Card-as-a-Service: technologies and use cases for banks and fintechs

Table of contents

CaaS – meet the newest "as-a-service" to enter the payments space

Is CaaS really so different from white-label and co-branded relationships? Consider: many of these are usually the result of a negotiated contract with a large traditional bank, specially developed for a company. If the terms of the card change, the program details need to be renegotiated and re-contracted from scratch, and the customization process can take several years. Also, traditional banks and processors expect the issuer to provide underwriting and capital for lending. All this has made issuing cards traditionally a complex and expensive process with lots of regulatory compliance requirements.

This is where CaaS makes all the difference. CaaS providers offer financial and non-financial companies – virtually anyone – a top-to-bottom card issuing solution that is not developed from scratch, but rather modular and standardized, often with similar back ends. Usually the desired card product can be released quite quickly through a set of payment APIs. A huge advantage for non-financial companies is that CaaS providers willingly take over a variety of functions essential to issuing, processing and managing cards, including:

-

underwriting

-

bank and personalization bureau integration

-

customer service

-

tokenization (Big Pays)

-

authentication and compliance (3DS, PSD2)

-

risk management and KYC – security systems, anti-fraud

-

card product configuration and management

-

virtual and plastic card issuing, distribution

-

payment scheme membership, such as Visa and Mastercard

-

Electronic Money Institution (EMI) license

These functions may be taken over by a single company with a banking license with processing capabilities, or by a liaison partner company who expertly manages the relationship with an issuer processor, a bank license provider, and other partners such as processors and cloud providers.

With all these financial partners working together to form support teams for non-financial companies, the fintech ecosystem is looking more and more like a team sport rather than a disruptive, winner-takes-all world. CaaS is part of an even bigger embedded finance trend, where, according to Forbes, "collaboration is the new competition". Thanks to the development of digital, open APIs, also payments in the cloud, more companies can be engaged in payments and share the space that banks traditionally occupy. Banking-as-a-Service, Payment-as-a-Service and other embedded finance offerings are the broader picture of the collaboration model.

According to a 2022 study, "74% of consumer payments will be handled by non-traditional financial services institutions by 2030". But banks don’t have to be left behind. As more and more non-financial institutions look to offer payments, banks would do well to seize the opportunity to offer the technological and processing solutions that they require. Some have, as we will see in the examples below.

Who are the players and partners in the CaaS space?

A diverse range of both banking and non-banking organizations are offering CaaS. Here are some of them.

-

Newly established banks providing CaaS as part of a larger Banking-as-a-Service offering, streamlining card issuing process for their clients. Solarisbank offers a Cards API as a licensed banking partner to organizations, allowing them to offer Visa or Mastercard debit cards integrated with Google Pay with contactless, custom limits and 3-D Secure with two-factor authentication. Railsbank, a UK fintech with a banking license, offers a large range of embedded finance solutions, including Cards-as-a-Service along with Compliance-as-a-Service.

-

Traditional banks and financial institutions are waking up to the advantages of CaaS over traditional co-branding relationships. Perhaps the most well-known use case of CaaS might be the Apple Card backed by Goldman Sachs. Although it may appear like a white-label product, the Apple Card is Goldman Sachs’ first foray into BaaS and the model is part of its overall BaaS strategy. By making its API publicly available to development, the bank hopes to utilize its success with the Apple Card model by repeating it many times with non-financial businesses to integrate lucrative services into its own products, competing with fintechs and neobanks on their own turf.

-

B2B payment enablers expanding into CaaS. This is a logical next step in the development of a B2B digital payment platform, shifting from payment processing to partnering with a variety of clients. Rapyd defines itself as a "fintech-as-a-service", offering companies the opportunity to incorporate money collections, bank transfers, digital wallets, and card issuing into their apps. Adyen, which processes payments for big online partners like Facebook, Netflix and Uber, has expanded into cards for various client needs, from marketplaces to online travel agencies making disbursements for airline and hotel partners.

-

Agile, innovative fintechs focused on Cards-as-a-Service. For digital-native fintechs like Enfuce and Simplifi, it’s natural to work with other digital native startups. Simplifi is a CaaS platform for MENA and Pakistan, providing a one-stop solution for non-technology businesses to instantly issue cards and manage them seamlessly across an untapped region with a population of over 400 million. Nordic fintech Enfuce prides itself on allowing businesses to issue feature-rich payment cards in a mere eight weeks, with cardholders able to start paying immediately after applying for the card.

Benefits of the CaaS operational model

Hassle-free, economical and flexible

What do all CaaS clients have in common? They are looking for a way to build, launch, and manage a full-service card program without investing heavily in card knowledge, technology, or compliance. On the other hand, these clients do not want to refer their customers to another organization, or give up cardholder and program data. In time, they may want to take over some responsibility for certain processes themselves as they grow.

