To better navigate their financial futures and be prepared to make smart choices, children need to learn about earning and spending, saving and investing, using credit wisely, paying for college, and recognising and avoiding financial fraud.

Financial literacy: the current challenge for youngsters

Young people are already financial consumers who encounter complex financial decisions, like student loans. Citing figures from the Nationwide Building Society, Financial Times mentioned that there are 2.8 million accounts held by those under the age of 18, in the UK alone, as 750,000 new accounts are opened each year.

Many teenagers struggle to understand money matters as they lack basic financial skills. On average, across OECD countries and economies, 22% of students do not have basic financial skills, and only about 12% of students are top performers in financial literacy, as they can tackle the most difficult tasks, such as dealing with bank accounts and debit cards, or understanding interest rates on a loan or mobile payment plans.

OECD assessed around 48,000 15‑year-old students in financial literacy, from 15 participating countries and economies (e.g. China, the US, the Netherlands, Poland, Australia, Brazil, etc.), to find out what they can do, with what they know about finance.

According to the OECD Programme for International Student Assessment (PISA) test of financial literacy, some 19% of 15-year-olds have a prepaid debit card and 56% have a bank account, but fewer than one in three students (31%) have the skills to manage their account.

The financial trio - children, parents and funds

Parents are the single biggest influence in shaping children’s attitudes towards managing funds. On average, across participating OECD countries and economies, 84% discuss money matters with their parents at least once a month, and students who do so tend to perform better in financial literacy.

Pockee, a financial app for teens, performed a survey on a group of parents in the UK and their findings revealed that a vast majority of parents considered teaching children about money and financial responsibility important. As such, they recommended that children should start learning about personal finance when they are aged 8-10 or 11-13.

Another study conducted by the University of Cambridge stressed that children’s money habits are set from as early as age seven. At this age, several basic concepts relating broadly to later ‘finance’ behaviours will typically have developed. By four to five years old, children understand that they need to pay for merchandise, but may not understand that coins have different values. However, typically, by the age of seven years old the child is able to cognitively ‘represent’ value. Moreover, at this age, children begin to understand that exchanges involve a set of unseen transactions among other parties, i.e. card payments, wearables, and mobile payments.

Even if parents play a big role in teaching children about good money habits from a young age, more than half say they lack the confidence or knowledge to teach their offspring how to manage their funds, according to Experian research. However, many financial apps have been developed lately to support this learning about finance journey for both the youth and parents.

Pocket money, spending limits, paid chores? Sorted via apps

Parents who are keen to educate their children about the value of money, but want to retain a margin of control over what their kids do with their cash, can take advantage of app-based services.

For instance, they might want to monitor their child’s purchases, or restrict what they can spend on in-app purchases or digital downloads. Moreover, they can set tasks, such as completing chores – tidying the bedroom, cleaning the kitchen table, gardening - for their child to earn their pocket money.

Despite children being the main users of these apps, parents are the actual decision-makers and target customers. Nevertheless, every child is different and every family has a different approach to money, depending very much on what works for the child and the family (when to start offering pocket money, how much to give, and whether you should pay for chores and grades).

Before deciding which app is best to use, there are some features that are worth being taking into consideration:

Having a contactless card attached (e.g. Osper, goHenry and Nimbl), that allows parents to open online accounts which are controlled via smartphones.

-

Possibility of topping it up from parents’ own phone;

-

Setting spending limits;

-

Providing children with an educational tool that will help them learn about the value of money in a non-invasive and fun way.

-

Making the platform flexible so that it can adapt to parents and children, depending on their age and maturity.

-

Having the gamification element included that would support the education, without letting children get addicted.

-

Possibility to “lock” the card if it has been lost or stolen.

-

Ensuring high security standards.

