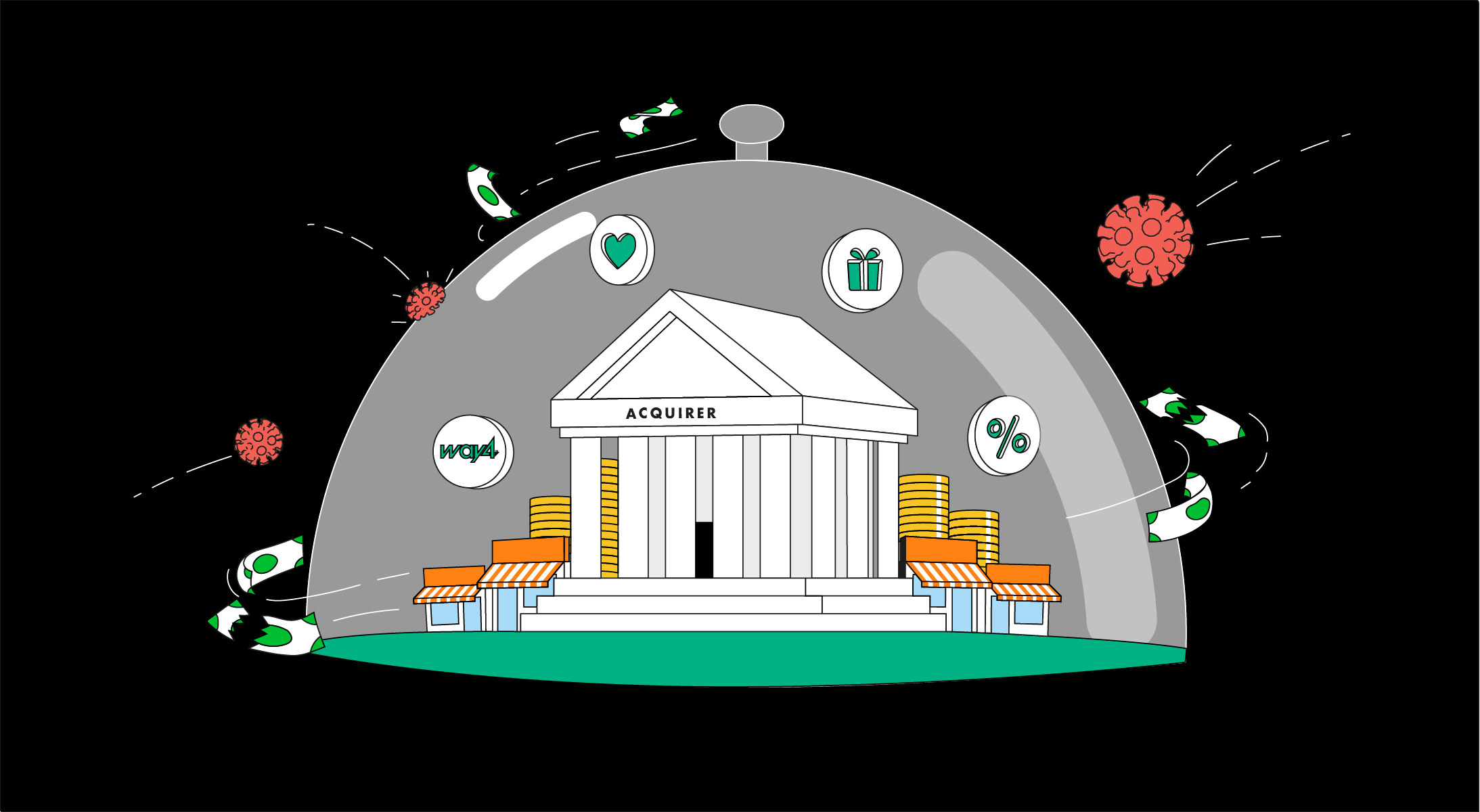

Explore the adaptation strategies of leading merchant acquirers, including Alipay, areeba, Halyk Bank, Network International and SmartPay. Our case study shows how acquirers can prepare their payment systems to survive and thrive in economically unstable times.

Learn about:

- Five emerging revenue niches to compensate for the overall drop in transactions

- Acceptance methods that merchants can afford even during crisis and recession

- Digital technologies to monetize social benefit distribution, marketplaces and cross-border commerce

- Merchant acquiring platform: tips for flexibility and resilience

Table of contents:

-

No quick cure for the economy

-

Merchant acquiring in crisis – stats and trends

-

Very affordable alternative to POS terminals

-

Compensate for empty stores with omnichannel

-

Offering the best acceptance fee

-

Dynamic multi-factor merchant pricing

-

More revenue niches that acquirers can explore

-

How to reduce operational expenses

-

Why waiting out the crisis is not an option

-

Why acquirers keep relying on Way4

-

Learn more: analytic reports, news and case studies

Leading acquirers referenced in this case study:

-

Alipay, a mobile platform with 1,000,000 users globally

-

areeba, the leading processing company in Lebanon

-

Halyk Bank, the largest acquirer in Central Asia

-

Network International, the leading processor in the Middle East

-

SmartPay, an innovative digital wallet platform in Vietnam, and others

-2.jpg)

-1.jpg)