Merchant acquiring profitability: a piece of cake or a pig in a poke?

It is hard to tell someone’s age by their appearance these days: a 15- and 35-year old look similar on Facebook. A tip: ask them whether they ever were required to pay 3% on top of the purchase amount when attempting to pay with a card at a local store. If they look surprised, bet on Gen Z. A lot of water has flowed under the bridge since you could find such a store (although if you do, let us know — we’ll get a photo for this article). There was a time when many merchants were reluctant to accept any cards at all. Now, when most of them do they are reluctant to pay through the nose for acquiring services and are very picky since there are so many service providers vying for their attention. To win customers, acquirers have to offer the best rate along with VAS-perks, sometimes to the detriment of their profitability... What can be done by acquirers to keep the profits while securing the lucrative offering to the merchants?

We at OpenWay, the global leader in digital payments software, have been keenly observing how acquiring business models have changed – before and after the outbreak of the pandemic. To prepare this report, we have interviewed experts representing major regional acquirers to learn about what profitability challenges they face in their regions and verticals. We also found out which business solutions and technologies are helping them grow profits and optimize costs. Read on to learn our findings, and see what the future holds for merchant acquiring.

Table of contents

Click on a header to skip directly to that section.

Acknowledgments

Thanks to these experts for contributing to this report:

Ilya Dubinsky, VP CTO Office at Credorax

Credorax (now part of Shift4) is an innovative award-winning European merchant acquiring bank serving global e-commerce merchants and PSPs. In addition to his duties at the CTO Office, Ilya is also a contributor to the Berlin Group and author of Acquiring Card Payments.

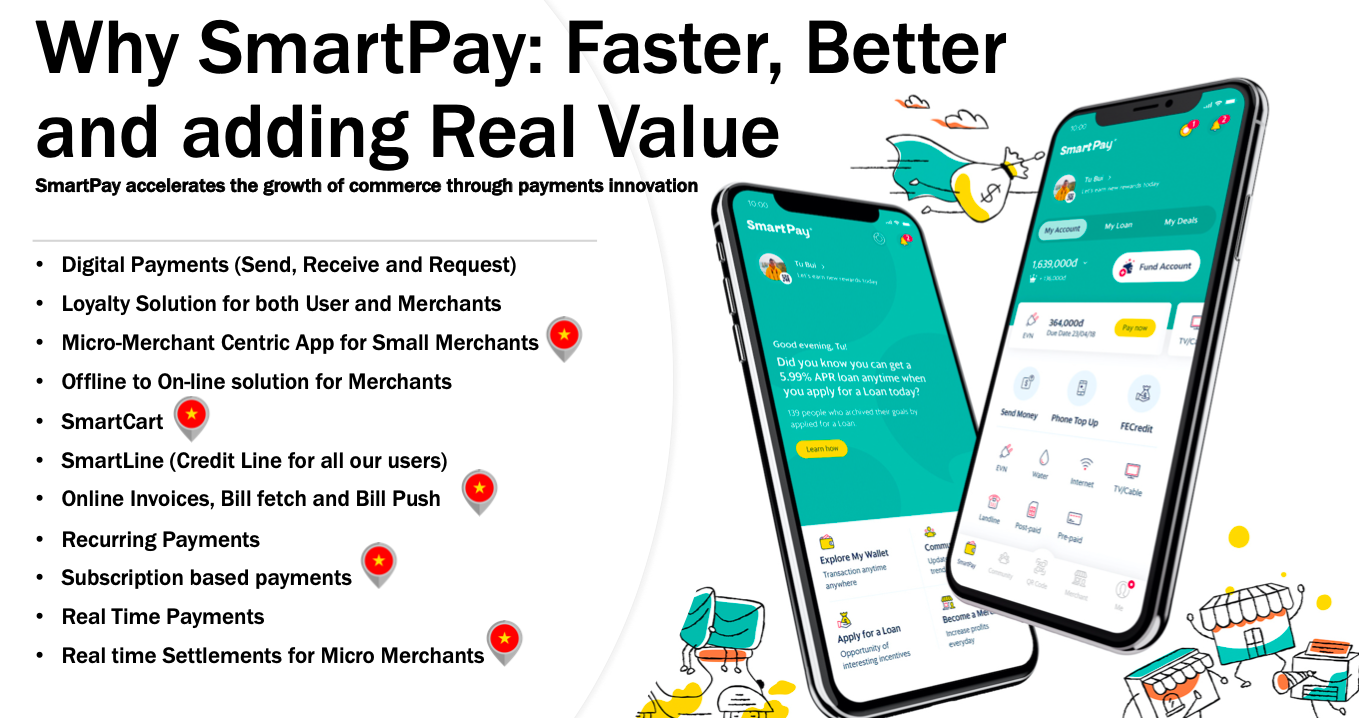

Marek Forsyiak, CEO at SmartPay

SmartPay is one of the leading financial inclusion wallets in Vietnam. Marek oversaw the creation of a nationwide network covering 700,000 merchant acceptance points comprised mostly of SMEs, acquiring a user base of over 40 million customers initiating over million monthly transactions.

Hermann Tischendorf, Digital Transformation & Innovation Consultant

Hermann is a consultant specializing in IT strategies and digital products in FinTech, PropTech, and InsurTech.

What merchant acquiring looks like in 2021

Unprecedented M&A activity among merchant acquirers, an irrevocable shift to digital payments, and the launching of no-acquirer payment schemes: OpenWay has identified the three factors impacting on the economics of low-margin merchant acquiring in recent years.

