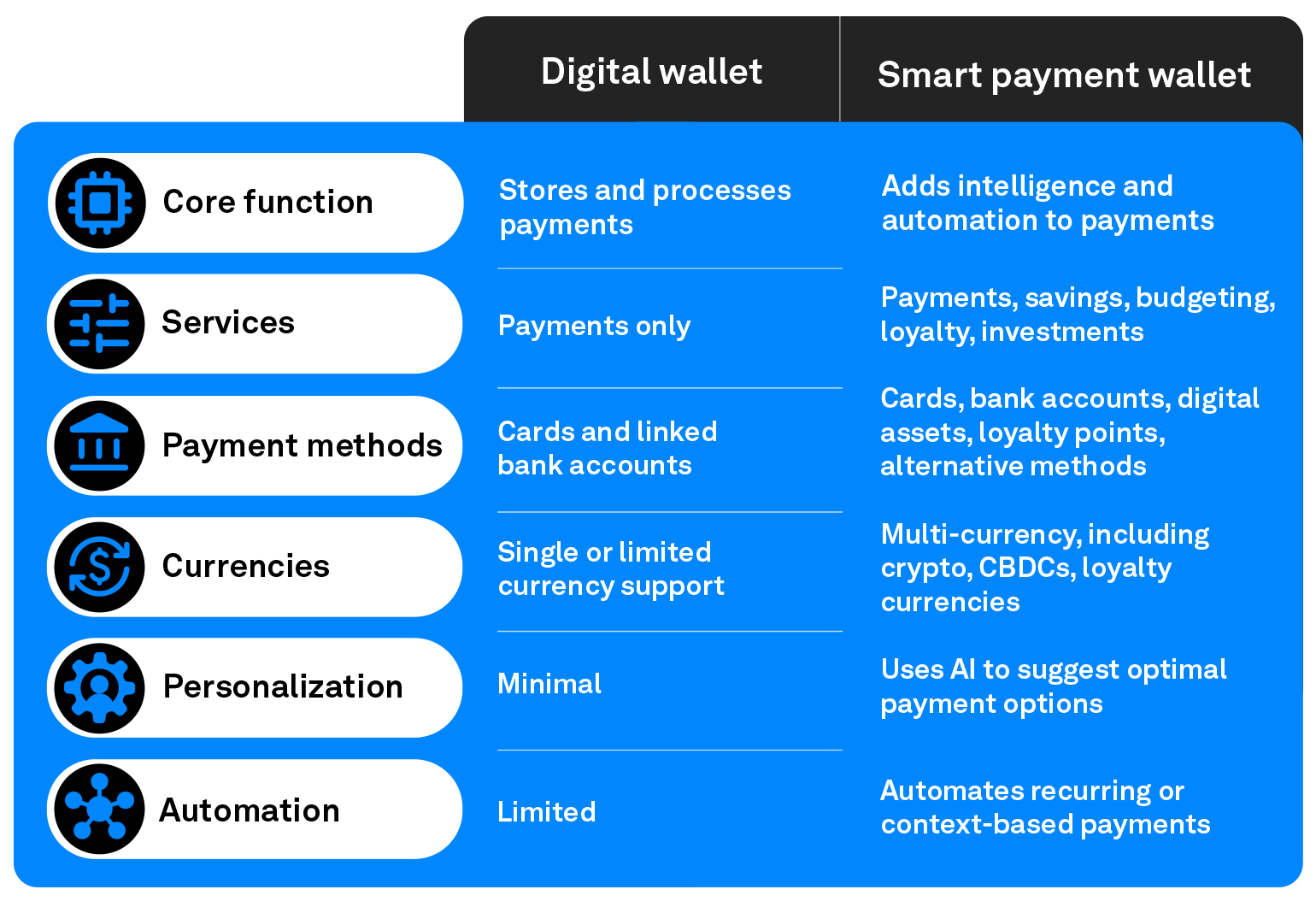

The payments landscape is evolving fast, and the smart payment wallet is a global trend in an increasingly digital world. Customers and businesses expect different payment methods and sources of funds to be available at their fingertips through a single wallet interface. Product leaders must act now to capture this opportunity and avoid being left behind.

-

Expand reach with device compatibility

Ensure your payment methods work seamlessly on most smartphones to maximize your addressable market.

-

Enable multiple funding sources

Allow users to link bank accounts, cards, digital assets, or other sources, with smooth conversion into standard payment currencies.

-

Integrate crypto and digital assets

Provide the ability to convert cryptocurrencies and digital assets into payment currencies to attract next-gen customers.

-

Reduce payment friction with automation

Incorporate smart functionality that automatically picks the best payment source—wether multiple currencies, CBDCs, or loyalty points.

Don’t dismiss smart payment wallets as a passing trend. These intelligent wallets reflect how consumers want to pay today and tomorrow. With global adoption accelerating and major players like Visa, Revolut, and PayPal releasing their own products, the time to act is now.

By partnering with OpenWay, innovators can launch next-generation wallets that meet evolving consumer expectations and stay ahead of the curve. Ready to build yours? Discover how Way4 can help you lead the way. Let’s talk!

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.

-3.jpg)