Two forces block profitable card issuing: legacy infrastructure and ecosystem complexity. Aging batch systems with static rules slow innovation and make personalization nearly impossible. Meanwhile, the payments ecosystem has exploded. Cross-border payments, CBDCs, BNPL, wallets, and embedded finance require instant, secure, context-aware integrations.

Those who can’t keep up face delays, fragmented experiences, high costs—and a growing competitive gap. Fast innovators are 18 times more disruptive, reports BCG, and getting new products to market quickly generates more revenue, at least 30% of the total.

What technology sets successful card issuers apart and makes them future-ready? OpenWay, whose Way4 digital payments software platform empowers leading banks, processors, and CaaS providers globally, has identified five essentials.

1. Platform flexibility: ready for whatever comes

From cloud-native processing to regulatory agility, issuers need platforms that support rapid responses to changing markets and scale quickly.

Client case: Nordic cloud-based processor scaled to run 16M+ cards for over 35 banks by emphasizing configurability, fast onboarding, and a multi-tenant model. Its revenue grew from $3.1M to $7.2M in 2021-2024. In Vietnam, digital wallet SmartPay scaled to 40 million users and 700K merchants in four years, supported by an issuing platform that enabled multi-product management and fast partner rollout.

The point: Modern issuers ensure product logic doesn’t depend on rigid legacy systems, so no bottleneck prevents exponential portfolio growth. Modularity, API-first design, and compliance-by-design are now essential.

