Rocker, the Swedish neobanking pioneer, has selected Enfuce – Finland’s largest fintech startup – as partner for card issuing and payment processing. The collaboration enables Rocker to issue VISA prepaid cards easily and securely.

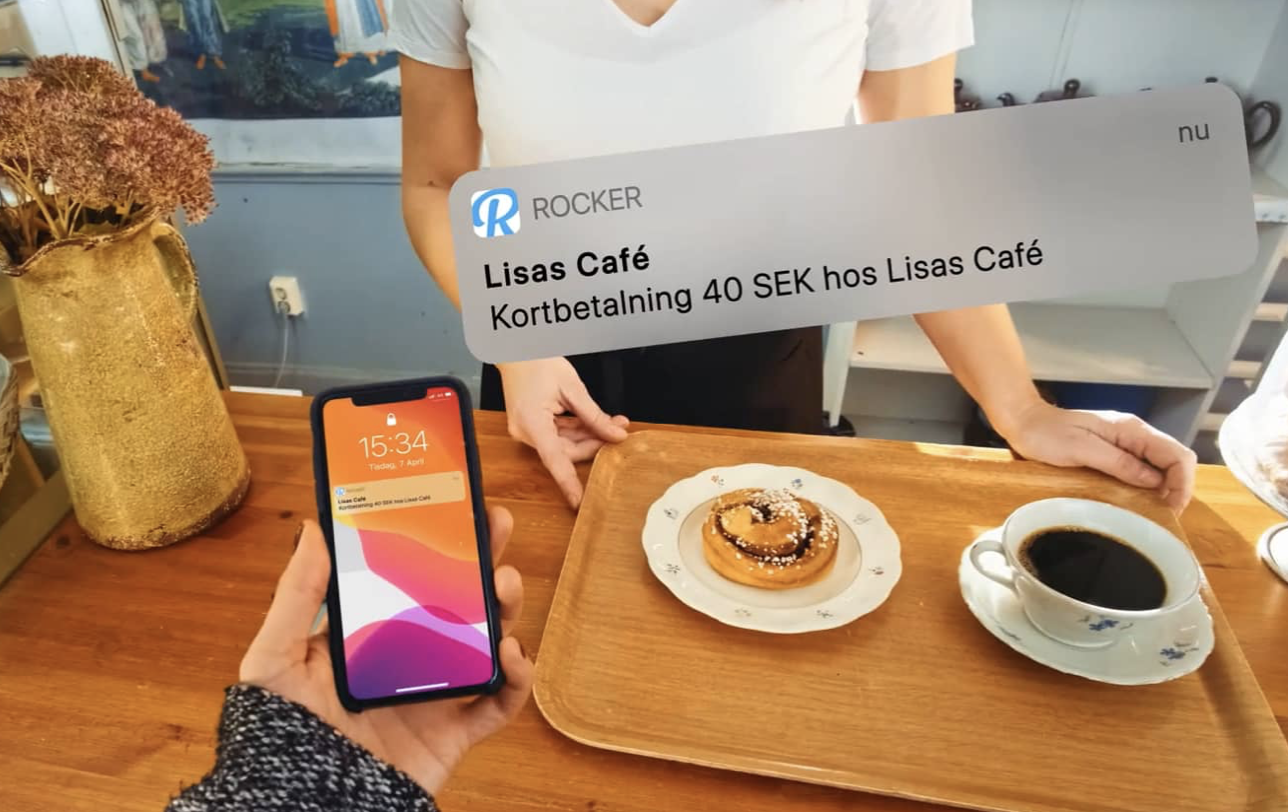

Stockholm-based Rocker, formerly known as Bynk, builds a mobile platform for personal finance and continuously expands its offering within the areas of loans, payments and savings. Earlier this year, Rocker expanded its business within consumer payments by launching a debit card. Building on a background in consumer lending and peer-to-peer payments, Rocker had sought a flexible solution to underpin a prepaid card offering.

Rocker joined forces with Enfuce’s team of experts in order to fast-track an otherwise complex card issuing process. Besides supporting licensing, compliance and payment processing, Enfuce’s one-stop-shop service helped Rocker to process card transactions according to the highest security and compliance standards.

"We are a tech company building a retail banking platform with services that are more flexible, super easy to use and more affordable. As we expand towards our vision of becoming Europe’s number one future neobank and offer people the chance to replace their old bank, we need strong and flexible infrastructure partners to be part of the platform creation."

Enfuce enables Rocker to issue feature-rich cards compatible with any payment method, currency or geography, which helps the company in its announced plans to expand its business on a European scale. By integrating Enfuce’s web-based API, Rocker can seamlessly control features like dynamic spending limits, push notifications and geo blocking.

"We’re excited that Rocker chose us to power their cutting-edge neobank service. Through our card-as-a-service solution, they can launch modern payment services easily and securely. We’re thrilled to work with a team of innovative professionals who are building extraordinary products within personal finance."

In addition to powering payments, Enfuce is helping Rocker cover operational needs with a suite of back-office services – comprising Dispute- and Risk Management as well as Service Desk Support.

‘Our partnership shows how collaboration is the key to achieving big things in fintech. By internalising all the complexity of the payments industry, we help Rocker to focus fully on building amazing customer experiences,’ adds Monika Liikamaa. ‘We’re thrilled to join forces with a truly like-minded partner and look forward to growing together.’

Enfuce’s business runs on Way4 cloud-based payment processing software

Enfuce, a Finnish payment service provider founded in 2016, offers payment, open banking and sustainability services to banks, fintechs, financial operators, and merchants around the world. One of the reasons behind their rapid growth from startup to global provider of cloud-based payment services, is successful partnerships like with Amazon Web Services (AWS) and OpenWay, a global vendor of digital payment solutions.

By running OpenWay’s Way4 payments software platform in the cloud, they provide their clients with a broad range of integrated card schemes and practically every card product available on the market, whether they are pre-paid, debit, credit, or instalments.

In 2019 Enfuce and OpenWay jointly won a PayTech Award as the “Best Payments Solution for Payment Systems in the Cloud” and in 2021 Enfuce became a pioneer in shaping a Card-as-a-Sevice offering for its clients.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.