Payments in the Metaverse – (almost) everything you wanted to know

Gartner is predicting that by 2026, “25% of people will spend at least one hour a day in the metaverse for work, shopping, education, social and/or entertainment”. Even if you’ve never set foot in the metaverse, you might have heard announcement after announcement of yet another familiar company setting up a presence there. Shortly after its rebranding in 2021, Meta made widely known its plans to “bring the metaverse to life” with Horizon Worlds. And now, organizations of all shapes and sizes, goals, and ambitions are entering the metaverse: Walmart is going to sell virtual electronics and personal care goods, JP Morgan opened a lounge in Decentraland, making it the first bank in the US to make its presence in the metaverse. Even the Vatican has announced a strategic partnership with tech company Sensorium to create an NFT gallery of the Vatican’s art collection.

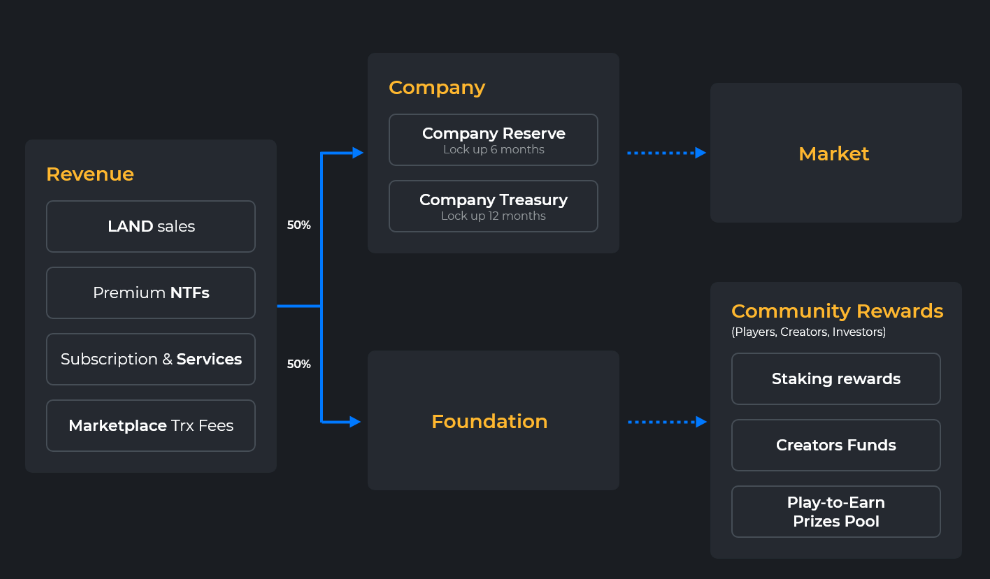

Companies are visualizing the metaverse as a lucrative source of revenue for themselves and increasing numbers of developer-creators, invited to test innovations and produce different social experiences for growing numbers of users. After being proven in a metaverse, some new ideas are even brought back to the offline world as new services.

OpenWay, a top-ranked digital banking and payments provider, explores what people mean when they talk about the metaverse, what role payments are playing there, what steps big financial industry players are taking to enter this space as we speak, and the risks and challenges involved.

Table of contents

What is the metaverse?

Many definitions of the metaverse exist, but the underlining idea is that of a series of interconnected, intercompatible online worlds with elements of virtual reality and augmented reality. It has been defined by Onyx, JP Morgan’s blockchain unit, as “a seamless convergence of our physical and digital lives, creating a unified, virtual community where we can work, play, relax, transact and socialize.” Metaverse proponents see the metaverse as an evolutionary concept. Here are two stages of this evolution in a nutshell.

The metaverse of Web 2.0

What often comes to mind when people think of a virtual world, the closed metaverse of Web 2.0 is comprised of a proprietary virtual platform or series of platforms owned and monitored by a large corporation. What is driving their growth?