Unprecedented M&A activity among merchant acquirers

"Acquirers have a much more important role in this business then they did 10 years ago… In Europe they are forced down to be more efficient, and in the US they are forced to be more competitive. That is reflected in the recent mergers we have seen."

— Brian Riley, director of card services at Mercator Advisory Group, 2019

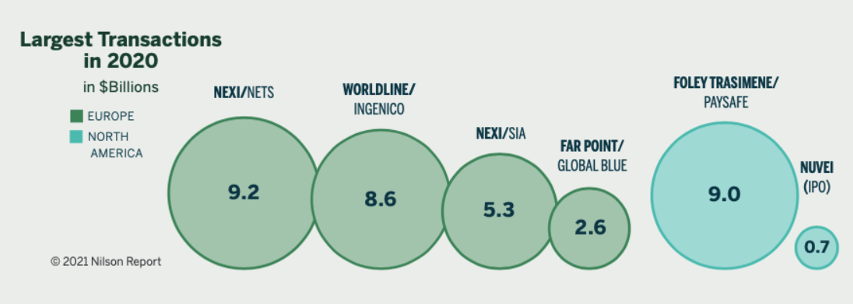

With revenues from core merchant processing being commoditized, most large players took steps to build scale and cost-efficiency through massive acquisitions across geographies and delivery channels (namely, POS and e-commerce). According to the Nilson Report, a total of 91 merger and acquisition transactions took place in 2020 in 31 countries in the merchant processing and acquiring sector of the payment card industry. The largest transactions were in Europe when Italy-based Nexi initiated takeovers of its domestic rival SIA and Nets, based in Denmark. The combined value of those transactions was $14,50 billion.

How have these acquisitions affected the acquiring landscape? When businesses are consolidated, one entity usually takes over the management of the diverse payment platforms inherited from various companies. This creates redundancies in functionality and operations and makes maintenance more expensive, which in turn raises processing costs. Acquirers can be caught at a real disadvantage when competing against the legacy-free and cloud-native new-generation players who can offer more competitive rates to merchants. So it’s hardly surprising that the majority of big acquirers are now re-evaluating their entire infrastructure. Their goal is a more integrated and scalable platform with a single view of merchant data across multiple geographies, channels, and verticals.

Irrevocable shift to digital payments

Adobe surveys found that 9% of US consumers, 8% of Japanese consumers, and 15% of UK consumers said they had never purchased anything online before March 2020. Online shopping is becoming the preferred method of grocery shopping for a growing number of consumers. And it’s not just groceries: according to eMarketer, online retail sales will reach $6.39 trillion, with e-commerce taking up 21.8% of total retail sales in 2021. Although total worldwide retail sales declined by 3.0% in 2020 due to the pandemic, eMarketer estimates that worldwide retail e-commerce sales grew by 27.6%. This represents a substantial uptick from the mid-pandemic assessment of 16.5% growth.

In many regions, this growth is because of SMEs going online. Since e-commerce payment acceptance is more expensive than traditional POS acquiring, during the first wave of the COVID outbreak many governments required acquirers to reduce or cancel the merchant service charge (MSC) for SMEs signing up for online payments. Overall, McKinsey expects merchants’ payments acceptance costs to rise by 6-10% as commerce migrates to these higher-cost channels. For acquirers, this means they must adapt their pricing models and acceptance channels to SMEs, taking into account their smaller transaction amounts and low monthly turnovers. The challenge is how to offer SMEs affordable online payments without the acquiring service losing profit.

A financial inclusion digital wallet in Vietnam running on Way4: “Vietnam was badly hit by COVID-19. As a result of the lockdown, as many as 25% to 30% of micro-merchants and street vendors have closed. Thanks to our focus on this segment, we ensured that our clients had all the opportunities to survive in these times and replace lost revenues. Financial inclusion wallets like SmartPay can play a big role in these goals. How do we take a traditional offline merchant and bring them online? By adding a real value that allows their businesses to grow! We deliver VAS that allow micromerchants and street vendors to be as successful as the most advanced e-commerce provider. Technology allows for democratization of these processes and we are putting the micro-merchant first. This is why we purpose-built SmartPay from the ground up. We had to think of how to deliver the products and services relevant to SMEs on a cost-effective basis to ensure our ability to succeed in the long term.”

No-acquirer payment schemes

The largest regional economies have recently launched local A2A payment schemes. These provide faster and cheaper transaction processing as they can bypass international payment schemes and use newer technologies such as cloud and blockchain, and data-rich communication protocols like ISO 20022.

In most scenarios, card acquirers have no or minimal involvement. So unless acquirers can find a role for themselves in these new schemes, they may lose profits when some of their transaction traffic diverts to a more attractive (read: cheaper) cardless scheme. How can acquirers take the initiative and get involved in the creating of a new scheme?

These market changes are requiring acquirers to rethink their market strategies to stay relevant and keep growing. They must be able to quickly develop, scale and price services to merchants and modify them as necessary. They might be maxing out the limits of their current technological platforms and seeking out investments in new solutions. Later we will discuss which solutions and technologies are showing great promise.

Revenue from core processing: what’s happening globally?

