guaranteed, it's crypto", but the problem is that crypto, it depends on where you will store your private key, for example. So it's a technology that is extremely interesting, but which, in my opinion, does not solve the problem of cross-border trade on a daily basis. We have other cryptocurrencies that we call stablecoins, which indeed have the advantage of being less volatile, but we also have the same concern for security, for transparency, acceptance too. Cryptocurrencies are not accepted everywhere. And then, we will also come up against the problems that we encounter when making multi-currency payments. From the moment there are several competitive cryptocurrencies, so how will the exchanges between the different digital currencies take place? So there are problems in cross-border payments that we have not solved with crypto and fiat currencies, and that we will not solve, in any case, not right away, with CBDCs, Central Bank Digital Currencies. There too, we are still at the concept stage, finally in the state of experimentation. But we risk having the same problem of interoperability between the different CBDCs that will emerge one day. So we must actually observe what is happening on this side, and in particular on the side of stable coins and CBDCs, but it will take time and I am not sure that will solve the problem of fast, inexpensive and regulated cross-border payments.

JEAN-NOËL GEORGES: Luc Edmond, what you are currently working on and what are the obstacles you see to extending your switch to cryptocurrencies or electronic currencies in the years to come?

LUC EDMON ADJAHO, GIM-UEMOA: At the regulatory level it is not something that is adopted and regulated today by the central bank. We have prospects for creating use cases around cryptocurrencies, blockchains in general, so we have studies in progress. Because today, in developing inclusive services for the public and searching for lower-cost solutions, we are obliged to explore all the technologies which exist.

Challenges in building cross-border payment systems

JEAN-NOËL GEORGES: How do you see the evolution in the years to come of the cross-border payment system implementation? What is still holding it back?

JEAN-MARIE BENOÎT MANI, AFREXIMBANK: There are a lot of obstacles and there is already the fact that many countries protect themselves and their currency, but I think that, with the system on which the African Union is working with Afreximbank, we should have a very good evolution in the African payment landscape. The summit is still a long way off, as I told you, we are at one stage then the other, and we still have to gradually integrate all the African central banks so that all the countries can make payments to each other. But it is an evolution that is absolutely necessary for our continent. What is currently blocking it is the extent of the work that needs to be done. I was thinking about that, because earlier in the implementation, as a single currency or a payment system, countries must work at the economic level to achieve what is called convergence. If there is no convergence, systems will be blocked, because some countries are unable to cover their position because they have economic difficulties or are structurally in deficit.

So, in parallel with the establishment of the system, it is absolutely necessary for countries to upgrade, also economically, in order to be able to work efficiently and not obstruct the system. The implementation of these systems like the PAPSS will also raise the development of these countries. A country that sees itself excluded from the system will be forced to question itself and try to see what is wrong on the economic level and manage both its domestic currency and economy so it can perform better than other countries. That's kind of the evolution I see. It takes a lot of laboratory work to be able to convince everyone and control all the risks, because we're talking about a system here, and when it comes to a system, the risk is never far away and a small grain of sand can disrupt the functioning of the whole system.

I think that the advantage we currently have on the political level is the African Union, which is the supranational political organization at the continental level. It has taken the bull by the horns and fully supports this initiative, and can therefore allow all the countries to succeed in setting up this system which will be one of the first in existence. Perhaps others will emulate it because it is not a question of having exclusivity, but of being able to create an environment in which everyone can work in complete safety, and also that all users are protected in their transactions.

JEAN-NOËL GEORGES: Earlier we talked a lot about trust in payment systems in general and in cross-border and inter-regional payment systems. Reading the comments of our listeners, I see that this trust is based on two things: a security vector, as we have said: system security, trust in partners. And then, also, a question of price. So, first question: what are the initiatives that you have put in place in terms of security, Hakima, to maintain and strengthen this confidence in payment systems? Second, how do you see the role of fintechs? Will it ultimately bring down prices, this digitization that Jean-Philippe told us about? Or, when new players are added, will everyone want to make a profit, and in the end will we risk having more expensive services?

HAKIMA EL ALAMI, BANK-AL-MAGHRIB: First of all, about trust, we will say that it is a set of measures which are implemented over time, and based on a number of things, in particular a certain number of reports that we request from our reporting entities, on fraud, in particular, on the nature of it which will mean that we will put in place an action plan to counteract this fraud and improve the security of payments tools. There are many things that are there. For cards, for example, it was the migration of all the cards to the EMVCo standard. For mobile payments, because it can be done on different channels, it is the standard for QR codes. These are just examples, but there are many things that have been implemented to increase payment security. As I was saying earlier, when there is a fraud or there are customer complaints, it is necessary that the deadlines for handling complaints and their processing are as short as possible. Because we can't talk about an electronic means of payment, to talk about instant payments with very long deadlines or unprocessed complaints. In fact, all of these risks curbing or harming the very use of digital payments. So that is very important to us.

