This is considered a key financial solution for Mirae Asset Finance Vietnam (MAFC) for meeting the financial needs of customers while creating an ecosystem to connect them with retail partners.

Harnessing technology in product improvement to create better customer experiences when interacting with brands is essential, given the current fierce competition in the industry— both in the retail market in general and in consumer finance in particular. Impacted by the pandemic, consumer tastes have changed, and most businesses are finding it challenging to create new products and services.

Specifically, there has been a noticeable change in the habit of using cash. The percentage of consumers using cashless payment methods through NAPAS (the Vietnamese national payment gateway) has increased by 125%, and the total value of card payments at Point of Sales (POS) has increased by 50%, according to Vietnamese State Bank statistics.

Miraeasset Credit is a pioneering method of contactless credit disbursement through bank accounts in Vietnam

Upholding its motto to constantly innovate and always put customer interests first, MAFC is a pioneer in applying technology to deliver the best customer experiences.

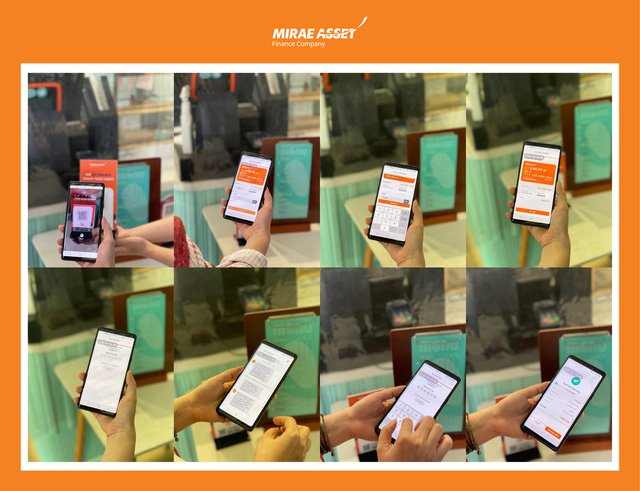

MAFC took advantage of the API development to launch a first sales model through alternative distribution channel without staff at the counter in collaboration with FRT in 2019, as well as 100% online financial support solution via FPTshop.com.vn, an online shopping website, from July 2021. Following that, MAFC has taken advantage of the popularity of QR codes in recent years in Vietnam to launch Miraeasset Credit, a form of touchless credit disbursement via QR code. This is a form of non-cash disbursement through a customer bank account. MAFC customers can use this solution to pay for products or services at more than 16,000 MAFC-affiliated partners such as FPTshop, The Gioi Di Dong and other partners through BNPL ( Buy Now Pay Later).

Miraeasset Credit is considered one of MAFC's strategic financial solutions in meeting the financial needs of customers and creating an ecosystem to connect customers and retail partners. Eligible individual customers may receive a credit amount within 24 hours after a few simple steps through the My Finance application. They can borrow up to 20 million VND (approx. 872 USD) for up to 45 days of no interest. Partners providing products and services who wish to be included in Miraeasset Credit's ecosystem may download the Smart Merchant application to register and receive a dedicated QR code.

When a customer wants to make a purchase using the approved loan, they scan the QR code in-store using the MAFC My Finance app, enter the transaction amount, and confirm the payment. The purchase will be financed by Miraeasset. Customers can conveniently repay the loan through bank cards or popular mobile wallets such as MoMo or ZaloPay.

Way4, the top-ranked digital payment software by OpenWay, is used in this product to manage customer and merchant information, set up credit, create instalment plans and calculate interest. Way4 provides online transaction processing as well accounting and merchant settlement.

Creating a competitive advantage and enabling MAFC to officially enter the credit card market in 2022

Miraeasset Credit is expected to increase MAFC’s competitive advantage in the consumer finance market. Compared with typical credit cards, Miraeasset Credit aims to bring better, more flexible and secure experiences to customers via QR payments. Building and developing Miraeasset Credit products will enable MAFC to officially enter the credit card market in 2022 with their virtual card based on QR technology, a breakthrough in the credit card industry. This promises to be a special and convenient form of card that increases the customer’s opportunities in accessing diversified financial solutions in the future.

Source: CAFEF

About Mirae Asset Finance Vietnam

Mirae Asset Finance Vietnam is proud to be a member of the global finance company from Korea, Mirae Asset, with 20 years’ experience in finance, securities, investment and asset management, and being present in 15 countries, with 200 offices and branches worldwide.

Showing appearance in Vietnam since 2006 and officially commencing from 2011, the company has built with the vision to pursue the optimal investment management strategy, and in order to always be with customer in their long-term strategy. Besides, with the goals of optimizing opportunities for customers to access the effective, legal and safe capital, Mirae Asset Vietnam has made lots of efforts to improve the consumer finance products.