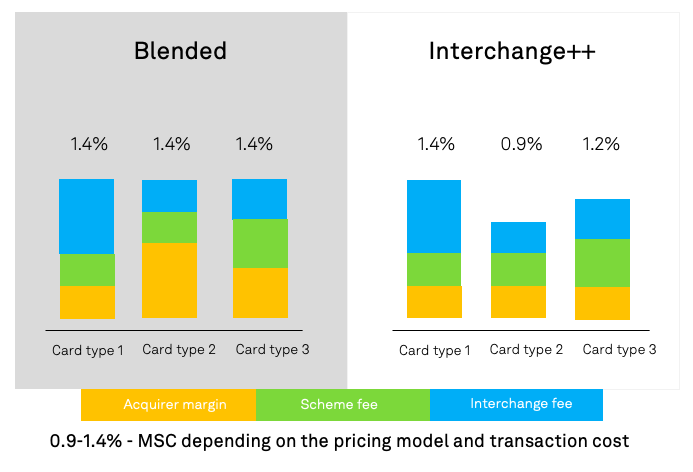

Visa estimates that the MSC line item contributes between 60-90% of an acquirer’s total revenue depending on the country. The two most widespread pricing models that generate this revenue are blended pricing and Interchange++ pricing.

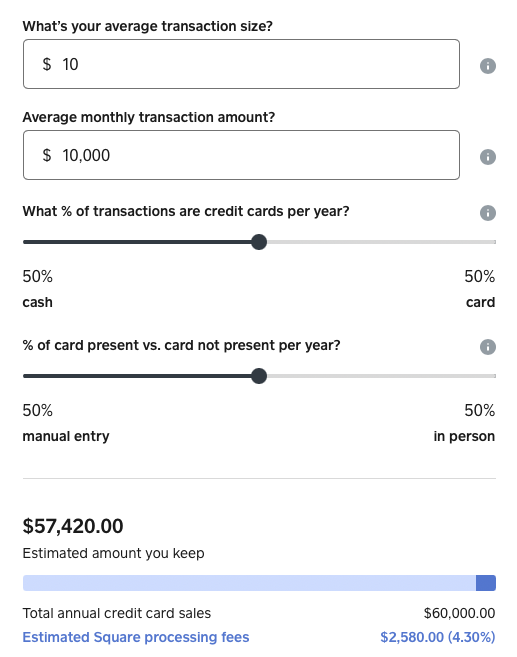

The blended pricing model is easier for merchants to comprehend and allows them to predict the monthly acquiring service cost as it is a fixed per transaction rate. The transaction cost is hidden in this rate, so merchants do not see the amount of the acquirer markup. This model is widespread in developing markets, but it is also often offered by fintechs in developed countries. For example, Square charges 2.6% + 0.10 USD per card-present transaction and 3.5% + 0.15 USD per CNP transaction. According to Square, this makes their rates competitive, as the average cost of processing payments for US businesses with $10,000 to $250,000 in annual payments volume is between 2.87% and 4.35% per transaction.

Square fee calculator for merchants. Source: Square website

In some countries in Eastern Europe and Central Asia, up to 90% of acquiring profits come from the MSC. In most cases, pricing is blended, but merchant fees can vary for cards of different international payment schemes, like Mastercard and Visa. When the acquiring market began to develop in these regions, there were cases when merchants were charged a 6% fee. That is no longer the case. The highest fee of around 3% might be charged to high-risk online merchants trading in quasi-currencies or those who are involved in the gambling industry. But usually, fees range between 1,5 to 2%. A small business may be charged more, between 2,5 to 2,8% if their turnover is small, so the acquirer can cover the cost of maintaining the merchant’s terminal. At the same time, retailers with a large turnover might be given an exclusive offer of a lowered rate, down to 0,8%.