Regarding fintechs, we must not forget that currently there are many things that are done by banks because the digitalization that we see is at the level of the whole banking system. When I say banking system, I mean both banks and payment institutions. This digitization movement is not about a lot of fintechs who were there first for this digitization process enabled first by technology, but about very agile people. The new systems relied on those people. Fintechs that come with new solutions, need approval within time limits defined by law and there should be tools to integrate these solutions with the classic systems. You have others who come with things that are not yet defined by law. Take the example of payment aggregation, or account aggregation. Credit aggregation or payment facilitation. These are things about which the law has remained silent for the moment. I believe, if I turn to Europe, PSD2 came with these reforms not that long ago, two years ago, where a number of things were implemented to make fintechs work easier.

We are in this dynamic, first to facilitate these new business models, because there are many things which allow the APIzation of the systems. It's either conventional, pending the implementation of appropriate regulation, but on the whole, the central bank is there to promote and create an environment that will allow these agile fintechs to operate or bring new business models for the benefit of the consumer. Fintechs are coming, bringing a new way, generally we are there to modernize the processes that exist, so there are savings for the end user, which also allow these fintechs to have a margin on the ultimate transaction costs.

LUC EDMON ADJAHO, GIM-UEMOA: It is still essential that integration with fintechs should be facilitated. In this respect, APIs are an answer, even if it is necessary, within the framework of harmonization to ensure that these APIs are structured and standardized precisely to prevent everyone going in their own direction. This is what we have undertaken and what we are working on regularly at the level of GIM-UEMOA for other regions. But I beyond that we also need to be able to use available technologies to redefine the economic models. Jean-Philippe mentioned the popularization of the ISO 20022 standard which is very conducive to conveying more information than previous protocols. So today we have an opportunity to collect more information, both through transaction and payment flows. There should be a strengthening of cooperation between regulators and fintechs so that we have a legal and regulatory framework on the structuring of the collection and monetization of payment data, which will give impetus to the rebroadcasting of the economic model to have payment data linked to other types of services and to have other revenues that can finance initiatives around the implementation of other low-cost solutions to meet inclusion, population and development goals more broadly.

JEAN-NOËL GEORGES: A question on cross-border payments, a security question on anti-money laundering and the fight against terrorism. How can we protect instantaneous, inter-regional, multi-currency payments in e-commerce, cross-border trade from less honest activities?

HAKIMA EL ALAMI, BANK-AL-MAGHRIB: The payment system is a channel, we must not forget that. You have the banks, the payment institutions which are subject to a number of KYC and KYB due diligence. And so, there is the FATF which implements a certain number of standards which are transposed by the central bank, and therefore this filter there already exists at the level of the opening of an account which will allow us not to open the floodgates to suspicious transactions, or to fraudsters, or to the financing of terrorism. And of course, there is an exchange, a certain number of exchanges, in practice, you have blacklists and a certain number of things, always within the framework of the fight against money laundering, which is a mandate from various banks and payment institutions. So I don't think, as long as the due diligences are there and they are implemented, that integration is going to favor suspicious things.

Forward-looking vision for cross-border payments in Africa

JEAN-NOËL GEORGES: Since we're entering the last part of our debate, I'd like to take inspiration from Ali Faïm's question, which I'm going to put to all of you as a last point for you, and then perhaps a kind of conclusion or forward-looking vision. “Hello, knowing that the intentions of the various actors, central banks, fintechs, banks, are good, how to speed up the process and live up to the aspirations of the continent?”

LUC EDMON ADJAHO, GIM-UEMOA: Today, I think, is a good transition from the question on the impact of technology in payment. It takes cooperation, but some innovations need to be structured to really meet the challenges. So, from my point of view, such issues are user confidence in payment systems, good version management and we have seen that it is not enough to transact, you have to create and maintain user confidence in payment systems by having good management of the end-to-end transaction cycle, security, and by strengthening authentication to create confidence, and the fluidity of the customer experience through the services offered.

As I said earlier, you need mastery of data, and therefore a new economic model to be built to reduce the cost of transactions. As we have seen, all this is facilitated by a judicious choice of technologies and it is already at work to promote exchange from the standard between a good integration of different players, whom we will call producers. Fintechs in this ecosystem are producers of payment services, so their integration must be encouraged. They are the ones who will carry the innovation and allow the ecosystem to have inexpensive systems. And it is also necessary from our point of view to have a convergence of different payment means, such as a popularization of payment solutions through the new uses, and therefore new payment methods and uses.

