To get a sense of what merchants and banks are facing and what their goals and priorities are, technology analyst house Ovum (now Omdia) partnered with OpenWay, a global vendor of digital payment software, to conduct the 2020 Digital Payments in Africa survey.

“The idea was that this research would help banks in the region prioritize areas in their payment infrastructure which need immediate investment. OpenWay has been providing banks and fintechs with digital payment software to for more than a decade, and some of our key clients are in Africa. We are impressed with how the market has changed recently and we know firsthand that many great ideas are being born, which often just need the right technology to turn into a stable product. And we are ready to support financial institutions in their journey towards a digital, more efficient payments future with card projects, digital wallets, instant payments and QR, whether they are individual banks or participants in national and cross-country projects.”

“Retail payments is a key area for investment for African banks and merchants alike. 69% of banks and 75% of merchants predict spending on payments infrastructure will increase over the next two years; with 25% of banks and 28% of merchants anticipating significant increases in spending of 6% or more. In an environment where most organizations are seeking to reduce their cost bases, this highlights the growing strategic importance of retail payments.”

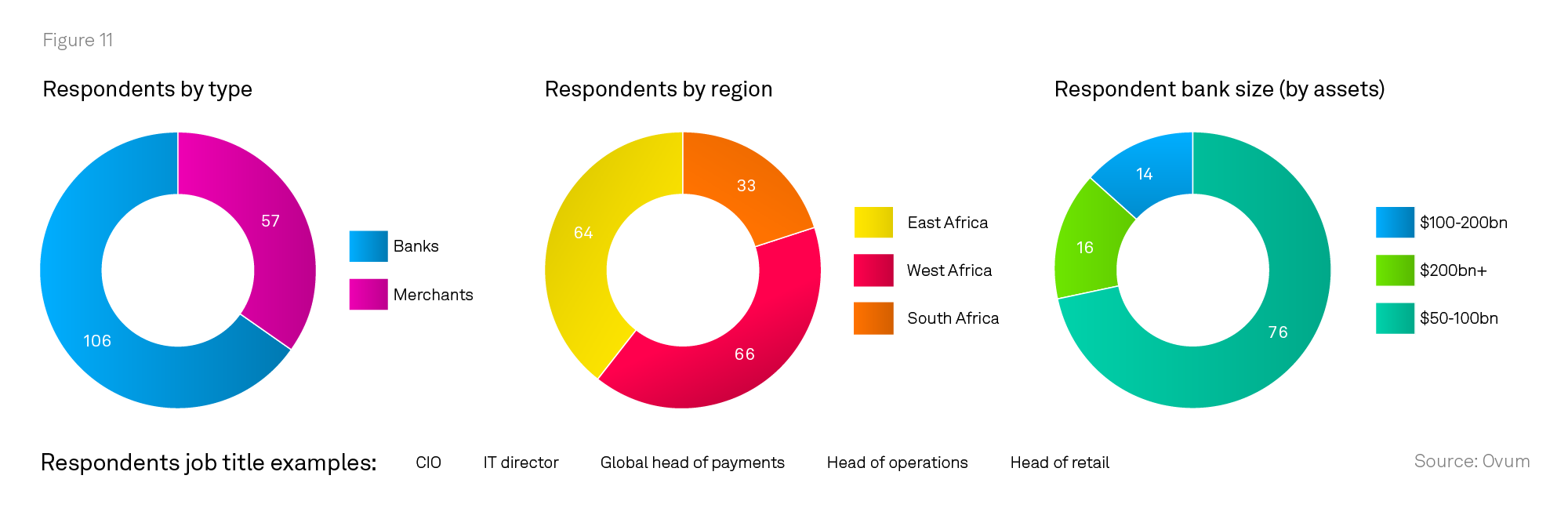

Results came in from 106 banks and 57 merchants in Ethiopia, Ghana, Kenya, Nigeria, Rwanda, South Africa and Tanzania, which together give a glimpse into the retail landscape of East, West, and South Africa. They were questioned on what payment products generated the most revenue, where they see the biggest opportunities in retail payments, their main priorities in improving their infrastructure, and where they will be spending the most. Here are a few takeaways from the report.