Socialization and gaming

These are the biggest driver for the development of metaverses and the money spent on these is staggering. For comparison, spending worldwide on music is only half of the amount spent of virtual goods, and in-game ad spending is predicted to reach $18,41 billion by 2027. Fortnite, Roblox, Second Life and World of Warcraft are examples of closed metaverses provided by very large, centralized players.

Web 2.0 metaverse platforms sell to its users games and related paraphernalia, access to virtual events and experiences, and virtual items like gear, skins, and land. They may allow their users to buy and sell among themselves and from the platform itself, behaving in effect like an e-commerce shop. For instance, Battle.net, an online shop by World of Warcraft, allows users to load their Battle.net balance via different traditional payment methods such as credit or debit cards and PayPal. After that, they can buy in-game items such as mounts or pets, character services such as a level boost or transfer between WoW realms, digital games and more.

Virtual platforms may take a percentage for facilitating commerce between users. For example, Meta Platforms FB announced that it will charge almost 50% commission from the sale of all digital assets on its Horizon World virtual reality platform. In comparison, Apple charges developers 30% for selling apps through its App Store. Platform owners often provide tools to developer-creators in their communities to create their own games and experiences, taking a hefty and lucrative fee. For the most part, people buy and sell digital assets using in-platform currency purchased by traditional payment methods, and these assets are locked within the platform. Take Roblox, which has a native currency called Robux, which cannot be generated and are only sold in exchange for real-world currency through the Roblox currency. Second Life has its own virtual token called the Linden, which can only be used within its platform.

Industrial, education and healthcare applications of the metaverse

Besides games and socialization, some see practical applications of the Web 2.0 metaverse for industrial uses: VR (virtual reality)- based environments provide a training environment for those learning highly precise, physical tasks such as complicated mechanical repairs for helicopters and planes. AR (augmented reality) type metaverses are favored by designers of new products and services and can evolve into marketing and sales promotion-type environments, of which the IKEA app is an example. Digital virtual platforms are attractive for companies seeking to simulate real environments for training, engineering, and assessment of potential job candidates on how they perform within a simulated environment.

The role of financial institutions in the Web 2.0 metaverse

Financial institutions can act as e-commerce enablers facilitating payment processing for game merchants and as accounting and settlement engines for in-game transactions held in virtual currency. The differentiators here are the wide support of local payment methods, multi-country payments, and efficient fraud prevention and chargeback management. For example, Finaro, who relies on OpenWay’s Way4 software platform to run its cross-border e-commerce acquiring business, offers e-merchants an approval rate analysis and optimization service, which secured an 83% approval rate (6.3% above the industry benchmark) for a gaming giant.

Financial institutions can also enable the issuing of branded gift and prepaid cards, and manage digital wallets for gamers.

The metaverse of Web 3.0

The metaverse of Web 3.0, the ambitious vision of a single, interconnected, intercompatible and open virtual world, is more a hypothetical concept than a fully realized environment at this stage. However, everyone agrees on several things.

The metaverse of Web 3.0 should be community-governed. Instead of a company owning the environment, the metaverse should function as a DAO (distributed autonomous organization) where contributors are creating and enforcing set rules, like the way Wikipedia functions. However, it should be noted that even Wikipedia is owned and regulated by the Wikipedia Foundation, which has authority to carry out policy decisions for the entire site (such as its recent decision to stop accepting bitcoin as donations). What exactly constitutes community governance is still poorly defined at this stage, particularly when it comes to a single, cross-platform and open metaverse.

Cryptocurrency support is mandatory for the metaverse. Payments are enabled through crypto wallets in cryptocurrency, although native tokens may also be used. Value is also stored in digital assets that are transferable and portable, like NFTs (nonfungible tokens).