JEAN-MARIE BENOÎT MANI, AFREXIMBANK: I think things are gradually falling into place. As I pointed out a little earlier, at the African level we lacked organization, leadership. I think this leadership and this organization are taking shape and we should, in the years to come, see a certain acceleration. But, as we also underlined, payment systems are a fairly sensitive area and we must avoid going too fast and making mistakes that could undermine the confidence that exists in relation to the new payment mechanisms, the new means of payment that are being put in place. So go fast, but also ensure safety. In Africa, the ground was practically virgin, so it is a question of putting all the infrastructures in place, even already at the mental level, that people are more up to standard in terms of performance, in terms of all the qualities necessary for these systems to work and to do everything that is expected of them, to lead to economic development. And we must avoid arriving at systems that will encourage and promote exclusion instead of financial inclusion because it is a question of including as many people as possible, especially those who are still outside financial systems. We already have new tools like mobile money which have arrived and which, in fact, make it possible to accelerate this inclusion a little, perhaps not banking, but at least already financial. And the big advantage we have with digital is that it makes things much more controllable. What is digital, once it is entered in the system, we have a trace and we can then control it. Earlier, we were talking about the risks in terms of the financing of terrorism or crime and everything, I rather think that it is in our interest for the maximum number of people to enter into digital processes. Because there, the controls are much easier. There is a lot more traceability and there is at the level of customer enrollment. That is where the first security is done, because we make sure that we do not bring people into the systems who have a criminal record, and in addition, since the data is stored, we have plenty of time to come back afterwards to carry out checks and ensure that everything is going well. So I said that the prospects are very good, it's true. We would like it to go very quickly, but it will have to go quickly while keeping in mind the need for the security needed so that confidence in the systems does not fall. All it takes is a crash in the system for all the stored trust to go away and we have to start from scratch. The processes are underway, the mechanisms are being put in place. I think the future at the African level, in terms of payments, is rather optimistic.

JEAN-NOËL GEORGES: So, thank you very much, Jean-Marie, for this conclusion. Hakima, I would like you to answer Adjoa Christelle N'Guessan's question: "Can we achieve cross-border payments when we know that each player in the system has their own fee schedule which often stems from their business model?” And then, in a second step, perhaps, if you want to go back to the question that I use for everyone: what remains to be done? How can we accelerate knowing that all the players seem to be in the same direction?

HAKIMA EL ALAMI, BANK-AL-MAGHRIB: We are not there to put standardized tariff schedules, we are more market-oriented, and this market convergence will cause price reductions and fair competition for the benefit of the consumer, and that is very important. The regulator is there perhaps to go and regulate a certain number of things which will affect the cost of the transaction itself. I can give the example of the interchange commission for cards, where maybe the regulator can control the cost of the transaction to be minimal for both the consumer and the merchant. But in general, let the market do it, and, perhaps, on certain points which are determining factors in the transaction cost, the regulator has a right of scrutiny and can do things to facilitate the acceptance.

To summarize a little bit what we have said, the regulator is there first of all to put in place the conditions for an environment favorable to the development of payments, which it is there to ensure, to reassure the consumer on the payment method. Security measures, being there to lead the modernization of payment systems, is what will facilitate their integration later. Consultation with players is very important, the central bank is not not there to do things on their own, but really the consultation is there to carry out the work within deadlines while maintaining the public's confidence in the currency.

What remains to be done: to continue of course, at the national level, because it is very important, I spoke about it at the beginning. We talk a lot about integrated payment systems and so on, but if we don't facilitate people's access, we don't facilitate financial inclusion. We can set up the systems we want, it won't work. We really need to be able to fight against the informal sector, by facilitating people's access to banking and financial systems in general. Financial education is very important. In Morocco, we have also just launched digital education, because sometimes even just launching more new developed mobile features, we lose the audience. So this digital education on the use of platforms, on minimum security rules, on a certain number of things, it is very important so that people who have been excluded until now can access the financial system according to the rules and minimal fees that are imposed by central banks.

Eight points to take away

JEAN-NOËL GEORGES: Thank you all very much. Here is the eight points that we can take away from this discussion.

-

Regulatory framework: a single, harmonized base is needed. And then, we need leaders at the regional level, there is a need for regional initiatives.

-

Digital infrastructure: there are new technologies, we have to get up to standard again. The ISO 2022 standard is a good basis, but not sufficient. There is a lack of standards.

-

The cost of transactions: there are new economic models, but let the market do it, with some actions from time to time or, if we need the regulator, to manage these costs.

-

Let's be quick, but do it step by step anyway. Not too fast to make sure to maintain confidence to maintain safety.

-

Consultation with all stakeholders. There is a collaborative spirit that already exists, so it must continue with all the partners.

-

Everyone must be included in this digitization. There should be no exclusion of certain populations. We talked about financial inclusion, and also about digital education.

-

Urgency of modernization, so as not to disappear from the ecosystem, for banks wishing to make cross-border payments, and not to be disintermediated.

-

Interconnection rules. They are extremely important to make cross-border payment a success.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network Int. and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.