How SmartPay built a financial inclusion wallet from scratch

Table of contents

To skip to a particular chapter, click on its name in the list below.

Why financial inclusion is such a challenge in Vietnam

In Vietnam, estimates suggest that around 25 million people are unbanked. As reported by the World Bank, a “two-tier” financial services system exists in the country, accessed mostly by large merchant chains and banked, wealthier consumers. These upper-tier customers are affiliated with banks and use cashless payments, while low-wage earners, micro- and small merchants earn and spend in cash alone, without access to financial products such as loans and savings accounts.

Why are so many people getting by without a bank account? For many people in cash-dominated societies, the ability to make non-cash payments is not a big enough incentive to change their habits. Also, even when low-income people seek out formal financial services, they face several barriers to accessing them. In Vietnam, according to a recent World Bank study, 6.2 million adults found that financial services are too far to access, 2.2 million adults said these services are too expensive to use, 2.3 million adults were restricted by the documents required to apply, and 1.1 million adults did not trust the financial industry.

Among the unbanked population are 6 million micro-and-small merchants, many running small online businesses that selling via social media. They also have little incentive to upgrade their payment acceptance methods. Purchasing additional hardware is expensive and many cannot afford to pay fees for each transaction. In one study, it was found that merchants did not consider that they completely understood the payment process, and cited lack of advice or training from banks as a put-off for implementing new payment methods.

Governments and non-commercial organizations like the World Bank are trying to reach the unbanked sector. Although Vietnam could not meet the government’s goal of becoming a cashless society by 2020, recently, it has adopted a wider national financial inclusion strategy with a due date of 2025. One of its goals is to have 80 percent of adults in the country open a bank account by that year. Reports one news portal: “The strategy is aimed to ensure individuals and enterprises, particularly low-income and vulnerable people, medium-, small- and micro-sized enterprises, to have access to basic financial products and services, such as payment, money transfer, saving, credit and insurance, in a convenient way and at affordable prices.”

Right research leads to the right model

Whether Vietnam realizes this goal depends on how well banks, fintechs and other organizations respond to the needs of the unbanked. As a rule, banks are reluctant to provide credit or financial services to people who earn small amounts, where the profit per customer transaction is counted in cents. Even fintechs and private sector organizations are slow to step into the gap, choosing to target the more affluent and urban population who are already using traditional banking services. Fintechs in Vietnam tend to focus on the personal and retail finance sector. More than 90 percent of the country’s e-wallet users live in two main cities, Hanoi and Ho Chi Minh City. What could be offered to the unbanked millions living in Vietnam’s rural areas?

SmartPay was created by technology and finance experts from the USA, Austria, Canada, Israel, Ukraine, Kazakhstan, India and Vietnam. Their combined decades of man-years of global experience in operations, risk management and data protection in countries with various economies fueled their interest in large segment of Vietnamese society – micro, small and medium enterprises, or MSME, and the unbanked population. This was an almost untouched new customer segment in Vietnam, and SmartNet saw in that an advantage. No one had designed yet a digital product for this segment, but SmartPay sought to do more than that – its goal was to create a whole new financial engagement platform, simple and attractive enough that it could entice this population into access to their first financial tools by bringing together buyers and sellers of goods and services on their platform. Ambitious indeed!

Before developing their product, SmartPay did extensive research to map out the current financial ecosystem that existed among the unbanked. Unlike FinTechs who focused on the spending habits of the middle class in Hanoi and other urban areas, SmartPay researched the lifestyles of the 25 million unbanked individuals, 6 million micromerchants, and up to a million people selling mostly over the internet, both in urban and rural regions. They found that people were doing multiple things at the same time, playing many different roles that overlapped as producers, sellers, buyers, and sourcers. Many produced small things and sold them on the street, often while working other jobs. Small stores and kiosks were selling food, shoes, and a plentitude of other small goods. Interestingly, a kind of e-commerce existed among merchants who were selling products and services through Facebook and social networks. What all these people had in common was cash, and a lack of opportunity to expand their business as well as risks associated with this way of conducting business. Many financial interactions took place informally, which made it difficult for them to demonstrate creditworthiness to potential financers.

It was clear that any payment solution for this population had to reflect these overlapping circles of relationships and comfortably accommodate the movement of money that already existed within them. Also, since the values being generated and moved around were so small, customer acquisition and servicing costs had to be close to zero. Encouragingly, SmartPay found that their consumer segment was well equipped to use mobile channels, with 89 percent of Vietnam’s rural population owning suitable mobile phones. It was apparent, that mobile delivery would be crucial to the success of the new solution.