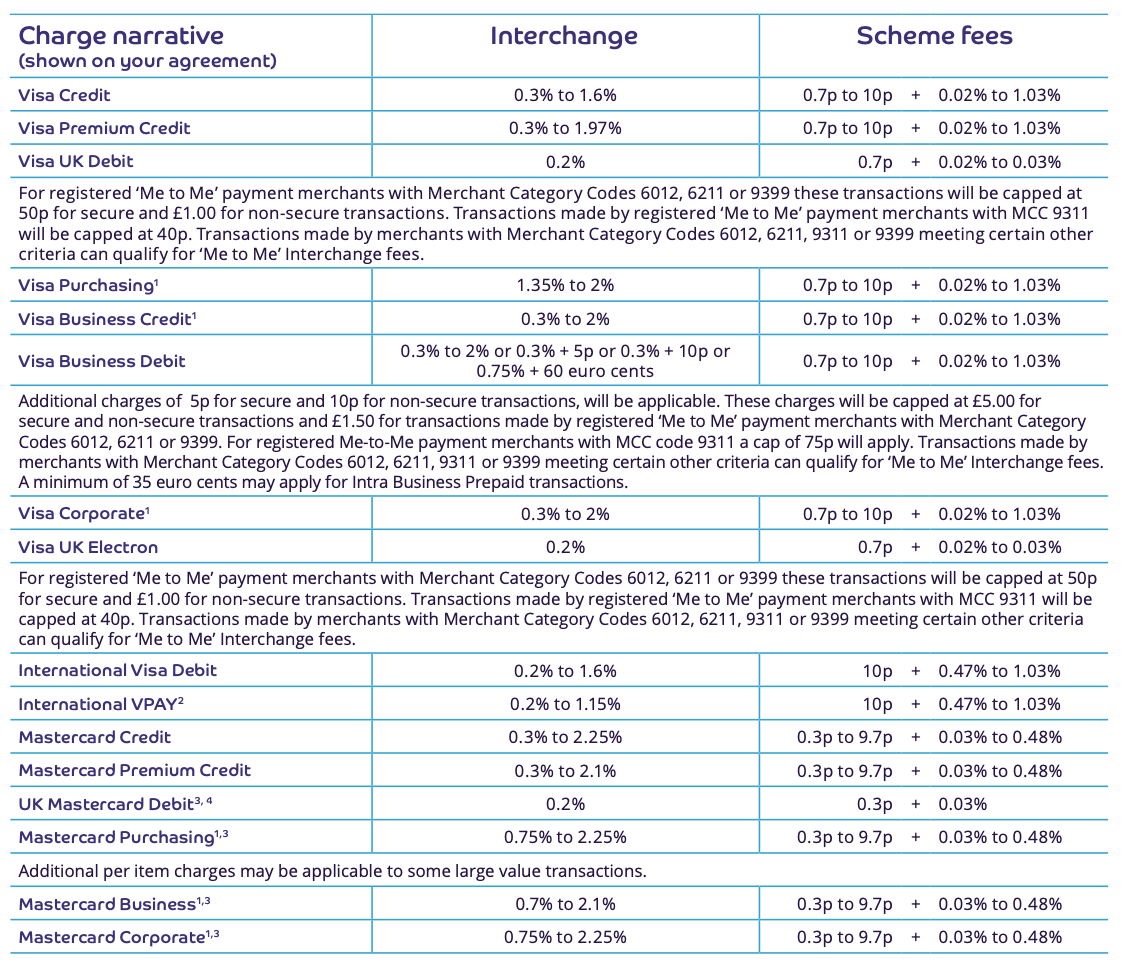

The Intercharge++ pricing model is commonly used in Eurozone. countries and in the US for Mastercard and Visa cards. It is the most transparent model, as all transaction costs incurred for the acquirer are explicitly shown in the merchant billing, including the interchange fee (IRF) paid to the issuer and fees paid to Visa and Mastercard. From 2015, acquirers in the EU are mandated to bill merchants using an Interchange++ structure. Additionally, the EU Interchange cap for consumer cards came into effect, stipulating a 0,2% fee on the transaction value for debit cards and a 0,3% fee for credit cards. Similar regulations were rolled out in Australia in 2017 and in other countries.

Interchange caps in different countries. Source: Adyen

When an Interchange++ pricing model is used, acquirers have to track all the changes made to IRF and Mastercard/Visa fees and update their pricing. While the interchange fee can be calculated at the moment of a transaction, the payment scheme fee is invoiced to the acquirer by payment period, which makes it challenging for the acquirer to include the precise fee amount in the merchant’s regular billing.

The tricky guide to Interchange rates and scheme fees by Barclaycard.

Since the top acquirers in Europe use Way4 Acquiring, OpenWay’s merchant management platform, they rely on OpenWay solutions to automate the routine calculation of these fees. The solution also includes fee prediction functionality, which makes sure that the correct fee is charged at the moment of transaction, even before the reconciliation file with the stated fee is received from the IPS. This allows acquirers to reimburse net payments to their merchants faster — on the same day or even several times a day.

Besides traditional blended and Interchange++ pricing models, there are other interesting merchant-acquirer business models. In some countries, instead of the merchant paying the acquirer, the acquirer pays the merchant. Although this may seem strange at first, there is still something in it for the acquirer! The merchant agrees to receive reimbursement for the processed transactions after a delay period, during which transaction funds are effectively lent to the acquirer. After the period, acquirers reimburse the merchant with the transaction amount plus interest.

Besides the direct acquiring revenue from processing, acquirers can gain additional revenue by charging fees for accompanying services. They may charge a fee to rent terminals or charge a monthly fee to merchants with a lower turnover. In Eastern Europe, the acquirer traditionally covers the costs of creating and maintaining the costly acquiring infrastructure, including terminal network and channels. The exact opposite scenario is seen in the US, where the largest acquirers charge merchants with many “per merchant” and labor-related fees for customer support, terminal help desk, and chargebacks. Especially acquirers who work with third-party providers for authorization and settlement services will most often seek to offset lower transaction pricing through fees.

Why are many acquirers finding it challenging to calculate merchant acquiring profitability?

While merchant acquiring profitability is expected and is a stable source of revenue in some regions, it is not considered essential in others. In Africa, many markets are monopolized with high fees, so acquirer profitability is a given. In other regions with developing countries it may be the opposite: merchant acquiring is offered by banks and not by specialized third-party processors, it is sometimes treated by as an auxiliary service that banks provide to merchants. Most of the profit comes from other offerings to merchants such as settlement and cash services, crediting, and cash-in-transit (CIT) services. That’s why acquirers there are used to estimating the profitability of their acquiring business quite loosely.

In those countries, where acquiring is considered to be an extension of banking services, not necessarily as a profit-making venture in itself, acquiring banks sometimes deliberately offer new merchants a very low MSC because they are confident that they will make a profit from other merchant services. In Europe this would not be possible, as there are many processors in the market who are not offering banking services. And according to the business model used by the US processors, it is unacceptable to allow any line of business to become unprofitable.

Monitoring and predicting profits and losses from transaction processing is a tricky business regardless of which pricing model is used. The interchange and payment scheme fees make up most of transaction costs for acquirers. But acquirers also depend on a variety of card and transaction parameters over which neither they nor their merchants have control: they can hardly force people to pay by domestic debit cards with low IRF instead of commercial credit cards with high IRF. Acquirers can only make general assumptions, such as that a premium card product would be used to make purchases at an expensive boutique in Milan rather than a grocery store in the suburbs. But even that assumption can fail: sometimes card issuers release a new premium card product for a wide range of consumers whose income level and lifestyle may not meet the optimal profile for premium cards. When cardholders use their premium cards to make purchases at discount stores and fast-food restaurants, this increases the transaction cost for the acquirer, who has no influence on consumer behavior in this situation.