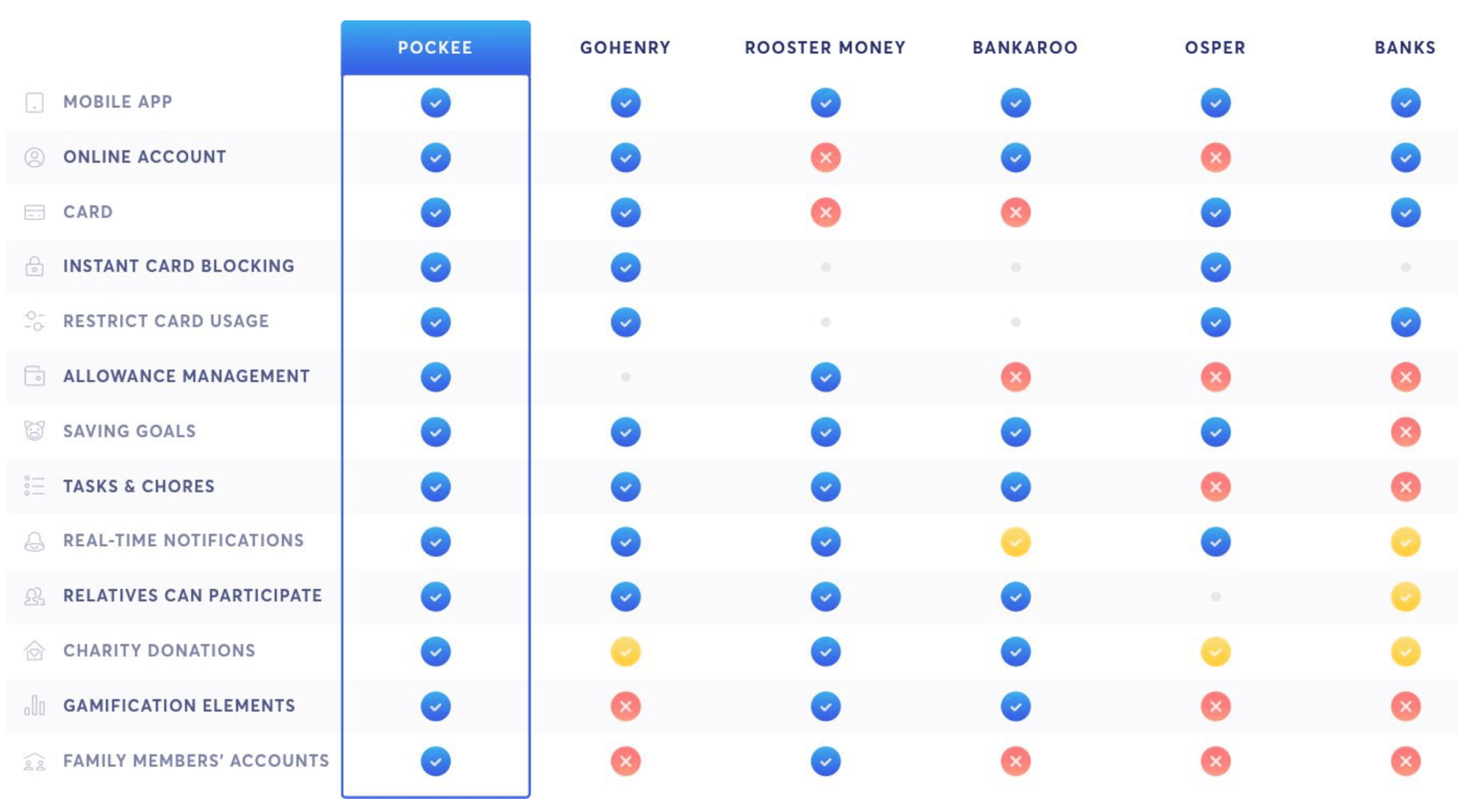

Examples of the most popular family banking application/allowance apps for children and young adults in Europe