A reliable platform making the most of data

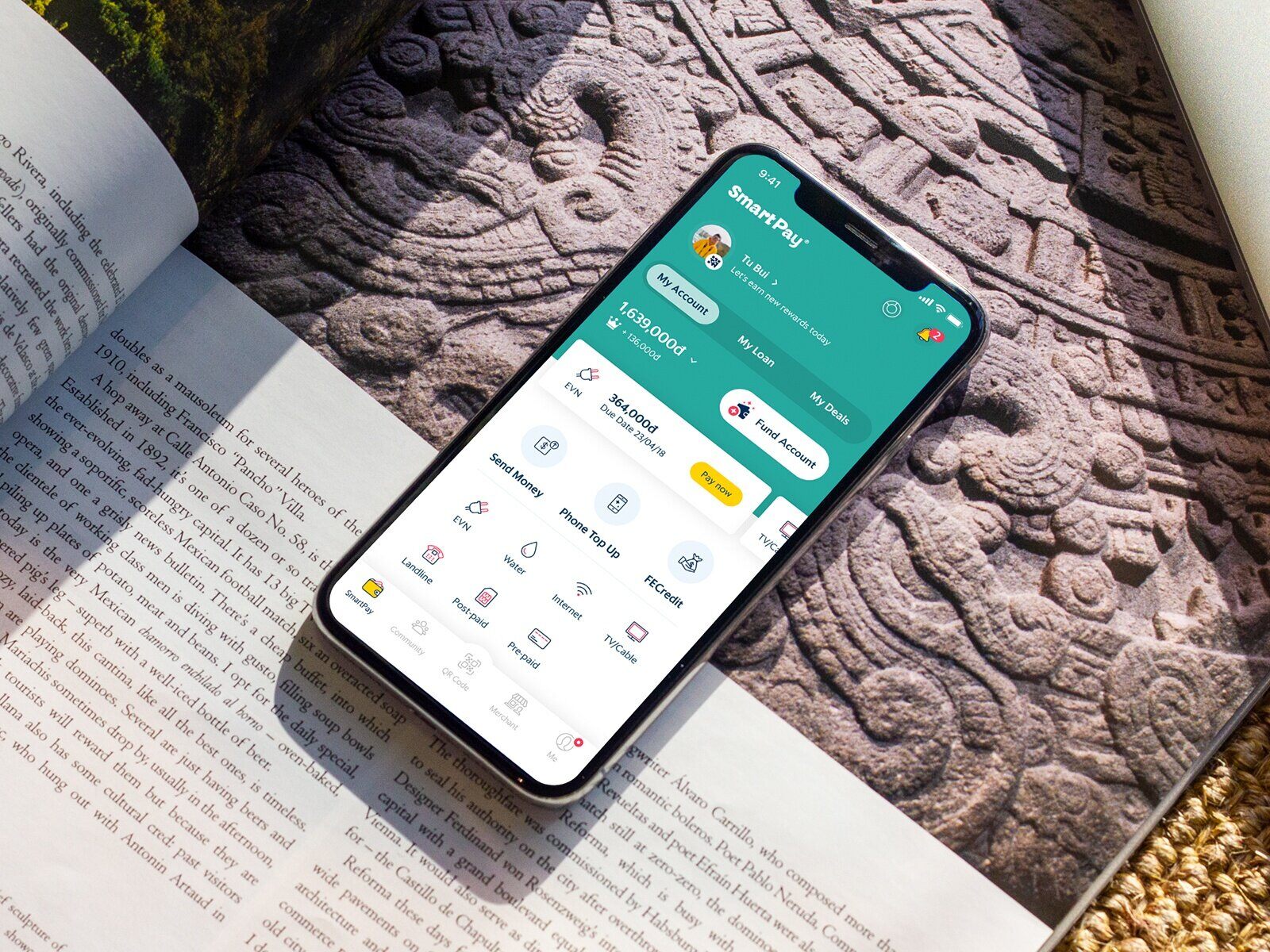

After extensive research, SmartPay created an ambitious business model, based on the idea of a digital financial services ecosystem revolving around a simple, user-friendly wallet app – SmartPay.

SmartPay was designed to provide reliable and stable financial services to the unbanked and underbanked population. Behind the app is a powerful platform capable of gathering and aggregating detailed customer data in sets of profiles. SmartPay gives access to products and services through a customer engagement platform supported by kiosk and merchant networks, which SmartNet maintains.

