We added new features to our classic web and mobile banking.

Payments and transfers

Recurring invoices

After a service provider assigns a unique account number to your customer, the latter can save this information in the web/mobile banking app. WAY4 will receive all the subsequent invoices automatically. They are stored until the user can review and approve/decline the payment.

Money request

Now users can request money from someone they know – by specifying this person’s phone number and the required sum. Both parties see this request in their WAY4 mobile banking app. They can exchange related messages and modify the amount, if necessary.

People who don’t use the same mobile banking app would receive such a money request via SMS. If they follow the specified URL, they can confirm/deny the operation and choose their payment method.

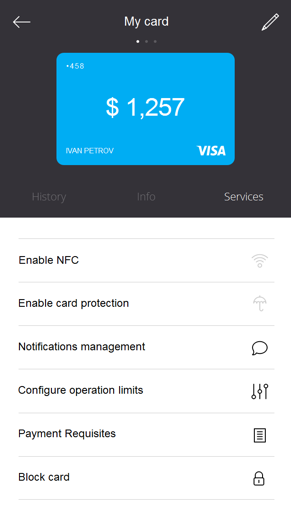

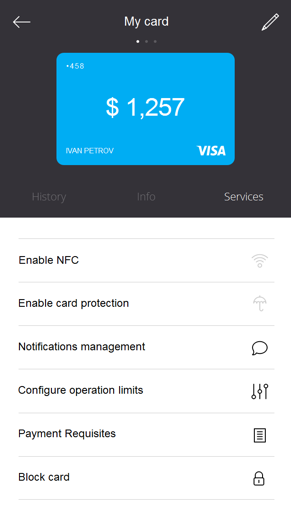

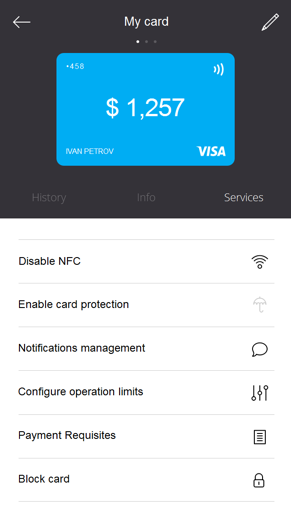

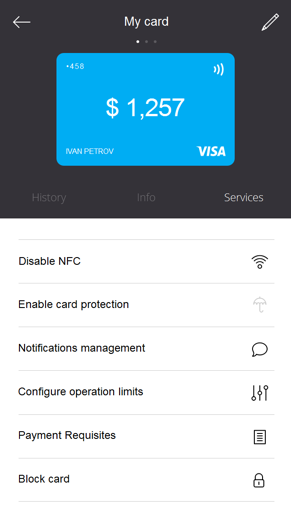

NFC enablement

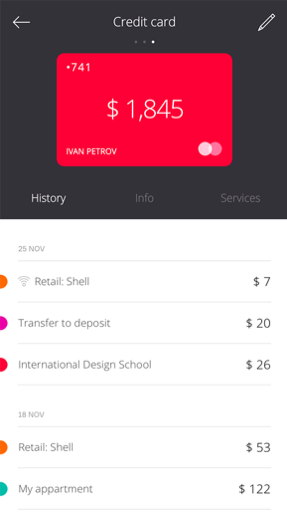

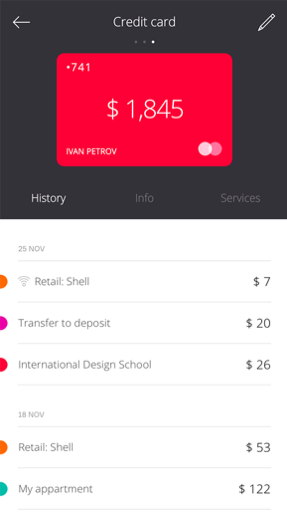

Now users can enable NFC for a linked card. The app becomes ready for contactless payments instantly. The operations history indicates when the contactless mode was used and when not.

If the customer applied this feature to multiple cards, one of them should be chosen as the default instrument for NFC operations.

