The growing priority of GenAI in banking and payments

Will generative artificial intelligence (GenAI) accelerate financial institutions on their path to increased revenue and cost optimization? If you pose this question to the zero-humility ChatGPT, it will say yes and offer multiple proofs from McKinsey, Gartner, Forbes, EY, and other leading analysts. Even more reassuring, financial institutions themselves also tend to echo this sentiment. 54% of FSIs surveyed in EMEA, USA, and APAC are already embedding AI into their offerings or expanding their initiatives, and 61% plan to use GenAI in 2024.

Artificial intelligence, in its broadest sense, has been a notable driver in the payments industry for over a decade. At OpenWay, a provider of digital payments technology to banks and processors, national payment switches and mobile wallet operators, we often see that our clients are recognizing the benefits of AI. Consider:

Enfuce, the fastest growing cloud-based CaaS provider in the Nordics, emphasized in its blog the role of AI-based scoring as a disruptor in consumer and SME lending.

This year, one of the hottest topics in our industry seems to be GenAI. Our client LOTTE Group, a leading consumer finance brand in South-East Asia, has prioritized investments in this area,as announced in their Chairman’s New Year message. Enfuce featured a guest from Amazon Web Services in their March podcast whose team has a strong focus on GenAI. Additionally, Nexi is predicting for 2024 that AI’s generative capabilities will “create hyper-personalized solutions that will enhance the shopper experience”.

Removing the barriers to leveraging GenAI’s full potential

GenAI embedded into a digital payments infrastructure is like a high-performance computer installed in a racing car. To optimize acceleration, it needs data from multiple sensors. To ensure an optimal trajectory, the wheels must be aligned and respond predictably to its commands. But financial institutions surveyed about their GenAI experience most frequently name “data quality and access” and “too much complex infrastructure” as two of the top three barriers to delivering more value from GenAI.

Those barriers can be overcome if GenAI relies on a payment processing platform with powerful data management capabilities and a 24/7 online front- and back-office. This is the exact architecture of our Way4 software platform, which has been top-rated by Datos Insights, Juniper, and Gartner. Way4 can instantly analyze customer and transaction details, both incoming and historical, and stream a consolidated, comprehensive data set to the AI engine in real time.

