What is embedded finance and what is it not? How can banks find their place in embedded finance? What strategies should you use when exposing your service to third parties, and what are the risks? What does embedded finance mean from the technology perspective?

To get the answers, Rob Manderson, Director of Partnerships at OpenWay, interviewed Zil Bareisis, Head of Retail Banking at Celent, at OpenWay Club 2021.

“There are several gaps in the adoption of embedded finance by banks. The obvious one is technology. A lot of banks don’t necessarily have the technology that’s needed today. So companies like OpenWay can certainly do a lot to help. Because we are talking about the platforms with modular components available as APIs, available as-a-service…”

Introductions

Rob Manderson, Director of Partnerships, OpenWay: Hello, everybody. Welcome to OpenWay Club. My name is Rob Manderson, and I’m the Director of Partnerships. I’m sorry we can’t be there today, but I’m here to welcome our colleague, Zil, from Celent, to talk about embedded finance. Zil, please say hello to everybody, introduce yourself and explain what we’re here to do today.

Zil Bareisis, Head of Retail Banking, Celent: Hi Rob, I’m delighted to be here today — unfortunately, not in person, but least on video. Thank you for having me. My name is Zil Bareisis, and I lead the Retail Banking team here at Celent. We are an industry research firm. We focus on financial services technology, so we work with banks, their technologies and services providers, investors: the entire community to help them understand how technology is changing and how they can make the best use of it.

What is embedded finance?

Rob: Thank you. So we hear alot about embedded finance. What is it? Can you tell our participants today some examples?

Zil: That’s a great question. So this is the reason why we wrote this report a few months ago, called Embedded Finance, or Demystifying Embedded Finance: The Promise and Peril for Banks, because when we looked at what’s happening in the industry, it’s clearly a very hot topic. Everyone is talking about it. We felt that there was a little bit of looseness in the definition. Almost anything can become embedded finance, and I don’t think it’s helpful. A lot of the conversations we have seen so far happening around embedded finance are from the disruptive perspective — all these new companies that are coming in and are promising to eat the banks’ lunch. We went in because a lot of our clients are banks and companies that work with banks. So we wanted to make sure that we take the banks’ perspective and say, ok, how can banks participate in embedded finance? What does that mean for that?

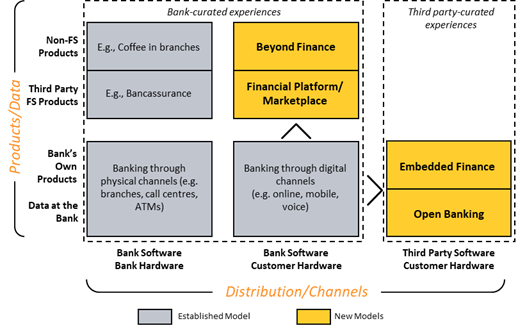

The idea of embedded finance is not new. What’s happening right now is that the ecosystem is opening up. Banks are far more willing to work with different companies — external parties, third parties. The big question is: who is going to curate that customer experience? Let’s say a bank that has a lot of agricultural customers can help them not just get the financing they need, but also understand when is the right time to sell crops. So it can create information that may be financial products, may be sourced from other parties and may go beyond finance, but it’s the bank that curates that experience. On the other hand, what you see, particularly with open banking, is a situation where there are a lot of fintechs, third parties that come in, and banks have to provide access to that data so that people can access their own banking data through those third parties. Embedded finance for us is another step forward.

I’ll give you some examples of what we think is embedded finance and what we think it’s not. Quite often people say, oh, Uber. They get into an Uber car, they step out, and the payment just happens magically. But it’s not really embedded finance. It’s a card-on-file experience. As a customer, I didn’t have to do anything. I just put my card on, and the card now sits with the Uber app. It’s a great experience, it’s an invisible payment experience, but from the bank’s point of view, there is no difference. You issued to me the card, and I’m just using it for Netflix, for Amazon, for subscription services I might have.

On the other hand, an Uber driver suddenly realizes that they would like to have faster access to funds that they’ve earned during the day, and Uber decides to issue them a card that they can use to immediately get those funds, then start it to buy petrol or to do something else. That Uber driver may not have had that card before. To us, that is actually a great example of how the need for financial services recognizes at the point a third-party experience. Banks are able to provide that.

