Table of contents

-

Banks and the challenge of keeping up with post-crisis payment habits

-

The habit of distanced payments

-

Cards or wallets? My bank or another bank?

-

Digital wallet users – going against stereotypes

-

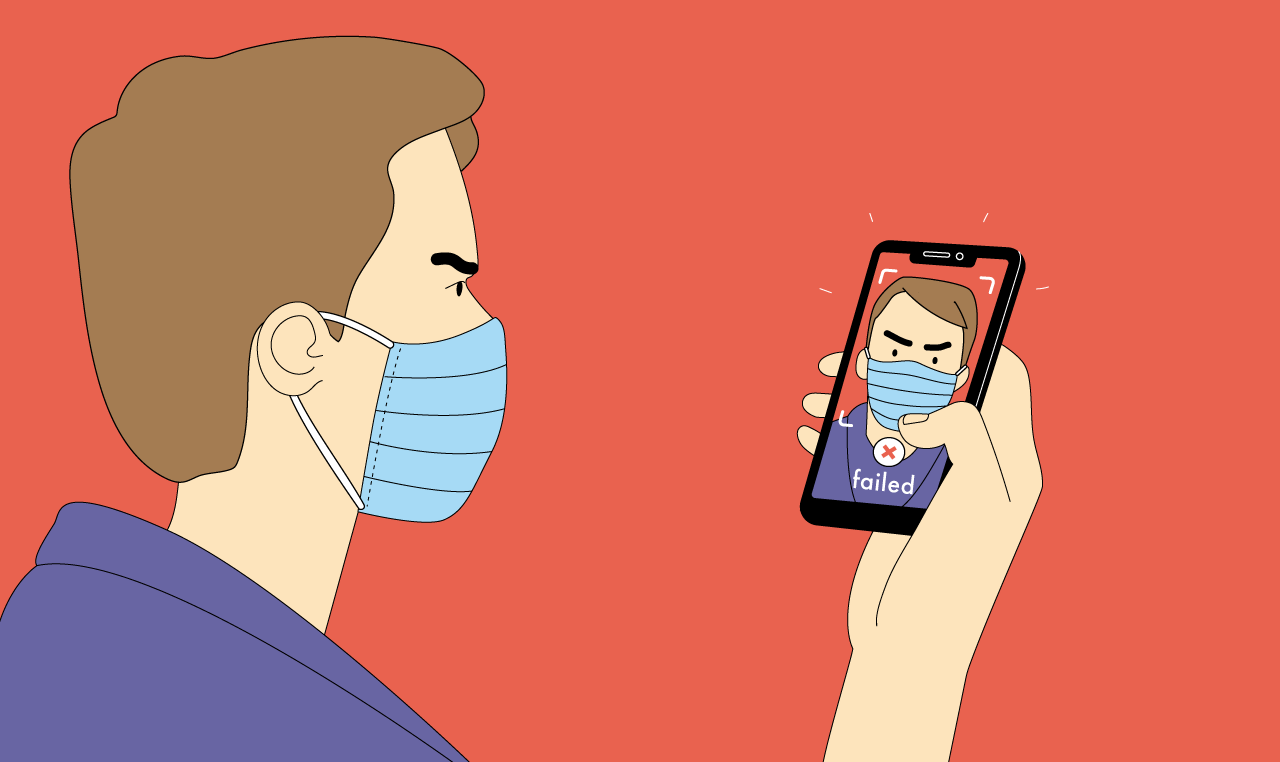

Annoying gaps in contactless and online payments

-

Digital card plus wallet: an enticement to switch banks

-

What cards can do that wallets can’t

-

Multi-currency cards and accounts

-

Pay-and-save: with cards or wallets?

-

Remote loans – in advance or during checkout?

-

Cards and wallets: smart combinations instead of competition

-

A reliable partner for card and wallet projects

Leading banks, neobanks, processors and wallet operators referenced in this case study

-

Nets, one of the largest processors in Scandinavia, provider of instant card-based loans

-

SmartPay, a mobile wallet ecosystem in Vietnam, connecting 1 ,000,000 consumers and 100,000 merchants

-

Network International, a leading payment processor and issuer of digital cards in the Middle East and Africa

-

Jysan Bank, a Central Asian issuer of multi-currency cards for payments and savings in 16 currencies

-

Payconiq by Bancontact, established domestic wallet in Belgium

-

iDEAL, established domestic wallet in the Netherlands

-

N26, a neobank with HQ in Berlin, serving 5 million customers across 25 markets

-

Airtel, one of the biggest mobile wallets in East Africa

-

and others

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.

-Feb-19-2026-12-35-53-1410-AM.jpg)