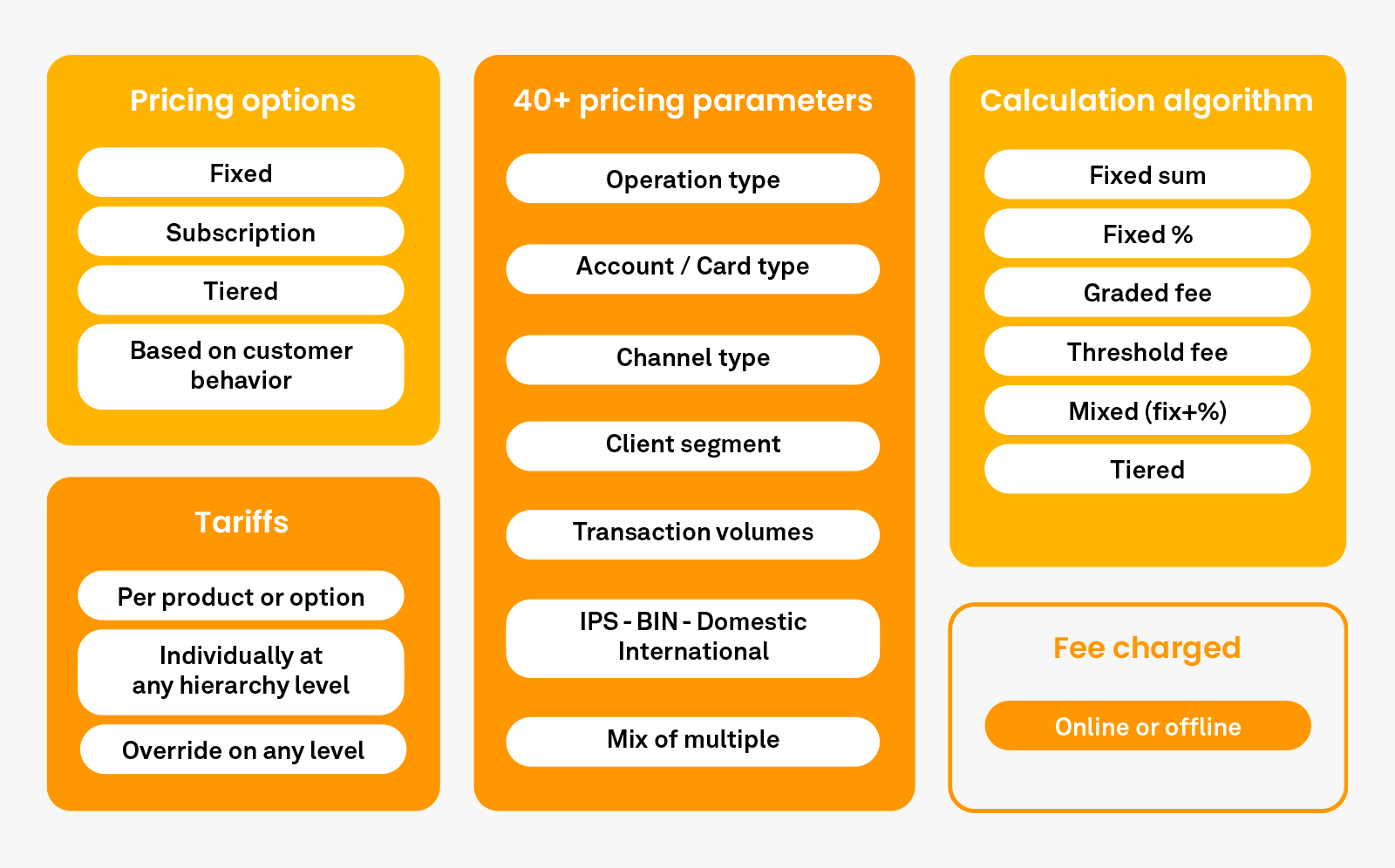

Moreover, when GenAI proposes enhancements to a payment product, risk rule, or customer service scenario, Way4 can implement these requests in real-time. Instead of hard coding, the platform administrator – whether a bank product manager or AI – configures new payment offerings using flexible parameters. Approximately 95% of product features in Way4 are parameterizable, compared to just 30-40% offered in competing systems.

Combining GenAI and innovative payments engine - 4 promising use cases

Based on our clients’ best practices, we have identified four areas where the combination of GenAI and an advanced payment processing platform delivers maximum benefits.

Use case 1. Rapid creation and easy testing of new products

Bank staff can use the flexible rules in Way4 to swiftly create unique payments products in the areas of issuing, acquiring, switching, wallets, BNPL, digital currencies, and more. Our platform also provides tools for testing product behavior with just a few clicks.

When trained by the product manager in a co-pilot mode, GenAI can automate many steps in product configuration and suggest enhancements to pricing, risk assessment, loyalty programs, value-added services, and other product elements. If necessary, Way4 can also apply specific limits and rules at the moment of product activation for individual customers.

Use case 2. Optimizing costs of customer service

When a customer makes a request, a GenAI chatbot initiates an exchange of rich data between itself and the processing platform. Data analysis enables GenAI to quickly resolve the reported issue and even offer new personalized products or services to the customer, whether they are a cardholder, merchant, mobile wallet user, or another type of customer. Way4 can create a new contract, including the required accounting schemes, and activate new products and services in real-time.

For instance, if a customer is going on a trip abroad, GenAI can request Way4 to transfer funds between bank accounts in different currencies. Additionally, it can issue a virtual multi-currency prepaid card and make it instantly available for payments. In all such workflows, steps can be added where AI decisions require manager approval.