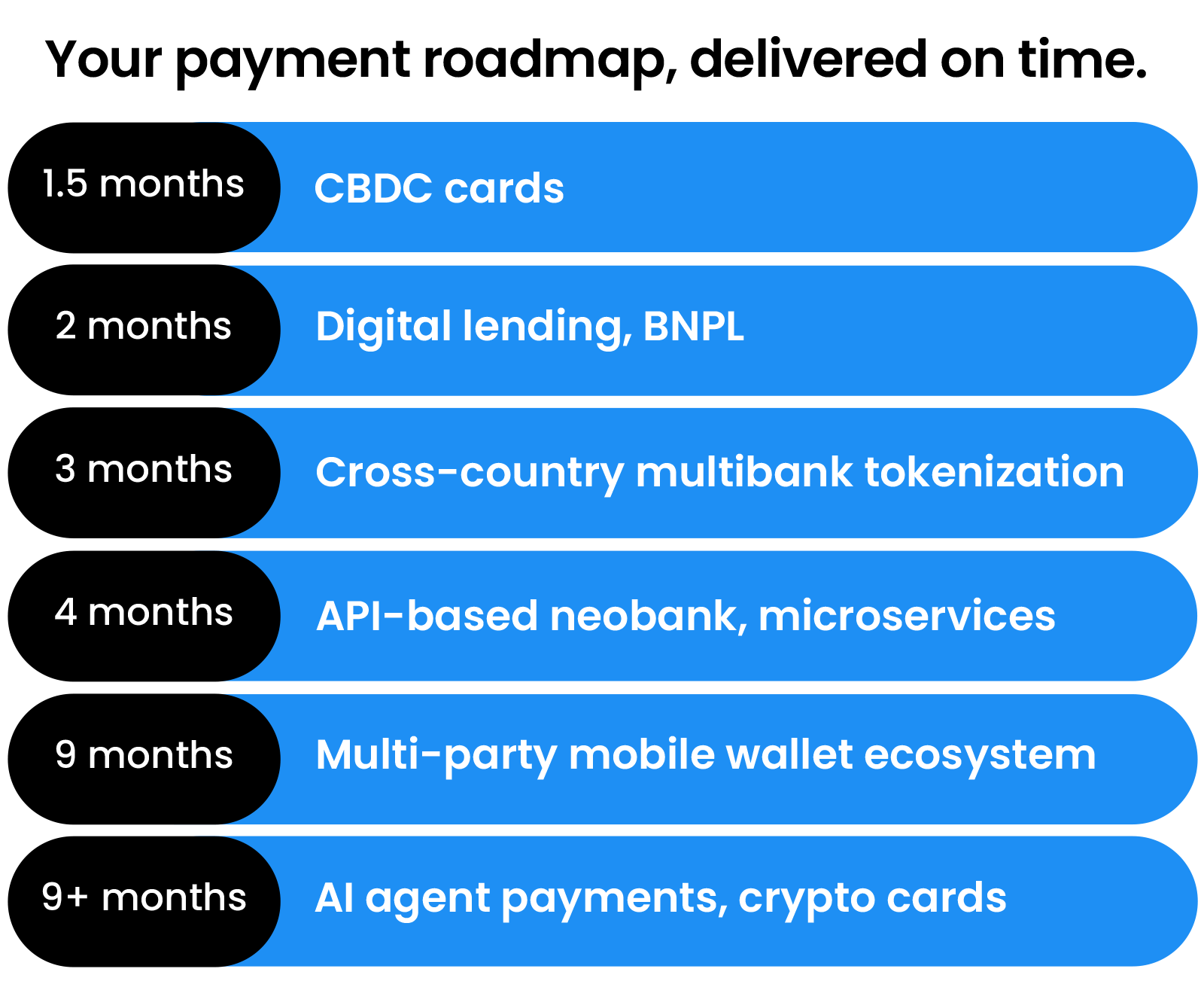

2. Rapid time to market: from pilot to production in just weeks

Whether launching a brand-new card program or a digital currency use case, the ability to deploy rapidly has become a strategic necessity.

Client case: Vietnamese digital bank Timo deployed its full digital banking and issuing stack in under four months on OpenWay’s Way4, leveraging its modular infrastructure and open APIs, and attracted $10M in investor funding a year later. Similarly, multiple financial institutions were onboarded to Eurasia’s first CBDC cards ecosystem within six weeks—a timeline unimaginable a few years ago. By late 2024, €75M of digital currency was in circulation.

The point: Issuers can shorten deployment cycles through a platform with microservices-ready architecture, rich APIs, and advanced partner onboarding tools.

3. Real-time hyperpersonalisation leveraging 24/7 online back-and-front processing

As consumers grow used to tailored services in other industries, real-time personalization of banking products has moved from optional to expected. That means not just targeted marketing, but adaptive financial experiences that respond instantly to user behaviour.

Client case: European issuer Nets, acquired by Nexi for $9.2 billion in 2021, enables cardholders to convert purchases into instalment plans directly at the POS or via app. This is enabled by rare card issuing systems, like Way4, that have a unified back-and-front architecture. With 24/7 online processing and event-driven decisioning, issuers deliver personalization at scale—right when it matters.

The point: A successful card issuing platform supports event-driven architectures and real-time data needed to build context-aware user journeys.

4. Always-on infrastructure: uptime should be a brand promise

Reliability is a prerequisite in payments. Outages have reputational, regulatory, and financial consequences.

Client case: Operating in seven African countries, Equity Group leverages its issuing system to deliver cards supporting real-time, optimal-rate FX conversions. Its integration with FX partners at the point of authorization ensures seamless service, even across borders and currencies.

The point: High availability and real-time partner integrations strengthen customer trust and become a foundation for extra revenue.

5. Strategic vendor relationships: beyond tech

As the ecosystem grows more complex, the role of the technology partner becomes strategic. Issuers increasingly value collaborative vendors who offer product capabilities plus consultative support, co-innovation, and global expertise with regional savvy.

Client case: During the pandemic, OpenWay client Nexi’s migration to a new payment processing platform was completed 100% remotely with minimal delays thanks to a resilient delivery model. OpenWay has migrated many clients rapidly from third-party platforms and legacy in-house systems.

The point: Strategic partner vendors offer onboarding support, roadmap alignment, and track record in helping clients adapt to market and regulatory change.

Transform your card issuing into a growth enabler

A card issuing infrastructure of 2025 and beyond is expected to be a highly configurable, interoperable system that connects financial institutions to consumers, partners, and evolving payment rails.

Treating issuing as a growth enabler, not a fixed utility, positions issuers to capitalize on what’s next. Stay ahead of the curve with a platform designed for agility, event-driven dynamic rules, seamless integration, and unlimited growth—backed by a partner who evolves with you.

Explore what modern, future-ready card issuing really means with Way4. Download our checklist and connect with OpenWay experts today.

Jean-Philippe Wolyniec is the Regional Director of Business Development in French-speaking countries and Europe at OpenWay. With over 17 years of experience in payments and smart cards, he has actively collaborated with major banks, MNOs and retailers, also payment and public transport industry stakeholders, to launch innovative services and engineer sales strategies. Prior to his current role, Jean-Philippe served as Sales Director at FIME and held various senior positions in sales and business development, product marketing and project management at Gemalto.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.