Most banks and merchants want to invest in new payments technology, even if the most profitable payments products in Africa provided by banks are still card-based

Across all regions, 41 percent of banks saw the greatest opportunity in retail payments to be in supporting digital commerce with digital wallets. The next greatest opportunity was seen in new services such as instant P2P and instant bill payments that are built on top of real-time payments. However, banks still see card products as their most profitable offering, as “consumer demand for payment cards typically outweighs that for other payment technologies such as mobile payments,” with debit cards in first place.

Even more interestingly, although most banks ranked the profitability of mobile money as average or less than average, their highest priority was to develop products around mobile account management. This may be a sign of the banks’ willingness to take on less profitable mobile payment projects for the sake of appealing to the next generation of customers, which 72% of banks ranked as extremely important in determining their payments strategies.

Existing infrastructure and new regulations drive demands in West, East and South Africa

Some responses differed regionally. Merchants in East Africa (represented in the survey by Ethiopia, Tanzania, Kenya and Rwanda) especially ranked security as a major concern and a priority area in investment. This suggests that they are aware of fraudulent transactions widespread in a region with good internet speeds and a relatively tech-savvy population. The demand for mobile bill payment products in the region is high, the same as the demand for debit cards. This is not surprising since a mobile payment infrastructure is already successfully in place, as shown by the popularity of M-Pesa and other mobile money offerings in the region. Also, with a bigger rollout of NFC-enabled cards and terminals than in other regions, banks in both East and South Africa showed a stronger interest in transition to contactless.

However, for West Africa (represented by Ghana and Nigeria), contactless was not a priority. Most banks in West Africa reported mobile account management as a particularly strong priority, showing their awareness of the widespread use of mobile money in their region. For banks in these countries, the biggest area driving additional investment in payments infrastructure was regulatory and compliance requirements, which prepare the region for intercountry payment systems that handle all types of digital payments. The report mentions as an example the Regulation on Electronic Payments and Collections for Public and Private Sectors in Nigeria, which was issued by the Central Bank of Nigeria in September 2019 and is part of the Nigeria Vision 2020 project.

South Africa, with its real-time infrastructure already in place, gave greater priority to implementing real-time payments and products such as P2P and instant bill payments than other regions. Banks were willing to spend more on product development, with 29 percent supporting new products on real-time payments infrastructure marked as their number one investment driver.

Based on the report data, it can be inferred that investment, demand and in turn revenue depends on technology infrastructure the region already has. This leads to the conclusion that timely investments in infrastructure can open new opportunities for banks.

