The Central Asian nation of Kazakhstan is an early adopter of a central bank digital currency (CBDC). Kazakhstan’s central bank expects benefits in using a CBDC for cross-border trade (especially with China), for more efficient deliverance of funds for social services, for fighting corruption and for establishing transparency of government disbursements. It also wishes to expand the global acceptance of its national currency, the Kazakhstani tenge.

Payment software specialist OpenWay, which has operated in Kazakhstan for more than 20 years, recently partnered with three card issuing clients, as well as with Visa and Mastercard, to support issuance of the first credit and debit cards tied to digital tenge currency.

Another OpenWay customer, National Payment Corporation (NPC), Kazakhstan’s central switch for routing card transactions, led the development of the digital tenge for card products.

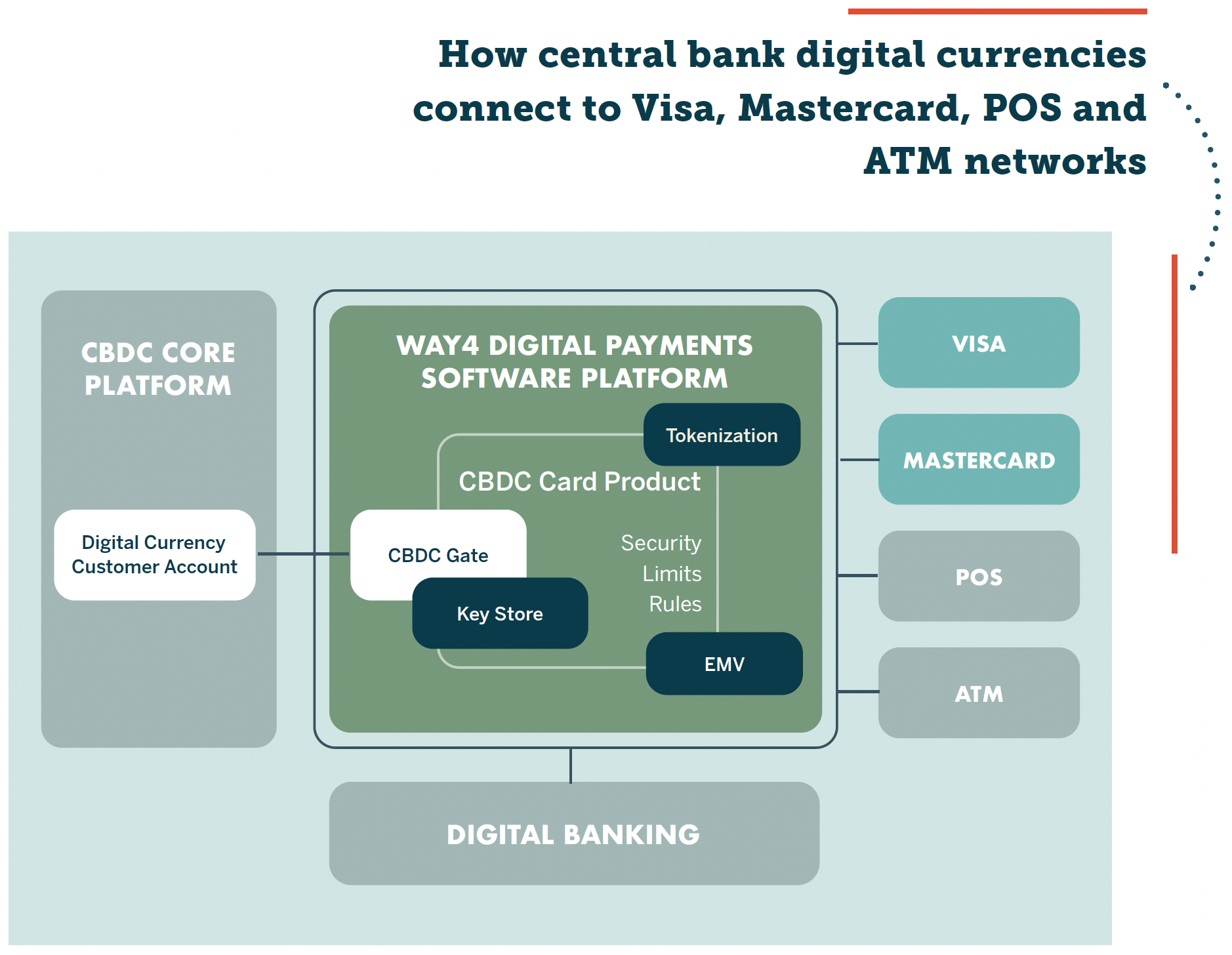

Banks are able to open consumer and commercial digital tenge Visa and Mastercard card accounts. Card payments at POS terminals involve real-time conversion from digital tenge to fiat tenge. Banks are also able to offer cash withdrawals from digital tenge accounts at ATMs.

NPC’s digital tenge platform was developed on Corda’s R3 open permissioned distributed ledger technology (DLT) platform. Every bank, as well as NPC, connects via an API to Corda’s R3 platform to manage DLT accounts.

Instead of a direct integration between Corda and the Visa and Mastercard networks, NPC and four digital tenge card issuing banks leverage their existing interfaces to access the card networks. Three of those banks – Eurasian Bank, Altyn Bank and Halyk Bank – use OpenWay’s Way4 software.

Kazpost, Kazakhstan’s postal service, also an OpenWay Way4 customer, issues digital tenge vouchers for uses such as school meals.

National Payment Corporation decided early in its CBDC card project to collaborate with Visa and Mastercard rather than develop a domestic-only payment system because it wanted to facilitate cross-border spending of the digital tenge.

The first card purchase made using a digital tenge was on a Visa card issued by Eurasian Bank in November 2023. All three of OpenWay’s bank customers involved in Kazakhstan’s CBDC project – Eurasian Bank, Altyn Bank and Halyk Bank – have issued digital tenge cards either as virtual-only products and/or with physical cards. Those three banks also acquire card payments from merchants using OpenWay software.

