‹New feature, separately licensed›

-

Way4 Issuing now supports Visa Instalments Solution (VIS), a new real-time open-loop API-based instalment service from Visa. This update combines Visa's reliable payment technology with the flexibility of the Way4 platform.

-

A new licensed functionality in Way4 provides frictionless instalment payment options, allowing issuers to enhance their product offerings by quickly launching credit programs like BNPL for Visa credit and debit cardholders.

-

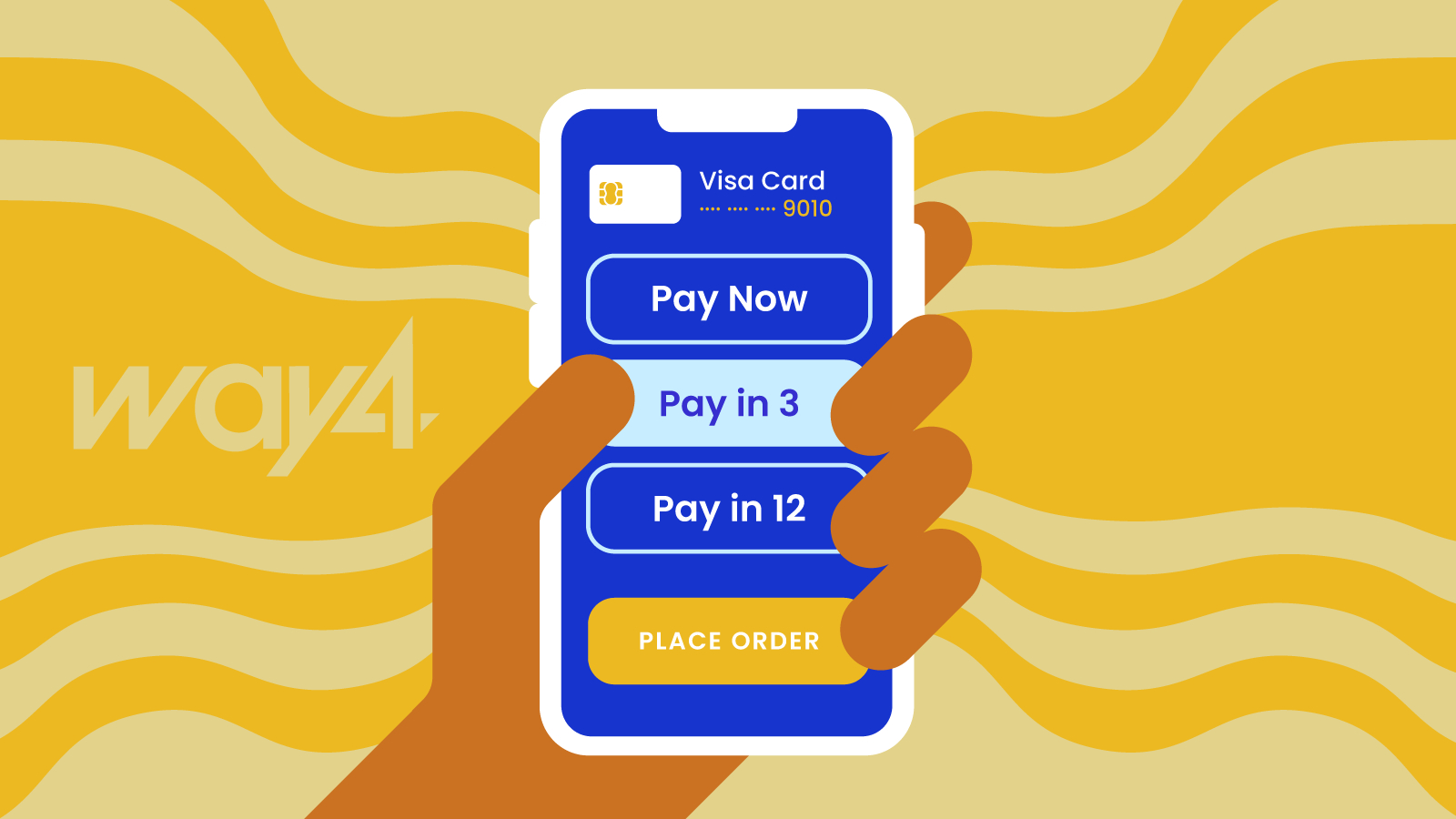

Instalment or BNPL programs may be customized for select merchants so they can offer flexible instalment plans on their websites. Seamless integration with the Visa UX is quick and easy.

-

VIS is initially available in the US, Canada, UK, Hong Kong, Malaysia, UAE, KSA, and Qatar, with plans to expand to 30 countries over five years.

VIS is a card-based solution that unites key stakeholders in the payment ecosystem, including issuing banks, payment processors, merchants, and payment facilitators. It allows Visa cardholders to opt for instalment payments at checkout, whether online or in-store. Cardholders can use their existing or new credit and debit cards for instalment purchases, with eligibility determined by the issuer. While VIS works with existing debit and credit cards, no new account is required, and the availability of specific instalment program products and features may vary by market. The issuer is solely responsible for its own instalment program.

The role of VIS in Way4 Issuing:

-

Instalment plans are configured in Way4, with Visa cards enrolled by BIN and account range.

-

Merchants display instalment options during purchase.

-

Eligible cardholders select a plan and agree to the terms.

-

Visa sends authorization requests and provides issuers with instalment details.

-

Issuers update the cardholder's statement to include the instalment schedule.

-

Visa manages instalment fee billing and settlement for reconciliation.