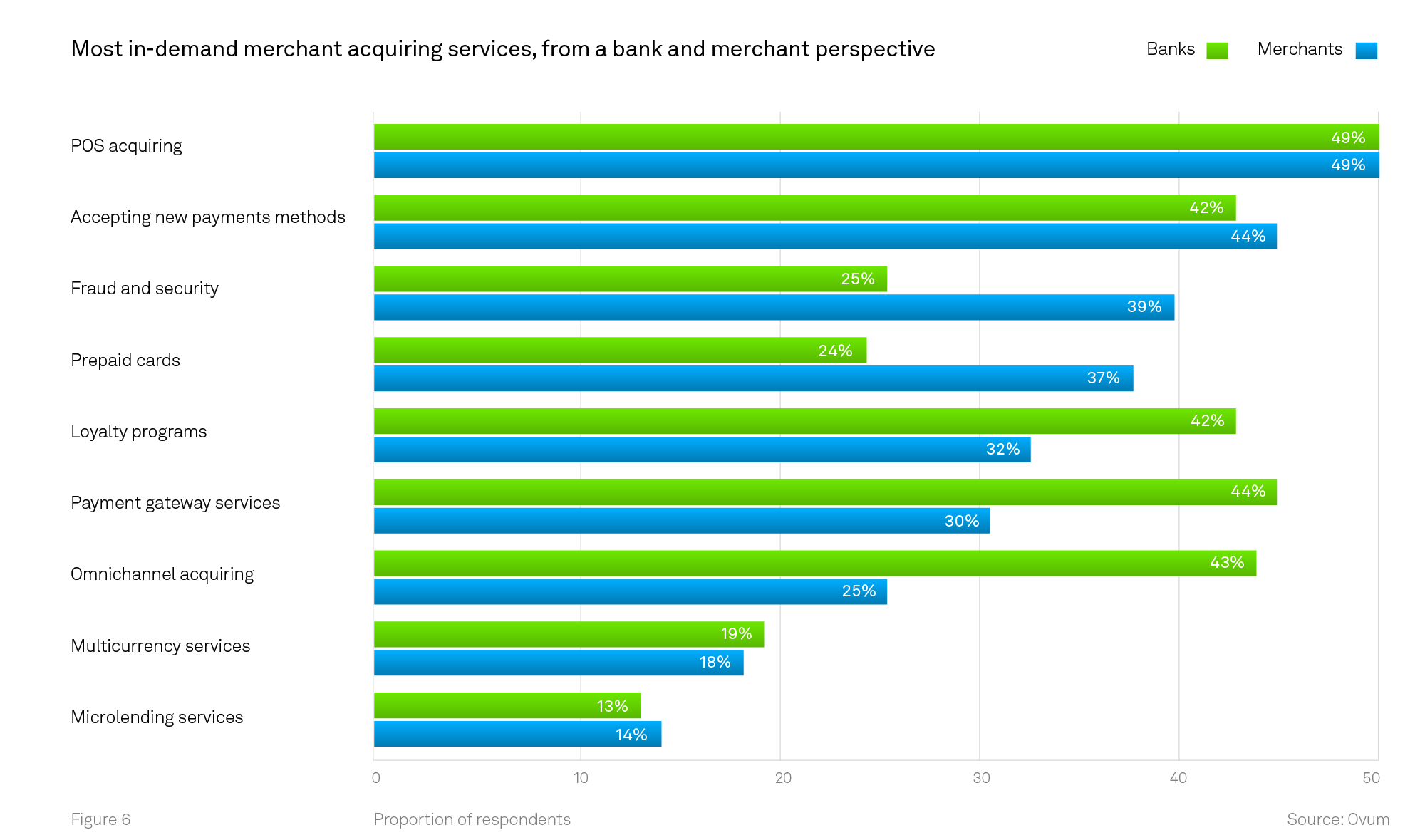

A gap lies between what banks want to give and merchants want to receive

The survey revealed where bank perceptions and merchant expectations are mismatched, especially on security and fraud concerns. 39 percent of merchants cited security and fraud prevention as the most in-demand merchant acquiring service, whereas only 25 percent of banks believed that it was.

Merchants saw a bigger need for prepaid with 37 percent wanting to invest, but only 24 percent of banks recognized this as a priority. The report also noted that “Banks, for their part, believe services such as loyalty programs, payment gateways, and omnichannel acquiring are more strongly in demand than the level of interest expressed by merchants would suggest”. The mismatch between the level of demand cited by banks and the level of needs cited by merchants might threaten bank-merchant relationships in the future, should other acquirers or non-bank players in the market take notice of a gap in bank offerings to gain a foothold.