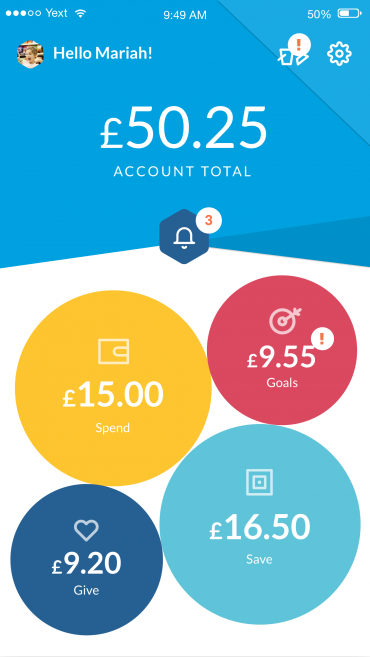

Roostermoney is a virtual budgeting app aimed at children aged 4 and above, allowing them to track their funds, save towards goals and earn rewards, while parents oversee it. Children learn to manage their money between “pots” labelled spend, save, give and goals. It also gives them the chance to earn extra cash for reaching certain “achievements” and completing chores. Parents can set up an automatic weekly allowance, taking away the hassle of having to remember to have change in the house for pocket money.

Roostermoney offers the ‘Split Allowance’ feature that automatically divides children’s allowance into different pots (to help them consider what to do with their money).

Children can learn the value of money by setting up Roostermoney’s Goals feature, which enables them save towards the things they want.

Osper is designed for children. The app has a pre-paid debit card attached, backed by Mastercard, allowing parents to monitor children’s spending. Parents can set up an allowance to be paid to the child directly from the app. Children can also tag spending under different categories and learn how to improve their budgeting habits. The cards cannot be used for anything involving gaming, alcohol or other age-inappropriate activities.