Optimized costs are just one benefit. According to EY analysts, GenAI’s hyper-personalization of offerings helps drive customer satisfaction, retention, and confidence.

Use case 3. Enhanced risk management

During transaction monitoring, GenAI can analyze vast amounts of customer and transaction data in real time from the bank’s or processor’s multiple systems. By continuously learning from new data, it can improve its detection algorithms and reduce false positives. When GenAI calculates a new risk score and sends this information to the processing platform, Way4 adjusts its own payment authorization scenarios accordingly in real-time.

Use case 4. Discovering strategic opportunities

GenAI can identify new revenue opportunities for the payments business by leveraging Way4’s ability to process rich data, including Level 2 and Level 3 data. Way4 can capture detailed information such as shopping cart contents, enabling it to apply purchase restrictions and incentives on the fly. GenAI can identify which government agencies or non-profits may be interested in this functionality and generate targeted proposals.

Way4’s configurable API facilitates seamless data exchange with third parties, allowing GenAI to suggest new profitable models of collaboration between the bank and other members of the payments ecosystem.

Additionally, GenAI can also analyze customer feedback, spending patterns, and emerging lifestyle trends to suggest improvements to the bank’s existing products. For example, if a new travel destination becomes popular among customers, GenAI can prompt Way4 to add another currency account to an existing multi-currency card.

What’s next?

While these four use cases seem the most promising, there are many more opportunities for financial institutions to unlock the full potential of GenAI. McKinsey estimates that, across the banking industry, GenAI technology could deliver value equal to an additional $200 billion to $340 billion annually if all potential use cases were fully implemented.

If GenAI is part of your roadmap, our OpenWay team invites you to collaborate with us to launch GenAI-enhanced payment projects that will secure early-innovator revenue streams for your business.

Get instant access to the Way4 brochure by filling out the form below:

Jean-Philippe Wolyniec is the Regional Director of Business Development in French-speaking countries and Europe at OpenWay. With over 17 years of experience in payments and smart cards, he has actively collaborated with major banks, MNOs and retailers, also payment and public transport industry stakeholders, to launch innovative services and engineer sales strategies. Prior to his current role, Jean-Philippe served as Sales Director at FIME and held various senior positions in sales and business development, product marketing and project management at Gemalto.

![OW 11 [Flexible by design]](https://openwaygroup.com/hubfs/Partners%20portal/Logos%20and%20icons/OW_Logotype_RGB_99x28_s2.png)

OpenWay is the only best-in-class provider of digital payment software solutions for card issuing, digital wallets, merchant acquiring, BNPL, transaction switching, tokenization, and fleet payments, and the best cloud payment systems provider as rated by Aite, PayTech and Juniper Research. Top-tier banks and processors, as well as ambitious fintech startups, have chosen OpenWay as their strategic partner. With its unique capabilities in rich functionality, fast-to-market, high availability and better ROI, the Way4 software platform guarantees an unparalleled customer payment experience.

Learn more: analytic reports, news and case studies

-

Dataiku: Top Use Cases for Generative AI in Banking, FSI, & Insurance

-

McKinsey: A generative AI reset: Rewiring to turn potential into value in 2024

-

McKinsey: The economic potential of generative AI: The next productivity frontier

-

EY: Five priorities for harnessing the power of GenAI in banking

-

Enfuce: 5 fintech trends that will shape the industry in 2024

-

Pulse: Korean app-based banking market may be joined by heavyweight financial names

-

Data Reply: Getting cloud and ML into the DNA of Nexi. From words to facts.

-

Enfuce: Why lending and credit fintechs should issue payment cards for their customers

-

Enfuce: Fuelling change – your fuel card as a driver for growth

-

McKinsey: The state of AI in 2023: Generative AI’s breakout year

This article was first published by The Paypers, the Netherlands-based independent source of news and insights for professionals in the global payment and ecommerce community.