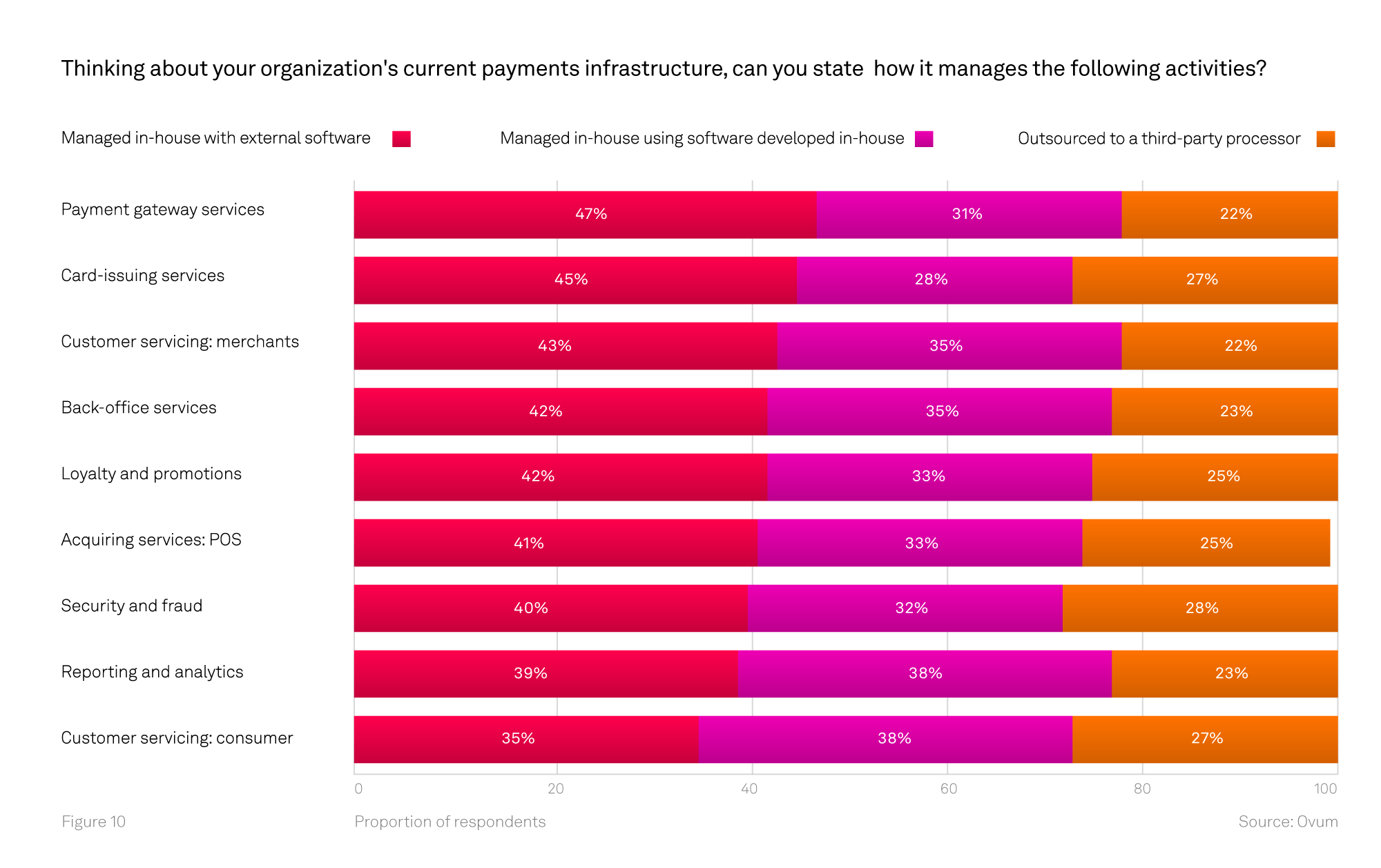

More banks are managing operations in-house than outsourcing, and they are choosing to use vendor software instead of developing solutions in-house

The specific operations managed in this way vary; for example, more banks use vendor solutions to manage their payment gateway and card issuing services instead of developing their own solution or outsourcing. This is probably from banks anticipating growth in this area that could exceed their own technological abilities, prompting them to form a relationship with a trusted vendor.

An interesting exception is customer service, which most banks handle in-house using software developed themselves. This may have implications down the road, since, as the report notes, “it is in these in-house solutions that legacy issues most commonly reside”. As far as outsourcing operations goes, only about a quarter of banks choose that option, and the survey notes that these are smaller banks who are looking to lower costs, although this “is not necessarily the best approach for innovation”.

The report concludes with some valuable recommendations for banks in Africa, among them:

-

To remember customers who depend on traditional payment mechanisms. The strongest customer demand in Africa is still for card products, which can be modernized and managed more efficiently with a better infrastructure and can include modern offerings like digital onboarding and mobile account management.

-

To listen to merchant needs, especially around fraud and security, and provide services they require, otherwise banks risk losing merchants to other providers that will step into the niche.

-

To make targeted investment in technology infrastructure to keep pace with customer expectations. Especially noted is the valueof real-time payment infrastructure, which give rise to and meets demands for P2P and instant bill payments. The technology infrastructure must be able to support new regulatory requirements in an increasingly cross-border payment ecosystem and allow for adding and managing new products, such as multi-currency cards.

Get instant access to the report by filling out the form below:

About the authors

.png)

OpenWay is a best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata (a Corpay Company) and Banesco in Americas, and Ampol in Australia.

-Mar-03-2026-03-15-57-6354-PM.jpg)