The digital wallet targets two main customer groups:

-

Private individuals. Mass market access to financial services, including P2P transfer, bill pay, saving and credit products, market place, job board and others all through a mobile wallet application.

-

MSMEs. Customized wallet solutions to the MSMEs segment to reduce transaction friction, increase the velocity of cash and enable behavioral financing.

To this end, SmartPay defined the following business principles behind their wallet solution:

-

A frictionless network where money stays local. A frictionless network means that value is kept in motion within an interconnected system. The company increases the velocity of money by enabling all kinds of transaction payments, transfers, QR code payments P2P, P2C, cash-in, cash -out within this ecosystem. In this way, money stays local for the benefit of communities, made up of buyers and sellers brought together on the SmartPay platform.

-

Higher value than just a transaction. Since digital payments are not incentive enough to change people’s reliance on cash, the platform would allow people to purchase goods offered by local merchants on deferred payment terms, and also access a range of in-app discounts, campaign promos and loyalty programs.

-

Smart trusted circle. The benefits of forming communities become obvious when relationships within them are transparent to all. SmartPay is able to reflect a known list of relationships between providers and customers, and contains a multi-merchant marketplace inside the app. When an app user needs to find a merchant selling a specific product around his or her location, SmartPay provides a list of vendors on a map. Customers can see immediately whether the vendors are known to them already, and merchants can also see that someone has been searching for a particular item, market, or promo campaign and is able to get in touch. Potential customers can also get a quick overview of what is accessible around them through peer reviews, where people have the opportunity of ranking and rating each other. SmartNet calls this the smart trusted circle – a community between particular merchants and their group of customers. Groups of communities then form a larger financial universe, or ecosystem.

An easy and attractive solution for the unbanked

SmartNet understood that to attract unbanked consumers, the whole combination of mobile payments, cash withdrawals, bill and loan payments and access to microcredit had to be offered in one easy-to-use app. First, users must be able download the app on their phone and start using it in minutes. To this end, SmartPay is designed with an intuitive onboarding process. A customer can download the SmartPay app and complete an automated, AI-assisted KYC, become fully enrolled and start making transactions in about a minute. If the customer is a merchant, he or she can become eligible for receiving a loan. This is particularly important for micromerchants operating on tight margins and immediate payment terms with their suppliers.

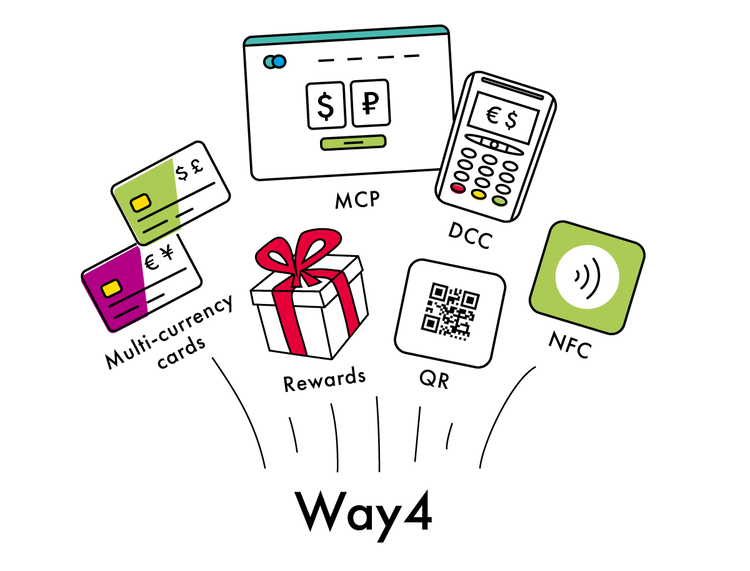

The development and launch of the SmartPay mobile wallet also involved an intense collaboration with OpenWay, an international payments software solutions business that has experience of integrating payments systems around the world. SmartPay’s mobile wallet core is based on the Way4 digital wallet platform.

SmartNet partnered with OpenWay to provide not just the ability to pay, but also access to microcredit, a loyalty program, and the capacity to pay bills and loans and make cash withdrawals. These helped to drive consumer demand for the wallet and expand the network of merchants accepting SmartPay. To help small merchants play on the same level as industry giants, SmartNet and OpenWay took care that the SmartPay wallet integrates the latest technologies and that requirements of information security are met.