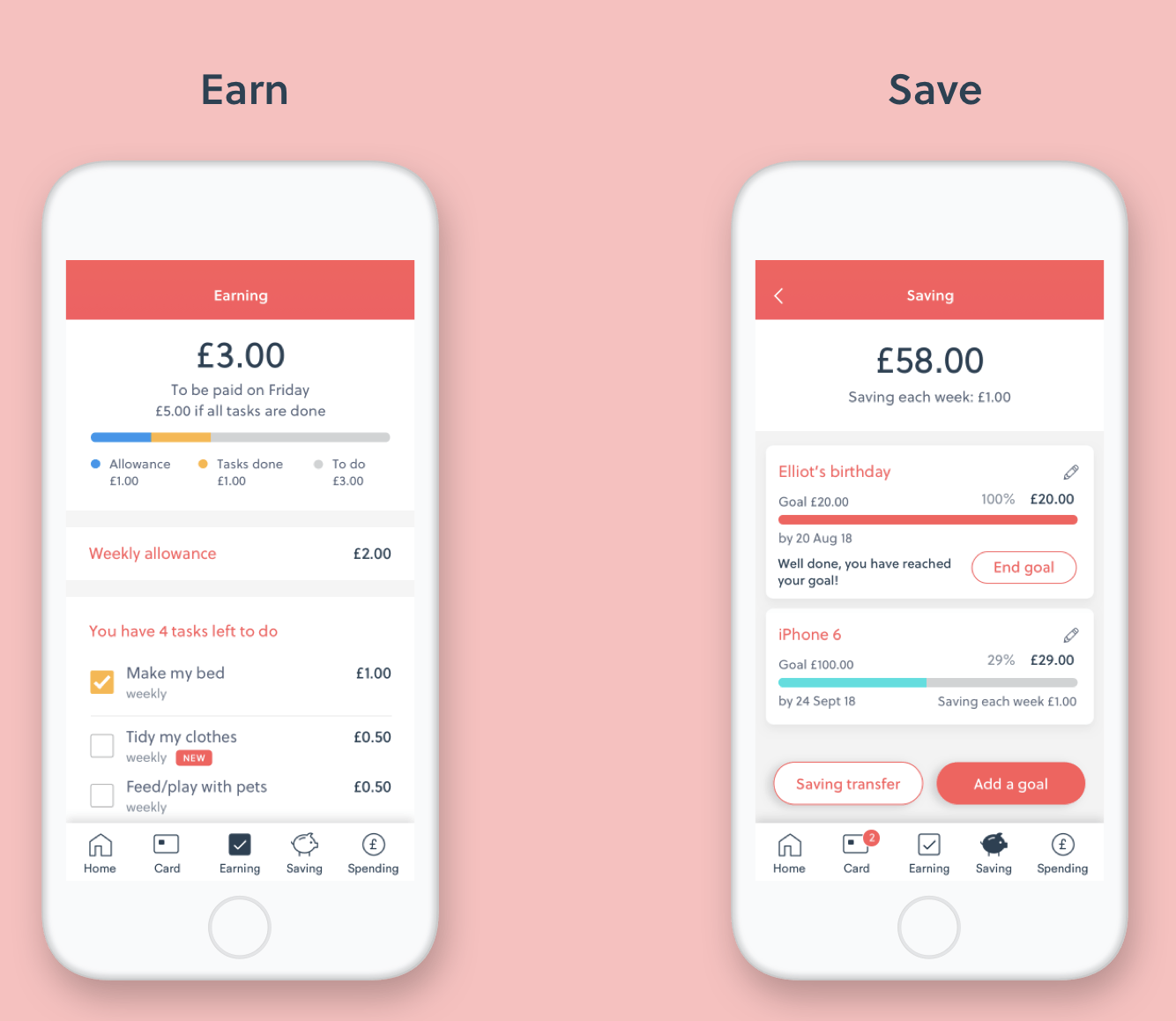

goHenry allows parents to give their children. Children are given a pre-paid Visa contactless debit card with parental controls through a linked online account. With goHenry, parents get a notification on their phone whenever their child uses the card. It is possible to choose whether the cards are used online, in store or everywhere. Parents can set up tasks for their children to complete in return for pocket money. Moreover, they can block and unblock the card instantly on their phone. Currently, you must live in the UK to be eligible to have a goHenry account.

However, it is not possible to have multiple parent login details or dual control over a goHenry account. This is because the issuing bank of the card requires that each goHenry account has one legal owner. If an additional parent would like to load the account, they can be invited as a relative to do so.

With parent guidance and goHenry’s earn and save features, children learn to earn, save and spend in a way that suits them.