National Payment Corporation publishes results of its projects annually in December. In the month between the card’s first use in November and the publication of NPC’s reporting, there were 1,714 digital tenge card transactions. The majority of those transactions came from customers of Eurasian Bank and Altyn Bank, which both support not only in-store but also ecommerce payments for digital tenge cards.

Source: NILSON REPORT, June 2024, Issue 1266

Interviewed for this article

Sophocles Ioannou is Regional Director, New Business Development at OpenWay. Sophocles manages a full portfolio overseeing business management in Europe and Latin America. He has over 25 years of experience in managing some of the most complex customer solutions for card issuing, merchant acquiring, payment switching and digital wallets. This involves managing various lines of interest, multiple decision layers and complex commercial models, and making sound decisions in a fast-paced and complex environment. He is instrumental in OpenWay Group's activities around the globe and a key contributor to OpenWay’s impeccable reputation in the payment industry.

Get instant access to the Way4 brochure by filling out the form below:

![OW 12 [Long | CBDC]](https://openwaygroup.com/hubfs/Partners%20portal/Logos%20and%20icons/OW_Logotype_RGB_99x28_s2.png)

OpenWay is the only best-in-class provider of digital payment software solutions for card issuing, digital wallets, merchant acquiring, BNPL, transaction switching, tokenization, and fleet payments, and the best cloud payment systems provider as rated by Aite and PayTech. Top-tier banks and processors, as well as ambitious fintech startups, have chosen OpenWay as their strategic partner. Notable among them are Nexi, Enfuce, Shift4 and NBG in Europe; Network International and Equity Bank Group in MEA; Lotte and JACCS in Asia; Comdata, BeePay and Banesco in the Americas; Ampol in Australia, and other leading payment players worldwide.

With its unique capabilities in card issuing, BNPL, merchant acquiring, transaction switching, digital wallets, and fleet payments, the Way4 software platform guarantees an unparalleled customer payment experience. Distinguished by its unique architecture, which unifies back- and front-office operations, enables online accounting, and ensures high availability, Way4 stands out as the only truly online payment platform for Tier 1 players. Our experienced and globally renowned team of experts, coupled with Way4’s exceptional flexibility and scalability, enables rapid innovations and propels our clients to industry leadership.