More benefits for small merchants include saving money on transaction costs, the capacity to pay suppliers rapidly and directly, maintain clearer book-keeping thanks to electronic records, and follow-up with buyers. By offering access to micro-credit loans based on credit history through the same platform, SmartPay also gives small businesses access to the funds they need to grow. With human support and the SmartPay app installed on a smartphone, any merchant can become a local point of sale and gain a useful tool for revenue and expenditure management, create promotions, and offer dynamic and static QR code payments to attract more customers.

Through SmartPay, the merchants’ customers are also introduced to personal e-wallets, loans, insurance, and payments of utilies like electricity, water, television, and internet. They can also begin using QR code payments and take advantage of promotions and loyalty programs.

SmartNet took seriously the research that showed how lack of support leads to consumers distancing themselves from financially inclusive solutions. The company provides a staff of several thousand sales associates who cover 63 provinces and cities. They assist people with SmartPay installation and training, including consultations to merchants on how to use SmartPay as a simple point of sale where other payment technology is inaccessible.

Access to credit and savings products – overcoming the hurdle

Unfortunately, even with access to a financial wallet, the unbanked and low-income population are often excluded from credit and savings products. Two factors work against them: they cannot make the expected minimum deposit, and they have no way to demonstrate creditworthiness in lieu of history with a financial institution.

How can SmartPay users prove their creditworthiness if they have never had access to credit products before? SmartPay is structured in such as way that by collecting data on how people are actually using the platform, it builds sets of behavior profiles that provide insights into their financial life which is a representation of their daily life. Whereas traditional banks have no way measure creditworthiness based on small transactions, SmartPay can analyze spending data in a quantifiable way, for example, whether their users are regularly paying their bills or making regular deposits to their account. SmartNet has also created an online job portal. In contrast to informal channels or job lists put up in front of factories, this allows those who have moved to the industrial sector from rural areas to quickly access job options. This also helps SmartNet to gather data on whether people are employed and have income or not, which creates more insightful consumer profiles.

Are these goals and data-gathering initiatives in line with national regulations? So far, they are. One reason may be that, in Vietnam, consumer data gathered this way can demonstrate creditworthiness much better than credit regulatory features that work in other countries, such as credit bureaus that perform background checks and make reference calls. With consumer data aggregation, analyzed in SmartPay’s databases with artificial intelligence and machine learning, the most low-income families in Vietnam can demonstrate their creditworthiness and qualify for loans.

It is expected that many small businesses will find it difficult to access loans to revive or expand their businesses during the current epidemic. SmartNet has become the strategic partner of many large corporations in finance and banking such as FE Credit / VP Bank. SmartNet has introduced financial and banking partners to each other and connected them, enabling merchants to access loans through the SmartPay application and apply for them instantly. The loan approval and financing process is fully automatic, a huge advantage when lockdown restrictions are in place and there is no need to visit a physical bank branch for handing over documents.

All needs covered on a single platform

There are great advantages of having the whole wallet on a single technological platform instead of gluing together multiple silos. SmartPay’s Way4 digital payments platform is capable of covering every aspect of the payments business, from card issuing to acquiring, switching, digital banking, mobile wallets, e-commerce gateways, loyalty and fleet cards. For SmartNet, the company created a tailored and flexible solution that met every specific requirement of the Vietnamese micro and small merchant community. This enabled SmartNet to achieve an acceptable cost per transaction, while maintaining the capacity to grow operations rapidly.

The Way4 platform allows SmartPay to integrate with partners and other service providers via APIs. It manages wallet accounts, processes NFC and QR-based transactions, allows to configure loyalty programs and dynamic pricing. Flexible and rich in functionality, it helps businesses meet new challenges, implement innovative features and scale quickly and efficiently.

Success reflected in numbers

Following the product’s introduction, the success of SmartPay speaks for itself. The app was downloaded more than 150,000 times in the three months after launch, and reached around 500,000 users just seven months after launch. As of August 2020, the mobile wallet was being used by more than 1,7 million Vietnamese consumers. On the merchant side, acceptance grew from 3 thousand merchants five months after launch to over 190 thousand merchants just a year after launch.

SmartPay is proof that with a cost-saving, data-driven and innovative platform, a wallet targeting an undeveloped market can be a commercial success. By creating a new financial ecosystem, it has generated increased revenue and profit for both merchants using the system, and for SmartPay as a company. With the financial and payment landscape shifting dramatically during the current epidemic, SmartPay and OpenWay’s success story may well be repeated by those who pioneer new digital solutions, driving investment and economic growth in an ever-changing market.