Turnkey solutions from a CaaS provider save fintechs, small banks and non-financial institutions time and money that would be spent on staff and infrastructure. CaaS providers serve a variety of organizations by taking care of regulatory compliance, credit policy, network, BINs, end-of-day settlement, and fee collection. As the number of client companies grow, the CaaS provider can reduce processing costs for each client through economy of scale and develop more interesting functionality and capabilities for its card offerings to differentiate themselves from the crowd.

Finding a niche audience with a unique CaaS offering

CaaS providers can target specific audiences with unique use cases, to compete with existing markets or to tap a completely new customer niche.

-

Fleet cards can encompass loyalty programs for drivers and line-item data processing, and be closed-loop, open-loop, B2B or B2C.

-

Cards with embedded sustainability features focus on the concerns of customers over climate, carbon footprint and spending to benefit ethical causes. An example is Enfuce’s My Carbon Action, a tool that is integrated into a payment app and instantly calculates a carbon footprint of each purchase.

-

Payment tools for children expand access to financial services in a controlled environment and teach financial literacy. A number of fintechs such as gohenry are focusing on contactless prepaid cards for kids, where spending can be monitored from parent apps.

-

Gig economy payment cards target couriers, professional service providers, handicrafters, musicians, and others who often face cash flow challenges. An example is Blocster’s Butterfly card.

-

Personal finance management platforms launched by neobanks need strong and flexible infrastructure partners and need strong support for licensing, security, compliance and payment processes.

-

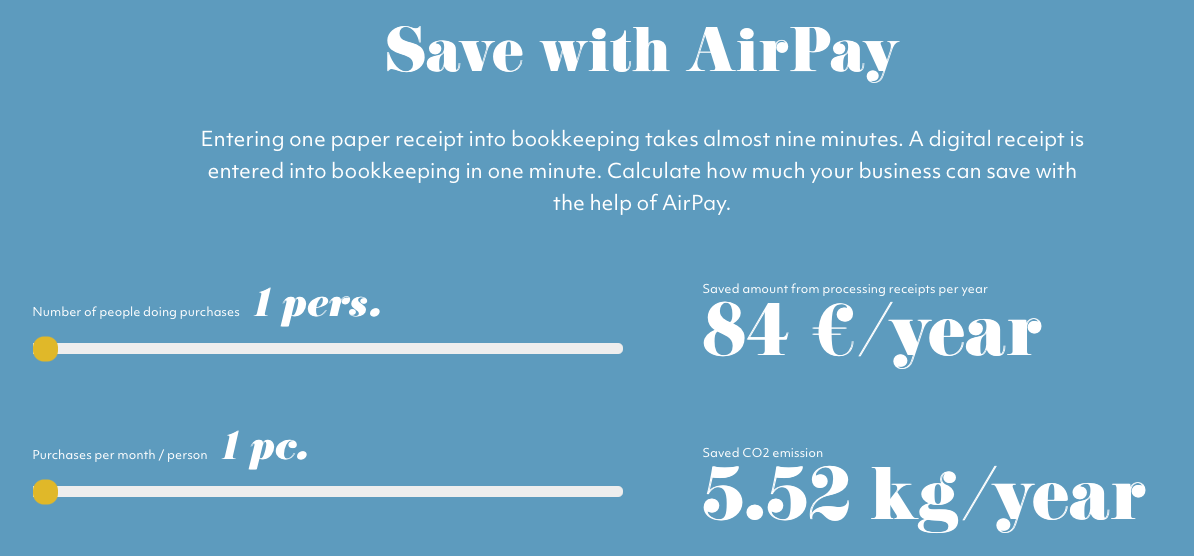

Payment offerings focusing on SMEs with a unique proposition. Airpay, a Finnish fintech, issues smart business cards for expense accounting, and is winning over customers with its unique digital receipt processing functionality which promises to save nine minutes of accounting work per receipt.

Card offers with fresh functionality

Fintech CaaS providers can provide functionalities and features appreciated by digital-savvy customers that will rival cards offered by traditional financial institutions. Digital cards can provide more wallet-like functionality that offer flexible choices related to the customer’s lifestyle choices, such as:

-

Personal financial management tools

-

Real-time notifications

-

Open banking

-

In-app card provisioning into with Big Pay wallets such as Apple Pay and Google Pay

-

Integration with loyalty and cashback programs, sustainability programs

-

Multi-currency

-

Transaction switching between different cardholder’s cards

-

Sophisticated anti-fraud features

Way4: the payment platform for any Card-as-a-Service offering

OpenWay has been supporting payment processors in their expansion into new customer segments and revenue streams for many years. Leading pan-regional processors and ambitious fintech companies use the Way4 digital payment platform to run Card-as-a-Service programs for challenger banks, neobanks, EMIs, retailers, and fintech startups. OpenWay holds a #1 global ranking in software solutions for Payment Processing Platforms by Aite, also by Gartner and Omdia. It was ranked "Market Leader in Digital Wallets" by Omdia and awarded as "Best Payment Software Solution Provider in the Cloud" by PayTech.