External payment hubs

We have integrated WAY4 with more payment hubs, including the largest one in Eastern Europe. It means more service providers whose invoices and bills can be paid from the mobile/web banking app. Our integration plans take into account which hubs are the most requested by our customers.

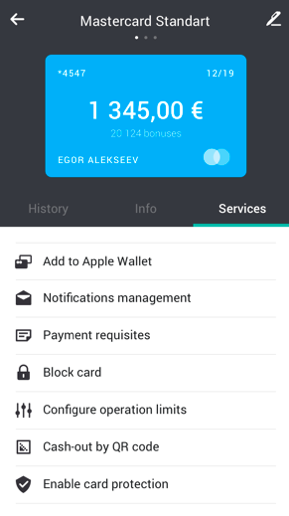

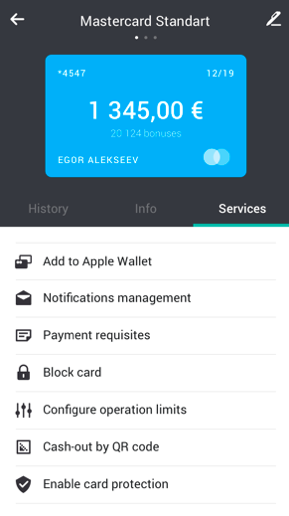

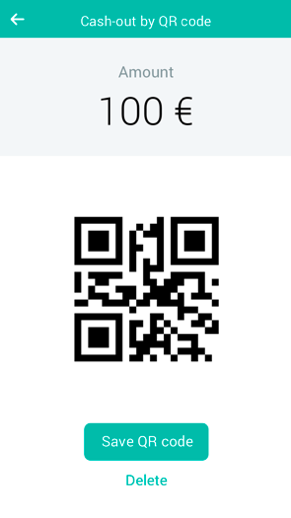

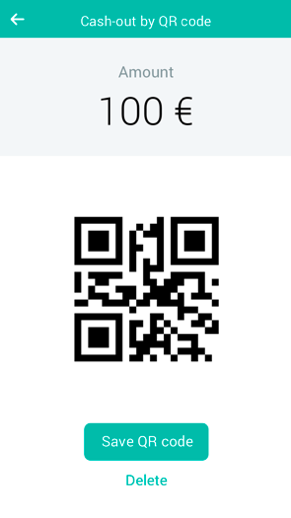

App-generated QR code for cash operations

Now our app can generate a special QR code for cash in and cash out operations. Your customer just needs to choose a card and then specify the cash amount. To complete the transaction, the ATM scans the QR code from the phone screen. The customer can use any the bank’s ATMs. The customer can share this QR with a friend.

Retailers’ logos

Retailers' logos appear next to each payment in the history of operations

Communication and information

Chat with a bank

The user can send messages via the app. Bank clerks can receive them and reply via e-mail. These replies are instantly shown in the mobile/web app, in the form of chat. Both parties can also send various attachments to each other.

Currency rates

Currency rates of the bank are displayed to the customer and updated in real-time.

Product management

Instalments

Now users can order and manage instalment cards in the web and mobile banking menu. They see the instalment operations history, applicable limits and commissions, and – of course – the due date and amount for next payment(s). The app also highlights every case of delinquency and fines to pay.

Multi-currency cards

Now users see several independent balances, each in its own currency, for every multi-currency card. The transaction history clearly shows which account, in its respective currency, was debited for each purchase.

Up-sales

Pre-approved loans

The app can notify users on a pre-approved loan by displaying a message or promo banner. The bank customer can confirm instant loan issuance, or decrease the loan amount first, or completely decline the offer.

Personalized offers

You can show personalised offers based on the KYC data (on the customer profile and behavior analysis). Also the platform allows to present your offers as pop-up messages.

Convenient security

Automatic OTP capture

Our mobile app is able to analyze the incoming SMS to grab a one-time password and automatically insert it into the confirmation form.

Push messages

Push messages can appear within the mobile banking app to notify customers on completed purchases. (The push functionality should be enabled on the device in the first place).