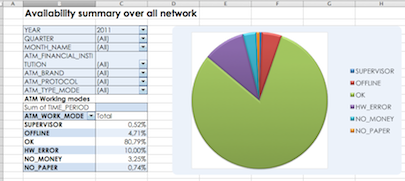

The Way4 ATM/Kiosk Statistic Analyzer solution makes it possible to find areas in which the efficiency of ATM and kiosk networks can be increased. The following reasons for device downtime are analyzed: device is out of order, unreliable channel connection, speed of service company's provision, device is out of cash or paper for receipts, etc. Way4 ATM/Kiosk Statistic Analyzer creates general reports on device availability for a period and special reports broken down by financial institutions, service companies, device vendors, ATM locations, and time periods.

The solution makes it possible to check the compliance of network service quality with SLA conditions. “How much time did ATMs spend out of order this year?”, “What is the performance indicator of terminals?”, “What were the main reasons for terminals being out of order last year?”, “How much time in a month were ATMs out of order due to no connection?”, “Which vendor's ATMs were out of order the least last month?” – by making it possible to answer these questions Way4 ATM/Kiosk Statistic Analyzer helps companies cut operating expenses and improve the efficiency of the ATM network.

Way4 ATM/Kiosk Statistic Analyzer uses the processing system's database and platform as well as the MS Excel software solution for data visualization and analysis, making it possible to cut implementation expenses and time. The key difference from the previous version is that instead of OLAP technology, it has its own schema and ready reports in Excel format can be used.

“In the past two years, OpenWay has offered several innovative solutions for ATMs, including cardless cash withdrawal and transfers at ATMs, integration with the Western Union money transfer system, issuing advertising flyers, and others", commented Maria Koshkina, OpenWay's development department director.

The Way4 ATM/Kiosk Statistic Analyzer solution is intended for bank analysts responsible for developing ATM and self-service kiosks networks and for technical specialists.

The solution is based on the ideas and methods of lean management, assuming systematic statistic quality management and a constant battle with losses. These methods were first used in the Japanese auto industry, and were later adopted by companies from other areas, including banks.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.

-2.jpg)

-1.jpg)