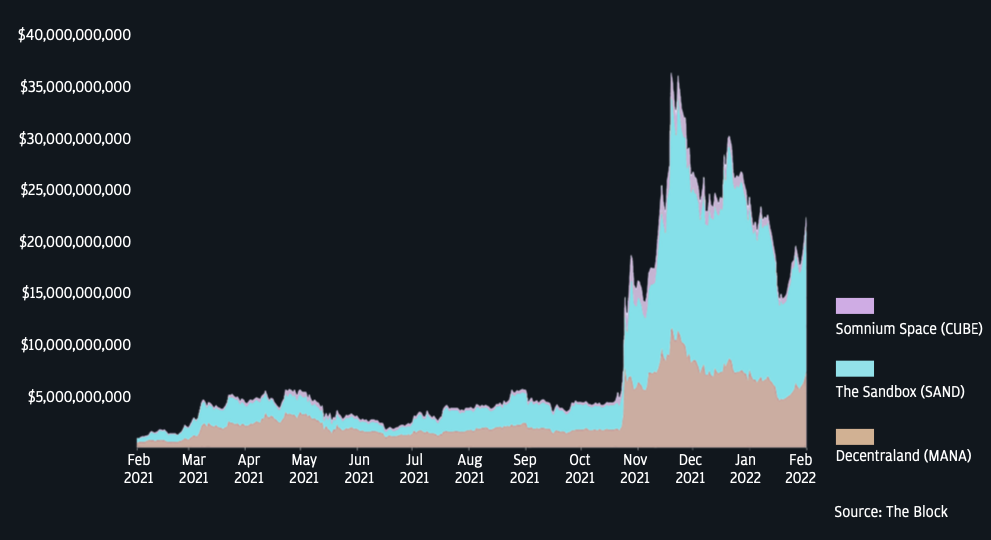

Platform companies such as Decentraland, The Sandbox, Somnium Space and Voxels (formed Cryptovoxels) are positioning themselves as prototype representatives of this new Web 3.0 metaverse. These platforms are said to be community-governed with native tokens in use. Payments are enabled through crypto wallets and digital assets such as NFT are transferrable. For example, Decentraland is Ethereum-based, and its native tokens are MANA, LAND and Estate tokens. Holders of these currencies hold certain units of voting power in the DAO. In addition, Decentraland has also a Security Advisory Board consisting of five members voted in by the Decentraland community, which oversees security and reviews governance proposals.

What are people buying and selling in crypto-based metaverses?

For one, people are buying up digital plots of land for virtual real estate, which owners can develop into personal virtual homes to showcase personal possessions, like a personal webpage, or keep as an investment. Forbes this year reports that the average price for the smallest plot of land on Decentraland or the Sandbox was going for around $13,000. Users are also creating, buying and selling NFTs. The transfer of value back and forth between NFTs and the real world, and the collaterization of loans based on NFTs are attracting the notice of the financial industry.

Besides buying and selling transactions, metaverse users are also earning revenue from governance activities and by receiving royalties on secondary trades of their NFTs. There is an emerging gig economy in the metaverse through virtual parties, concerts, and other experiences. It is important to keep in mind that all these activities are cryptocurrency-based blockchain transactions, so concerns about financial fraud, contribution to climate change from energy consumed by the whole cryptocurrency industry, and security are continuing points of debate.

What strategies are some financial institutions adopting in the metaverse?

Some financial brands have already made forays into one of the metaverses mentioned above, or have produced their own platform. JP Morgan made its splash by purchasing a large plot in the Decentraland metaverse and opening its Onyx Lounge. In South Korea, Kookmin Bank has constructed a metaverse VR branch in partnership with VR content developer Sharebox where headset-wearing customers can access financial services via avatars, while employee avatars help them analyze risk-return profiles and design investment portfolios. The Industrial Bank of Korea announced that it will be launching a virtual branch on Cyworld Z’s metaverse. In this way, banks hope to create awareness of their brand among a new, younger demographic used to spending lots of time in virtual roleplay and open-minded to innovations.

