According to statistics, there are more than 95 million people in Vietnam, and 1 out of every 4 people is unbanked or underserved. At the same time, almost 6 million SMEs and numerous individual online sellers struggle with cashless payments acceptance. SmartPay is addressing these problems.

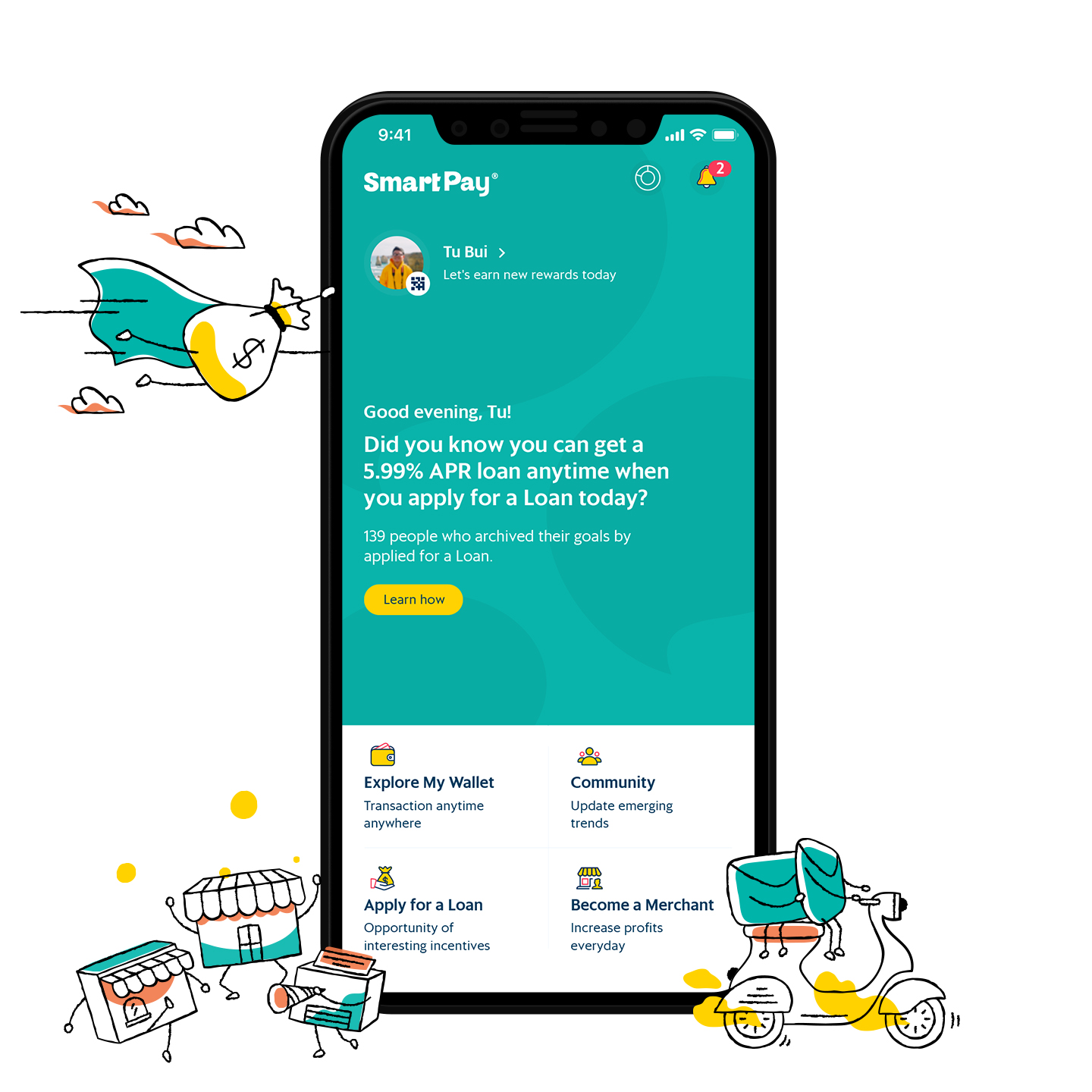

SmartPay is a digital wallet service for merchants and consumers. It ensures a better payment and finance management experience for retail customers by offering them digital payments, loans, savings, loyalty programs, bill payments, money transfers and data-driven services – all on mobile. The unbanked population especially benefits from easier access to financial services. For merchants – both SMEs and individual sellers – the wallet enables acceptance of QR-code payments without additional investments in POS infrastructure.

“SmartPay creates an ecosystem of local business and consumers, communities unified around one shared interest: creating mutually beneficial opportunities and keeping money localized in their community. SmartPay brings more value than a mere payment, it builds a whole network of services on top of it to provide additional benefits to customers, because that is what they are ready to pay for,” comments Marek Forysiak, Chairman, SmartPay.

One of the major obstacles to launching financial inclusion wallet is the low value of transactions, which is usually not enough to cover the cost of service with a traditional fee-based model. To overcome this obstacle, SmartPay is relying on WAY4 as the technological platform for its innovative wallet. WAY4 allows the fintech startup to achieve an acceptable TCO and be ready to scale up. Now SmartPay’s cost of providing service is so cheap that even for micropayment processing there still will be some margin.

WAY4 Wallet is an open software platform developed by OpenWay. The platform manages B2C and B2B wallet accounts, enables acceptance of QR code and NFC payments, and processes card- and account-based transfers online. It automates customer onboarding, claim management and other workflows, ensures security and BI, and provides APIs to integrate with payment schemes and partners. Companies that use WAY4 generate additional revenue streams from loyalty programs, dynamic pricing, and launching of personalized services based on basket data analytics and historical data.

“We chose OpenWay as our processing platform partner because with them we can put things together in a way that has not been done before,” comments Herman Tischendorf, CTO, SmartPay

“OpenWay is proud to be part of this project, which will contribute to financial inclusion and building a cashless society in Vietnam. Our WAY4 platform excels both in the more traditional domains (card issuing, merchant acquiring, transaction switching and payment gateway) and in the area of innovative products such as digital wallets, tokenization, instant payments and data-driven services. It means that our clients can move forward quickly and efficiently without switching their platform. They do not simply follow the market; instead, they lead the change – as does SmartPay,” says Rudy Gunawan, Managing Director, OpenWay Asia.

Learn more about WAY4 Wallet solution

Watch the webinar to learn how to make knowledgeable, long-term profitable decisions about wallet projects. The video features various wallet business models and explains how it can become a valuable tool for client onboarding, engagement and working with partners.

Video: How to launch a financial inclusion wallet

SmartPay launches a financial inclusion wallet in Vietnam, targeting 25M consumers and 6M SMEs....

Way4 brochures

Request a brochure to learn more about Way4 solutions and cases.

Explore the dedicated webpage to know more about WAY4 Wallet functionality, read relevant client cases from all over the world.

-Feb-19-2026-12-35-53-1410-AM.jpg)