Also, even a small change in IRF can injure the merchant, the acquirer, and even the issuer. Remember when payment schemes and governments capped interchange fees and MSC at the beginning of the pandemic to support SMEs? Many acquirers had to revise their pricing schemes almost overnight.

In most cases, data analysis and a personalized approach to each merchant is needed when selecting and setting up a pricing model. Why?

-

The Interchange++ model might be too expensive for merchants with a high ratio of online purchases made with international commercial cards. Meanwhile, the acquirer will incur losses if this merchant type is charged using a blended model, since the MSC will probably not cover the transaction cost.

-

With a blended fee model, it is not always evident to the acquirer what the lowest possible fee should be.

-

With an Interchange++ model, acquirers may not have the tools to automatically track and apply all actual IRF fees and generate merchant statements accordingly.

-

With either model, large grocery or fuel retailers whose margin is only 3-4% find it hard to keep prices low when they have to pay for transaction processing. The cost must come out of someone’s pocket, whether it is the customer, the acquirer, or the retailer.

Merchant acquiring is a highly competitive yet low margin business where a difference in hundredths of a percent, like being charged 1,56% instead of 1,57%, becomes the reason for large merchants to leave for another acquirer, since for them this difference means saving thousands of dollars per year that can be reinvested into their business. Also, there is underbidding by fintechs or the largest market players with a large share of close-loop transactions. Often acquirers hover at the edge of becoming unprofitable so they can win new merchants. To understand where the bottom line should be, they need a tool that will calculate with precision the P&L of each merchant and find its optimal MSC.

Tools for profitability analysis make a difference

How can the profitability of each processed transaction be calculated precisely? How can acquirers detect when a merchant is becoming unprofitable and optimize their MSC using reliable data about their actual transaction flow?

Reliable tools for profitability analysis can take this burden off of acquirers. OpenWay clients are successfully using Way4 Analytics, a solution for acquiring profitability analysis. It allows dynamic tracking of each merchant’s profitability and sends alerts when the profitability of merchants falls below a set level. Acquirers can use a built-in fee calculator to set the optimal MSC for new merchants and model new pricing schemes.

If acquirers are offering blended pricing, they can see the actual P&L of each merchant. The system provides data right down to each transaction showing all associated transaction costs, including IRF, scheme fees, and partner fees.

OpenWay experts once helped an acquirer analyze an unprofitable merchant who was processing an enormous number of transactions for very small amounts. Since the assessment fee is made up of both a percentage of the transaction and a fixed amount in euros, we discovered that all those small transactions ate up the acquirer’s profit. The turnover was large, but losses were even greater. After analyzing the data, we recommended that the acquirer collect from that merchant a fixed charge for transactions lower than a certain amount. This allowed the merchant to become profitable again for the acquirer . Of course, this does not prevent merchants from refusing to accept card payments for purchases lower than a certain sum.

If acquirers are on Interchange++, this solution will help them be compliant with regulatory requirements. For example, they can precisely calculate IRF and scheme fees for each transaction to include in the merchant statement.

Acquirers can also generate business reports in near real-time that show trends in their acquiring portfolio, segmented by merchant type, card type, international payment scheme, or other criteria.

With Way4 features enabling profitability analysis, acquirers can precisely calculate how much each transaction is costing them in terms of simple cost value. It works like an ultrasound that reveals to acquirers aspects of their business that they were unable to see before. In just 5-10 minutes acquirers can see pain points, receive a diagnosis and come up with a treatment plan. Not only that, much of the treatment can be administered by OpenWay. Our experts can help acquirers to configure and generate the reports they need, keep track of actual payment scheme fees, and provide consulting services on portfolio performance.

Way4 Analytics analyzes the profitability of three business areas: merchant acquiring, ATM acquiring, and P2P. It is based on the latest technologies allowing near real-time analysis of processing system data to produce reports that would take hours or even days to create using traditional reporting tools. OpenWay provides the profitability analysis tool as a service and hosts it on a secure infrastructure that acquirers can access via remote connection.

Which VAS bring revenues to acquirers?

Although most acquirer revenue comes from the core transaction processing service, value-added services (VAS) have started to generate a larger share of revenues. According to McKinsey, 29% of acquirers’ revenues in the US came from selling VAS in 2019 as opposed to 26% in 2017.

Key VAS that represent 70% of all VAS revenues of acquirers are those which are consumed by large merchants, including data analytics, fraud and enhanced payments. The list of top VAS services for SMEs includes financing and marketing solutions, cloud solutions, loyalty and gift, payroll and tax management.

“Payments is what we would call a hygiene function. No one is making money from payments. It’s something you need to have to enable all the other stuff, a sort of glue holding the whole thing together. Buyer or seller, private individual or merchant, we want to get people out of cash and into electronic payments. So we are providing services that are particularly tailored to the needs of these people. They don’t have access to credit. They don’t have access to savings products. They don’t have the opportunity to open a small web shop and show their products to the world. We are giving them a platform that is doing all this on top of payments.”

“Payments are a service nobody wants to see — customers just want it to happen as seamlessly and invisibly as possible. But to be truly invisible, a payment service must be very reliable, very global and very local at the same time. Which is what we do while adding value for our merchants — multi-currency pricing and settlement, 99.999% reliability, interchange fee prediction, and smart optimization of approval rates.”