Besides building a presence of their own in a metaverse, banks and fintechs can play a key role in this space by identifying potential customers, onboarding them through crypto wallets, and providing payments, lending and custody services. The use of NFTs involves currency exchange activities, an area where banks already excel. The metaverse comes with its own customer segments such as creators, gamers, storytellers, event producers, managers and artists, all of whom need an intermediary between cryptocurrencies and fiat bank account currencies, since very few people are able to use crypto in their daily financial transactions. Financial institutions can be providers of loans, financial planning services, and aggregation of income sources. Protection of digital assets might also be an avenue of profit for banks, especially if these banks are willing to take liability. And like with any other asset, banks can offer their expertise in managing risk, compliance, fraud, and data protection to safeguard the digital assets of metaverse users.

What challenges and unknowns may slow adoption of the metaverse?

It should be kept in mind that regulation, tax, and accounting of commercial transactions in what JP Morgan calls the meta-economy still have not been developed fully and carry risk. There are few regulations, not to mention that NFTs are destroyable, conditions of their ownership and possession are still poorly defined legally, and are considered securities. A financial institution should also consider real-life factors that may impede the adoption of existing and future metaverses by their customer base. Some of these:

-

Signing up for a metaverse is too complicated. Often it is impossible to enter a metaverse without a cryptowallet. Not everyone has the technical skills to work with cryptocurrency or even understand how it works. They may also be unable or unwilling to invest in additional hardware or computing power needed to even make an initial venture into the metaverse possible.

-

The technology behind delivering an immersive experience is nowhere close to smartphones and computers in their ubiquity. Technology is for the most part still shackled to big tech companies and their big platforms, which makes it a long way from making everything interconnected and open. A decentralized, autonomous future world will most likely need tools to make it accessible and usable to a larger audience. However, there is no incentive for big companies to develop such tools, since they will most likely push for centralization, power, and profit.

-

There is no guarantee that people will even want to hang out via avatars (sometimes even without legs) in a virtual space in favor of offline experiences in the real world, particularly after pandemic restrictions have been lifted.

Although many proponents of the metaverse compare its development and progress to the early internet, predicting what people will want is notoriously difficult. As WIRED notes: “Money pouring into a space doesn't necessarily mean a massive paradigm shift is right around the corner, as everything from 3D TVs to Amazon's delivery drones and Google Glass can attest. The history of tech is littered with the skeletons of failed investments.”

-

No matter how much virtual worlds evolve and become globally accessible, governments and regulators will be scrutinizing economic activity in the metaverse and there is no way to predict what actions will be taken to regulate or even outright ban key components of the metaverse. Think of China’s ban of cryptocurrency transactions by financial institutions last year, followed by bans on all crypto mining and cryptocurrency itself.

Regardless, it should be kept in mind that metaverse Web 3.0 activities are at a preliminary, conceptual stage. As with any innovation, there are many issues yet to be considered and explored in more detail to ensure that the customer journey is not only exciting but safe and reliable. This is where the financial services industry has probably more experience than any other industry sector.

How can Way4 help financial institutions who want to do business in the metaverse?

OpenWay sees the metaverse as an interesting area of exploration for innovative payment players who want to stand out and deliver a reliable and trusted payment experience to new virtual spaces. Here are some ideas of how financial institutions can use Way4, OpenWay’s end-to-end digital banking and payments software platform, to find a role in the metaverse economy:

-

Become an enabler of payments in Web 2.0 and Web 3.0. Financial institutions can become a bridge between traditional and new-generation payment rails used in metaverses. Using Way4, they can offer card, account-to-account, and wallet-to-wallet payments, also facilitate multi-currency and in-game currency purchases. They can integrate popular crypto wallets and alternative payment methods popular among users in a target location.

-

Create an all-in-one digital wallet experience. Despite being in – and perhaps even because they are in – the metaverse, customers want an easy-to-use, unified view of their finances. Way4 Wallet can load and manage all types of client financial assets in one place: payment accounts in multiple fiat currencies, loyalty accounts, virtual currency accounts and more. NFT and digital assets may also be integrated here.