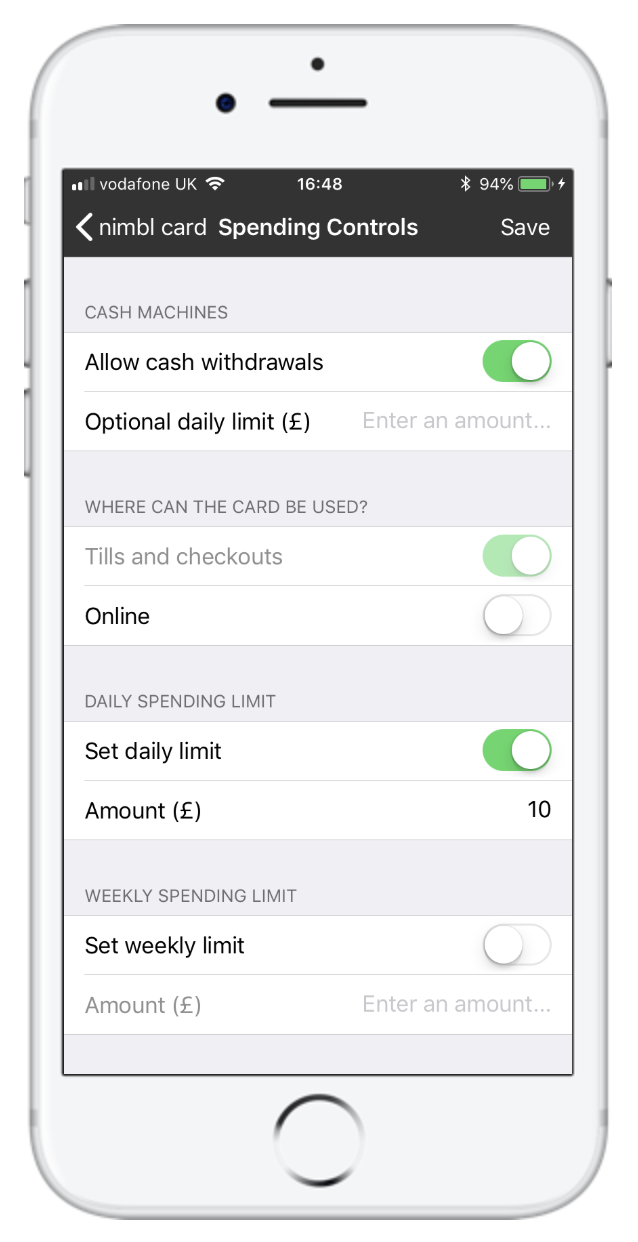

Nimbl addresses 8-18-year-olds and the app has also a prepaid Mastercard debit card attached, enabling parents to top-up, monitor and control their children’s spending via the app. It also includes a micro-savings tool to encourage children to save. Thus, a savings function can transfer a set amount of money from the child’s prepaid debit card into their savings account. Parents can disable cash withdrawals or spending online, and to lock and unlock the card via the app.

Users/applicants must be the legal parent/guardian for the child they are applying for, aged 18 years old or over, and be a UK resident.

To promote good money habits for 8-18 years, nimbl offers spending controls helping children learn within a safe environment.

The nimbl service is accompanied by a prepaid card and, to keep it safe, lets users lock and unlock the card through the app.

Vipps U15 is a payment service delivered by Vipps, a Norwegian mobile payment application, which is based on parental consent. This means that parents must add the child in their Vipps app, before the child can create their own profile. The child must have a Norwegian personal ID number and a mobile phone with a Norwegian phone number. Moreover, both parents must have an active Vipps profile that is verified by BankID.

Vipps U15 enables children to receive, ask for and transfer money to other people. Both parents must give their consent before the child can transfer money to other private individuals.

Bankaroo - virtual bank for kids - is a an educational virtual bank for kids that helps children learn about money, budgeting, setting goals, saving up, and being accountable for their decisions. It is designed for youngsters with basic reading skills. Most of their members are 5-14 years old.

The platform offers a family friendly interface and is accessible via the web and mobile apps.

With bankaroo children can manage funds, transfer money, and even be generous and donate funds to charity.

Bankaroo encourages children to set their own saving goals.