Credorax is aiming to be a robust hi-tech payment services player in the e-commerce arena. Their platform allows them to integrate and pilot new VAS providers quickly, making the company more agile and fail-fast. The key focus in VAS for e-merchants is rapid digital onboarding, advanced data services and continuous optimization of services, including approval rates.

In some countries where hundreds of acquirers are competing, no merchant is really willing to pay for services like a merchant portal, a dedicated account manager, or extended reporting. When the market is highly competitive, if an acquirer doesn’t provide these services for free, merchants will go to the acquirers who do. So VAS are intended to help acquirers attract new clients and keep existing ones rather than directly generate revenue.

Extra revenues from issuing gift and prepaid cards

An experienced processor can help retailers create a custom prepaid solution. Shared expertise can result in higher potential profits and brand awareness.

Issuing closed-loop gift cards for large merchants may be a very profitable initiative. Revenue from gift cards issued by large cosmetics retailers before the holiday season could equal the revenue from the acquiring service, while processing fees could be kept low thanks to closed-loop processing.

Some retailers benefit from prepaid cards, accepting them as no-interest loans from their customers. Starbucks is the best example: their stored value card liability and current portion of deferred revenue in 2019 reached $1,269 billion. To compare, 102 financial institutions in the US have domestic deposits of less than $1 billion. The funds loaded on Starbucks Cards generate yearly income to the company: according to the company’s spokesperson, 97–98% of the loaded deposits is redeemed. Although the stored funds on the cards don’t have an expiration date, the company keeps track of the so-called breakage amounts — the funds that were loaded on prepaid cards but never used. The amount is counted as a proportion of redemptions made over the recent year and those of the past, and these can reach $125,1 million in company-operated store revenues and $15,7 million in licensed store revenues, according to data from 2019.

Monetizing data for merchants

Most retailers are interested in analyzing transaction data on spending behaviors, the payment tools customers use, and how spending varies between locations and time periods. Customer data provides insights for marketing departments that help them plan promotions and sales on certain product categories, and also anticipate and create demand for offerings. OpenWay has developed sets of analytic reports for acquirers that they can in turn offer to client merchants who wish to analyze their market.

“Data increases the value of your services to merchants. You can't let data go to waste!”

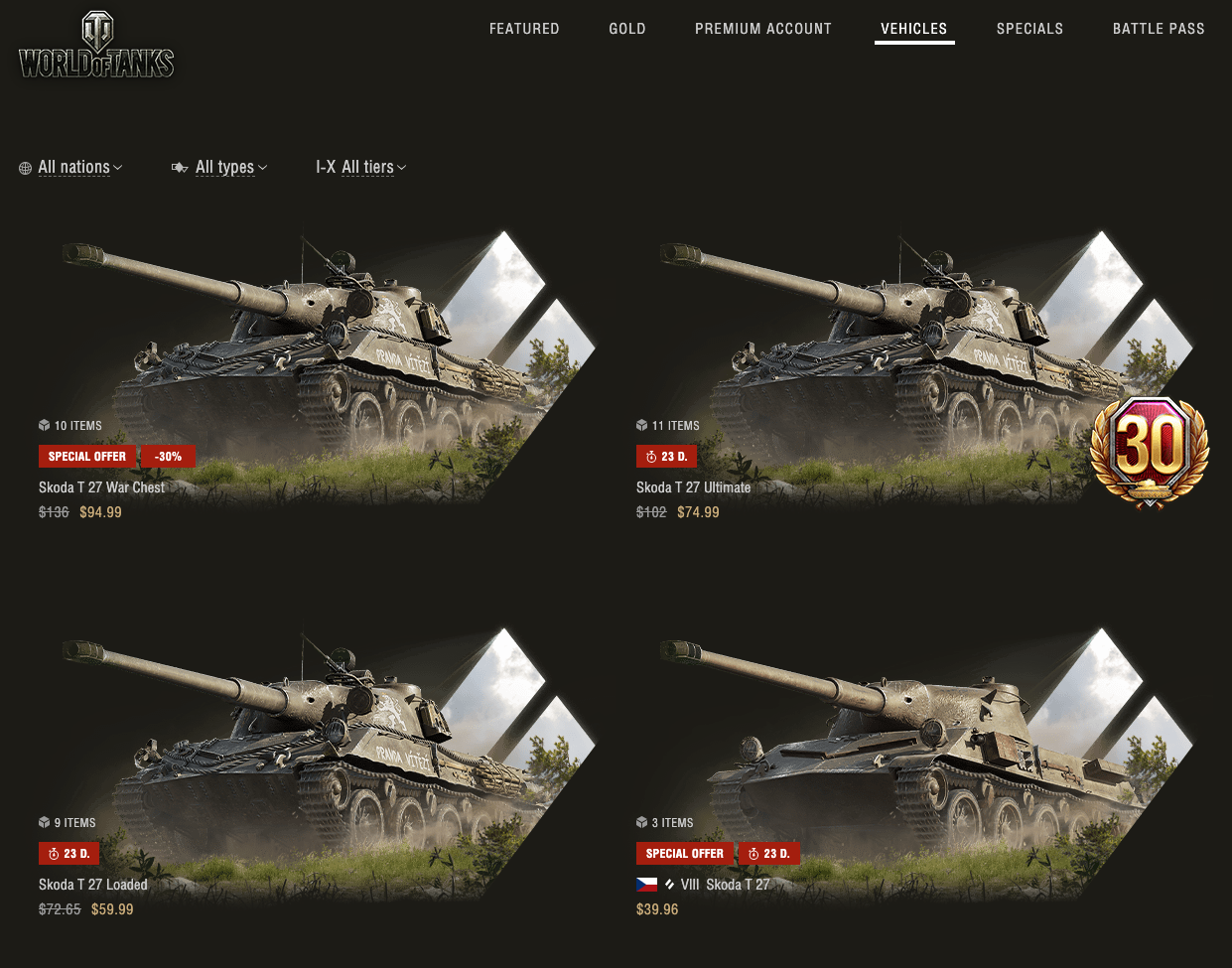

Using data- and AI-driven solutions, Credorax performs 24/7 detailed monitoring and analysis of the entire transaction funnel to minimize declines. Recently, Credorax secured an 83% approval rate for Wargaming, a popular online-gaming company — a rate 6.3% above the industry benchmark.