If your company aspires to become a Card-as-a-Service provider, here is how OpenWay payment technology solutions can help you.

Issue cards to reach new customer segments

On Way4, issuers can launch any type of card: credit, debit, corporate, fleet, instalment, prepaid, virtual, loyalty, gift. Our clients can target various customer segments with their Card-as-a-Service offering, among them are:

-

digital wallet providers who want to launch instant digital cards

-

neobanks who want to issue cards and focus on comprehensive PFM functionality and open banking

-

fintechs who target SMEs or courier services and want to digitize their expenses via business cards

-

fuel retailers or fleet companies who want to run card loyalty programs for corporate and individual drivers

-

retailers who want to embed payment services such as BNPL into the shopping experience

-

fintechs who want to offer unique card propositions to specific communities such as dog owners, Tesla drivers, crypto buyers, or those practicing mindfulness

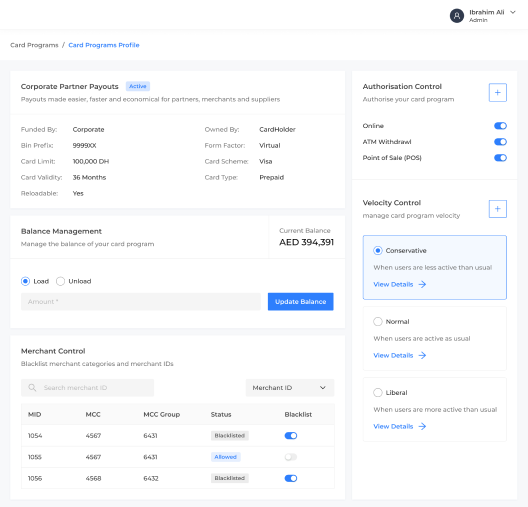

Corporate card issuing

Companies can offer different types of corporate cards as a service to other companies. These include business cards, T&E cards, purchasing cards, virtual one-time use cards, and fleet cards. Way4 supports managing complex corporate hierarchies with credit limits and billing rules assigned to each level of the hierarchy. Issuers can define types of goods and services allowed to be purchased with a card, restrict the number of merchants to a limited number of approved suppliers. The Way4 system comes with off-the-shelf interfaces to the most popular third-party BI- and ERP-systems.

There is a strong pricing engine in Way4 that allows users to dynamically select pricing schemes based on the combination of multiple transaction parameters such as currency, payment scheme, country, good category, or transaction time.

Business models for new revenue streams

Thanks to the flexibility of the product configuration on the Way4 platform, companies can be pioneers in launching various innovative business models, including BNPL, multi-currency corporate cards, and digital wallets.

Fast customer onboarding via standard products

Card issuers get a ready all-in-one product configuration pack from OpenWay, which includes standard product configurations, business requirements, implementation manuals, installation guides and testing plans. This approach helps issuers to set up new customers faster and maintain all customers on the same platform in the most cost-efficient way.

Any operational model for Card-as-a-Service

Companies can choose how they want to operate the Way4 platform for their Card-as-a-Service offering, based on their business strategy and access to IT resources. Here are the possible operational models for Card-as-a-Service on the Way4 platform:

-

Maintained and run by a client in-house on-premises, in the cloud, or in a hybrid deployment

-

SaaS model: IT platform maintained by OpenWay, and business itself is run by a client

-

Processing model via OpenWay clients: maintained and run by an OpenWay client

Access to wider payment ecosystem

Way4 solutions are based on microservice architecture, with the use of open source and cloud technologies. Users can integrate Way4 with other systems and third-party services leveraging a wide list of data-rich APIs. The Way4 system comes with off-the-shelf interfaces to the most widespread third-party risk monitoring, card personalization, and payment systems.

End-to-end payment business on a single platform

Way4 is a digital banking and payment software platform that covers every aspect of the payments business — account management, card issuing, merchant acquiring, transaction switching, digital wallets, tokenization, and fleet cards. If company decides to expand their offering by adding merchant acquiring, it can be done on the same Way4 platform.

What’s next?

If you want to learn how OpenWay solutions can support your payment business, please contact us. Our team will be happy to analyze your requirements and select the best option for your business.

Learn more: analytic reports, news and case studies

-Feb-19-2026-12-35-53-1410-AM.jpg)

Driving Angola’s digital payment momentum together

-2.jpg)

AI and invisible payments in Saudi Arabia: an interview with The Business Year

-1.jpg)