On Banking-as-a-Service

Rob: Understood, that’s great. How do you prepare for embedded finance? And in particular, banking-as-a-service?

Zil: Again, I think that’s a great question, because quite often we see that banks are able to conflate as-a-service with embedded finance almost in the same sentence, as if it’s one and the same. The distinction we want to draw is that for us embedded finance is the what, and banking-as-a-service is quite often the how, but it’s not exclusive. So that’s one way of delivering embedded finance.

So what is banking-as-a-service, first of all? Banking-as-a-service is modular, composable technology architecture. We talk about three layers. One is the orchestration layer — it’s the API integration, something that allows you to connect to those third parties. Then it’s the capabilities-as-a-service layer, where as a bank, you’re exposing a specific set of capabilities that the third party can make use of, whether it is card issuing as a service, payments as a service, or bank account as a service. It could be a product, it could be a set of capabilities around the origination, around the fraud management, around the operations, for example. And then you need a regulatory license. The question now is who brings all these components and how do these components get combined. The reason I’m saying this is not the only way to do it is because we have seen examples in the industry where clear embedded finance type ideas and notions can be delivered without having that full stack of capabilities.

Five ways for banks to engage in embedded finance

Rob: Can you give us some examples of how banks can use embedded finance?

Zil: Absolutely. In our research, we identified 5 different ways of how banks can engage. Wells Fargo is one of our winners of embedded financing, awarded in the awards program that Celent does every year. What they’ve done is they’ve worked with partners who gave them a set of tools, technology tools — APIs, SDKs, to embed a co-branded credit card application in the flow of their process. So you might be on a partner hotel’s website, and you might be in the process of booking from them, and you realize that getting a co-branded card from them would give you access to a lot of perks and benefits, and you want to apply for it right then and there. In the past, you would have had to leave what you are doing now and go to the bank’s website, and try to apply for that, wait for a week or for as long as it takes for the card to turn up. Now you can click the button, do the application right there and then within that flow, have it actually approved, and use that new card to finish off that transaction. So you’re getting a brand-new product, straight in the flow, and it’s a great way for the customer, the bank and the partner to participate.

The other approach is that you have a banking-as-a-service type of player that provides the technology but they don’t really have a banking license. Some of the processors in the US, for example, or other players, they focus on technology and they bring it in banks to provide BIN sponsorship or regulatory license components, and there are a lot of banks that are engaging in that way. Others actually say, ok, we already have a license, we can build out the technology ourselves, so let’s go to the market as a package — the banking-as-a-service technology package as well as the license. How you go about it again can vary, and can be very different. And there are different models within that. So Solaris Bank in Germany, for example, it’s really a fintech with a banking license, a banking-as-a-service provider with a banking license. In other cases, it’s a large bank that might acquire a technology provider, or might partner with another, so there are different ways of doing it.

And the last couple of models are where it gets interesting and quite sophisticated, because it’s not just a matter of providing capabilities to others, it’s about a bank partner coming up with an idea they want to launch in the market, and they are coming to you and saying: "How can we get this into the market? How can we get something for my consumers?" So we have the B2B2C model. Or even potentially serving businesses through another business partner for more of the business end, like Stripe Treasury. For those of you not familiar with that, Stripe Treasury is a proposition for marketplaces, like Shopify is one of their clients, and Shopify itself is a platform, a marketplace for bringing a lot of small merchants who want to get on the platform to transact. And in that process, you realize that they could benefit from a bank account. So again, they can open that bank account, or a bank-like account, right there and then through Stripe Treasury, through Shopify, through those partners. So there are banks that are supporting that proposition — Evolve Bank in the US, Barclay’s, Citi, Goldman Sachs are all involved in this. So very different ways, very different opportunities to participate.

Gaps preventing banks from succeeding in embedded finance

Rob: To succeed in embedded finance, banks obviously need to catch up, and to move forward. What gaps do you see right now within the banking sector?

Zil: Well, there are two ways to answer that. One is the obvious one, the technology. I think a lot of banks don’t necessarily have the technology that’s needed today. So I think companies like OpenWay can certainly do a lot to help. Because we are talking about modular components available as APIs, available as a service. So that capability is needed, and a lot of banks need to take a hard look at what they have and what they need to really participate in that effectively. But it goes beyond that. It really is a very different business model, a very different way of engaging with your customers. It’s an acknowledgement that you may not have that customer as YOUR customer, you are becoming slightly distanced from it. What kind of partners do you want to work with? What are good partners for you? It’s a big strategic question. And to that question we started with earlier, who owns that customer experience, it’s that kind of strategy and strategic thinking every bank has to go through.