Empowering the SMEs

According to McKinsey, SMEs have accounted for about three-quarters of all new revenue growth in merchant acquiring over the past three years. So it is not surprising that acquirers are trying to adapt their propositions to this promising segment.

This trend is also seen among OpenWay clients. In Central Asia and the Asia-Pacific region, QR payments projects have gone live, and instant settlement services and support of local e-money are being offered by acquirers and wallet operators on Way4 to facilitate sales for SMEs.

In the Middle East and Africa, Network International, the top payment processor in the region, has announced that SME and e-commerce acquiring will be its primary investment area for 2022. The main focus will be on reducing the acceptance cost for merchants, while maintaining revenue through support for new payment methods and data-driven services. The company uses Way4 to power its acquiring business for more than 65 000 merchants both as a direct acquirer and indirectly via banks as an acquirer processor.

According to Andrew Hocking, Group Chief Strategy Officer of Network International, approximately 86% of all transactions still occur in cash across the Middle East and Africa. Only about 20% of people in the region have a debit card, and only about 3% have a credit card. Acceptance is extremely low. To compare, in the UK there are around 40 POS terminals per thousand capita. But even in the UAE, which is regarded as an advanced market, that ratio is about 23 per thousand capita.

Andrew Hocking: “How do we drive cash away, add to the economy and move in digital forms of payments? We are trying to achieve almost a zero-cost acceptance. We are optimizing the costs in the front office as well in the back office. The cost of setting up the payment infrastructure in these regions is high, and the business doesn’t drive revenue from payments themselves. It’s about creating the underlining capability for merchant to be able to accept payments, adopt payments, and to begin to monetize these initial streams. So we drive data analytics. We set up our own analytics function and start to develop new methods to generate mainline context. We’re also looking at loyalty. On top of that, we help our bank clients to drive revenue by supporting them in setting up pricing on the acquirer and issuing side. We help them through some very basic stuff whilst beginning to enable some more advanced revenue streams over time.”

In Asia-Pacific, SMEs play an essential role in the region’s economy. In Indonesia, SMEs contribute 60% of the country’s GDP, in Thailand 45%, and in Vietnam, 40%. The benefits to small merchants and micro-merchants in the SmartPay network in Vietnam are numerous: street vendors with few resources can not only offer products online and accept payments, they are able to generate additional income in a number of ways. They can sell insurance products with the potential of receiving a commission of 50%, sell scratch cards, travel tickets, and hotel bookings in addition to core service and product offerings, earning bonuses by referring users, and acting as a POS for loan repayment and bill payments. As their monthly turnover grows, they can obtain a working capital loan.

“Real value comes from a platform that’s smarter: smarter in a sense that it understands the buyer-seller dynamics in real-time. Real value comes from adding capital to the exchange. As part of VP Bank, we are leveraging it by offering a credit to the buyer or a working capital to the merchant. Some features that we offer such as SmartCart are unique for Vietnam.”

Hyping with BNPL

Some joke that the COVID-19 pandemic caused a BNPL tsunami. A huge wave of BNPL (Buy Now, Pay Later) solutions swept across all regions: LOTTE, a Korean finance company, introduced the service with OpenWay in Vietnam; Klarna, a BNPL pioneer in Europe, is said to have become valued at $125 billion within 18 months, putting it on a par with HSBC, UK’s biggest bank. According to Klarna, its interest-free instalments increase conversion by 44% and spend per customer by 45%.

BNPL emerged first as a service that allowed e-commerce shoppers to split their payment for lower-ticket purchases into interest-free instalments, usually fully repaid in 2-3 months. Now some providers are offering BNPL options in-store for higher-ticket purchases, and with longer payment plans.

Acquirers can offer the BNPL service as part of their POS and e-commerce acquiring service, charging merchant a fee for all BNPL transactions or including it in a blended fee. For example, Klarna charges merchants 0,30 USD per transaction for transaction processing plus a variable fee as high as 5.99% depending on the instalment option selected by the customer.

Growth areas to watch

-

National payment schemes will continue to develop. Besides being cheaper than payments made through international payment schemes, domestic schemes open up new use cases such as instant B2B payments or request-to-pay that were not available earlier. Integrated with traditional IPS, the new tools will bring more convenience to consumers and businesses.

-

Contactless payments of different types will become more popular and widespead. Smartphones with NFC modules are becoming cheaper. Instant and ready-to-use digital cards are being issued by banks, payments with a glance are being piloted by top retailers.

-

Multi-currency payments. As the travel industry continually recovers after more than a year of lockdowns, DCC services launched on the ATMs located in traditional tourist hubs or supported at the duty-free stores can gain significant revenue from currency conversion fees for both the acquirer and the merchant.