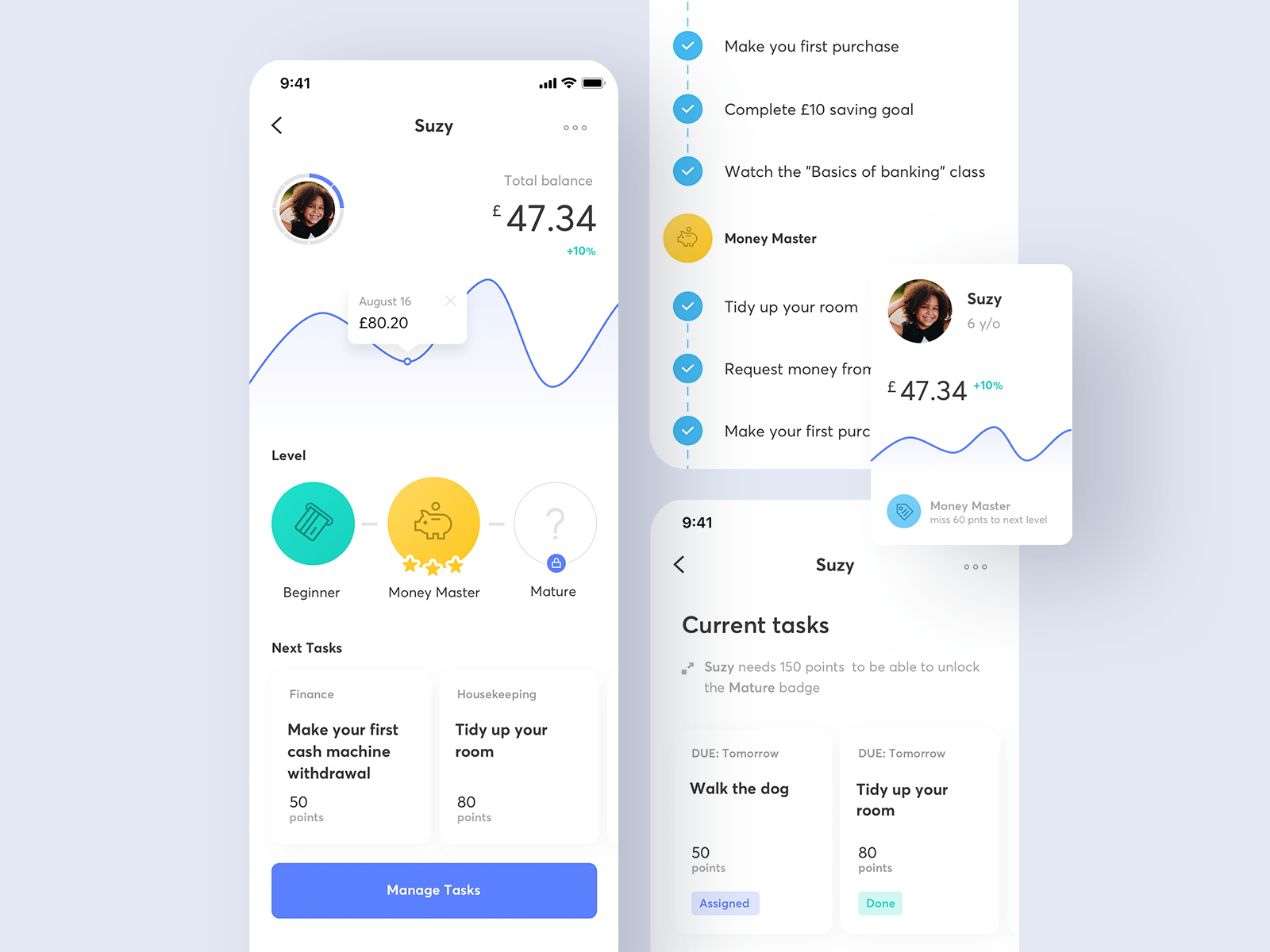

Pockee is a mobile coupon platform popular in Greece, and because the app is highly customisable, it has also created a feature to be used by parents and children with the age of 8-16. With Pockee parents can assign tasks to their children and the app is designed to adapt to a growing audience, as it changes when children grow and their expectations change. Furthermore, they can track their main activities, expenses, send money, manage tasks, and edit spending limits.

The platform offers video courses and interactive quizzes suitable for each user’s age, enabling youngsters to learn about personal finance. Children can complete assignments to gain points and badges. Unlocking new levels will allow them to use new services or ask for allowance.

Pockee introduces gamification elements such as badges (Beginner, money Master) and levels to support the financial learning journey.

Technology vendors are not the only ones to provide such apps, as banks also offer financial apps for kids, with the difference that their main product offering for children is opening a bank account/savings account. A kids’ bank account works like a conventional bank account, but with little differences. Many banks will let children open current accounts from the age of 11, although some are restricted to those aged 16 or over. For children under 16, a parent or guardian will usually have to open the account in-branch. Some kids’ bank accounts offer bonus interest, and to earn this interest account holders have to meet certain criteria. These can include making minimum deposits each month and not making any withdrawals.

Some accounts of this kind offer competitive standard rates, and with these accounts your children stand to earn interest without having to meet any deposit or withdrawal requirements. How your child can access funds depends on the chosen account.

In the UK banks such as Monzo, Metro, Nationwide, Santander, Barclays, Lloyds, and many others offer children's savings accounts.

Overall, money apps can be used as teaching tools, when it comes to financial literacy, and they can be more effective than dry lectures or textbooks. Most money apps for youngsters act like virtual banks, offering lessons on how to budget and save money for spending goals. Plus, they tend to emphasise child-parent interaction, as common features can track the chores a child needs to accomplish before receiving an allowance from parents.

Create wallets for youngsters using Way4 Wallet

Want to know more about Way4 wallet functionality, read relevant client cases from all over the world and get the understanding of our wallet platform advantages over other solutions? Explore the dedicated webpage and download the brochure or request a demo.