Risks of embedded finance for banks

Rob: So, on that note, what do you think about the risks of embedded finance for banks specifically, and how to protect them?

Zil: What I said is about being distanced away from the customer, and depending on the specific arrangement and how it might work, maybe you’re losing some potential revenue opportunities. Maybe you’re losing some data. So suddenly now, this third party gets access to that data that you used to have yourself before. So there’s always that risk. There are more immediate risks. There is a third party conduct risk, of the partner you are providing those capabilities to. What if you don’t like the way they behave? So how do you vet those partners upfront? How do you correct things if anything happens midway in the partnership? So those are certainly the risks, but the biggest risk is to not do anything at all.

Rob: That was my next question. So what happens if a bank does nothing?

Zil: I’m not here to say that, look, the traditional banking model is dead, forget about getting customers through branches, through online banking portals, that you’re not going to be able to get your customers that way, that embedded finance is the answer. It’s not. It’s always with these things, these things evolve, they take time to shake out. But it is happening. That ecosystem is opening up. And if you’re not thinking about what that means for you, if you’re not getting ready, if you’re not preparing, getting your technology back office in order, you will be missing out. You will be missing out on opportunities, and others will come in and be more successful. So FOMO is not a valid strategic driver, but it’s certainly an important one.

Rob: So flipping that question on its head, are there any first-mover advantages to embracing this?

Zil: There are. If you think about who will be those third parties who will control that experience, it’s quite easy to guess that it will be a handful of the usual suspects. Large tech firms, big brands, some niche specialists that might be focused on a very specific segment. An example is a partner website that targets landlords that manage properties for you, and then there are very specific services for them. What kind of financial services do they need and what can a bank provide? So if you miss out on some of these big opportunities, big partners, and if they already have banking partners, there’s a risk. You don’t need a lot of banks to provide this, you just need the good ones and the big ones.

Rob: So that concludes my interview, my questions for this session. Do you have any parting comments for the audience and our clients?

Zil: I guess, just to say — thank you again for having me and for this opportunity. I know that it’s a really great and big event, and we will enjoy it, and I would say, just go out and enjoy it, meet as many people as you can and come away inspired, having made new connections and stay healthy and successful!

Download report on embedded finance

This talk with Zil was based on the Celent’s findings from their recent research about embedded finance. OpenWay believes that the resulting report is highly relevant for our partners and aims to make it available to a larger audience. Please click the link below to download the complimentary copy.

What’s next?

Banks and processors can leverage the Way4 payment solutions by OpenWay to develop and launch their own embedded finance offering for fintechs, retailers, startups, EMIs, or neobanks. Some might consider creating a super app with its own ecosystem of embedded services like loans and ticket booking, like SmartPay. Others can become trusted payment partners for startups offering them an affordable card-as-a-service, like Enfuce. Or, like LOTTE Finance, you can help retailers to increase their conversion by embedding a BNPL payment option to their checkout.

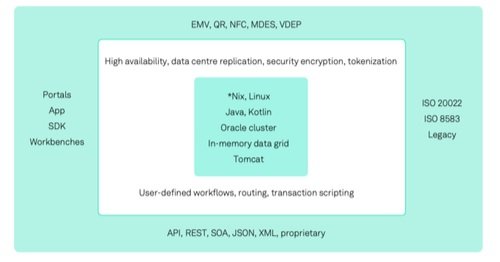

Way4 is a digital payment software platform for card issuing, account management, and merchant acquiring management, and digital wallets. The platform architecture is designed for open banking and real-time payments. It is based on an open framework with flexible, separated granular modules. Way4 comes with a rich set of APIs that allows financial institutions to easily integrate their payment functionality into third-party systems.

Contact OpenWay if you are looking for a payments platform to implement the following business models:

-

Your own marketplace or ecosystem of financial and lifestyle services

-

Payments-as-a-service

-

Card-as-a-service

-

Banking-as-a-service

-

Open payments within the PSD2 framework

-2.jpg)