-

Enable 100% digital workflows. The metaverse experience is mostly virtual. Way4 allows banks and fintechs to digitalize their bank office operations related to payments, such as new account holder or NFT merchant onboarding, chargeback processing, fraud prevention, and multi-party settlement with automated profit-sharing.

-

Embed payments and VAS to a metaverse via APIs. Way4 is an open payment software platform that comes with data-rich APIs and data streaming functionality that allow companies to smoothly integrate their payment services with other viable metaverse services, such as crypto wallets, AI and VR systems.

-

Enable cross-metaverse payments. The flexibility of the Way4 core allows it to be used as an engine for future cross-border payments between different metaverses. It is possible to set up any payment transfer and pricing mechanics, set rules for optimization of transaction processing costs, and manage currency conversion.

-

Introduce essential financial services to a virtual reality setting. Although unclear assumptions and uncertainty about financial transactions in the metaverse are abundant, it is safe to assume that users will want the same convenience in their payment experience there as they would find in the real world. They may want to use BNPL, pay-in-one click, and see personalized offers and discounts. Companies should be ready to offer these services and be quick to develop any other service that may be required by metaverse users.

The Way4 digital payment platform has always been at the forefront of payment innovation thanks to our future-facing clients and our stellar international team. Our visionaries are always open to designing and implementing payment solutions that help our clients strengthen their leadership in the dynamic world of payments.

What’s next?

The metaverse involves many questions and issues where it is still difficult to distinguish between fad, fiction and fact. However, there is already enough activity within decentralized finance, NFT and cryptocurrency for financial institutions to justify at the least an observational strategy so they can be alert to opportunities that may arise within this rapidly evolving market. They can closely monitor how regulations, technology and markets adapt to and accommodate the metaverse economy while at the same time analyzing their customer needs. In doing so, they can build short-term and long-term metaverse strategies that may just give them a first-mover advantage in the potentially huge metaverse market.

Banks and fintechs around the globe are using the Way4 digital payments platform from OpenWay to launch scalable payment business services that work in real-time and through any channel. Way4 covers every aspect of the payments business from card issuing to merchant acquiring, e-commerce gateway, transaction switching, and digital wallets. OpenWay’s stellar team works with clients to explore and analyze new business areas and create pioneering payment services together. Let’s work together to bring your next payment project – whether it is in the virtual or real worlds – to life!

Learn more: analytic reports, news and case studies

-

Press Release, February 7, 2022. “Gartner Predicts 25% of People Will Spend At Least One Hour Per Day in the Metaverse by 2026”. Gartner. Accessed May 23, 2022.

-

Sudhir Pai, March 15, 2022. “Banking on the Metaverse”. Forbes. Accessed May 23, 2022.

-

Sam Shead, April 13, 2022. “Meta plans to take a nearly 50% cut on virtual asset sales in its metaverse”. CNBC. Accessed May 23, 2022.

-

March 29, 2022. “The promise and peril of the metaverse”. McKinsey. Accessed May 23, 2022.

-

Eric Ravenscraft, April 25, 2022. “What Is the Metaverse, Exactly?” WIRED. Accessed May 23, 2022.

-

Bernard Marr, March 23, 2022. “How To Buy Land & Real Estate In The Metaverse”. Forbes. Accessed May 23, 2022.

-

Podcast. March 29, 2022. “Innovative and practical applications of the metaverse”. McKinsey Digital. Accessed May 23, 2022.

-

Joanna England, April 22, 2022. “Why are Banks and Fintechs Entering the Metaverse?” Fintech. Accessed May 23, 2022.

-

Danny Park, November 30, 2021. “South Korea’s KB Bank unveils a metaverse bank testbed”. Forkast. Accessed May 23, 2022.

-

Eric Ravescraft, March 12, 2022. “NFT’s Don’t Work the Way You Might Think They Do”. WIRED. Accessed May 23, 2022.

-

Phil Lempert. January 2, 2022. “Walmart Is Joining The Metaverse. Are We Ready?” Forbes. Accessed May 23, 2022.