Preparing for post-COVID and beyond

So what does the future hold for merchant acquirers? We can say for sure that merchant acquiring will keep growing globally as the pandemic pushes people into a cashless world, where contactless payments and remote e-commerce checkout are the new norm. It is true that this shift to digital was forced onto many, like those who embarked on their first digital transaction to receive social welfare payments, or those under lockdown who made their first home delivery online. But now, more people are simply finding that cashless methods are more convenient and are happy to withdraw cash less frequently.

The value-added approach we have discussed will help acquirers onboard more revenue-generating merchants and save profits from the growing commoditization of processing. As merchants across verticals start thinking about their post-COVID payment requirements, acquirers who innovate around these requirements have better chances to win and maintain their hold in the market. To compete effectively and protect their profitability, acquirers need a scalable payment platform that can support their goals to expand geographically and vertically. This platform must also allow them to launch new services faster, and increase the efficiency of their back office.

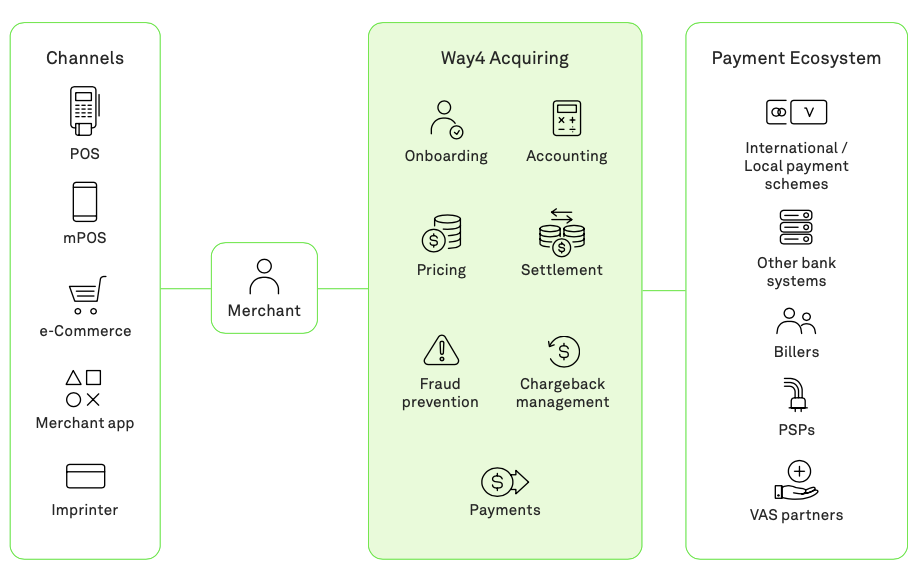

Way4 platform keeps your acquiring business profitable

Are you looking to consolidate or re-platform your acquiring business, or launching one from scratch? Despite the challenges posed by the pandemic, OpenWay clients in different geographies have demonstrated strong and consistent financial performance with improvements in revenue, profits, and market share. Here are some reasons to consider the Way4 platform:

-

All-in-one software platform for omnichannel acquiring with digital merchant onboarding and online pricing management, payment acceptance via any channel, fraud prevention and dispute assistance, instant merchant settlement and reporting.

-

Holds a #1 global ranking in software solutions for payment processing platforms by Aite, also by Gartner and Ovum. It was additionally ranked "Market Leader in Digital Wallets" by Ovum and awarded as "Best Payment Software Solution Provider in the Cloud" by PayTech.

-

Has been chosen by tier-1, mid-size and startup merchant acquirers, payment facilitators, national switches, card issuers, banks, payment processors, telecoms, oil companies. They include Banesco, Credorax (now part of Shift4), Worldline, Equity Bank Kenya, Nexi, Nets, Network International.

-

Allows merchant acquirers to earn more through innovative services: multi-currency pricing for e-commerce acquiring, multi-dimensional dynamic merchant pricing, branded NFC wallets for retailers, transit payments based on QR code, recurring payments, POS instalments, merchant wallets and financing solutions for SMEs — all available via Way4.

-

Brings more value for each merchant segment with examples being retail chains, SMEs, petrol stations, mass transit and parking, HoReCa, airlines, delivery services, e-commerce and digital marketplaces.

-

Helps clients reach compliance through solutions that meet all requirements of all major international payment schemes and are PA-DSS, PSD2 and GDPR compliant.

-

Increases efficiency of back-office operations through digital onboarding, intelligent fraud prevention and chargeback management, merchant portal, and real-time reporting.

-

Go-to-market from 2 months with the Way4 Acquiring Start solution and in-house, cloud or SaaS deployment choice.

A piece of cake or a pig in a poke? Summing things up

What with all the recent challenges and lifestyle changes we have seen, we are sure you agree: it’s an exciting time to work in payments, and merchant acquiring might be the biggest challenge of all. But you can make sure that the profitability of your business is a piece of cake, rather than a pig in a poke — a goal that OpenWay is committed to helping you with. Using Way4 Acquiring, you can grow and scale your business efficiently, and give your merchants what they need when they need it.

Do customers want to pay with an eye scan because their mask is preventing them from using Face ID? No problem! Do they want to send a digital tip to the pizza delivery person? You’ve got this covered.

Even the most experienced players can feel like fintech novices in this ever-changing digital world. Our club of digital payment experts can help you get up to speed, and we welcome new members to share their expertise. If you’d like to join us, contribute to our knowledge base, or find the perfect innovative solution for your payment business, drop us a line! We would love to hear from you.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network Int. and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.

Learn more: analytic reports, news and case studies

-

eMarketer, 2021. Accessed August 26, 2021. Global ecommerce update 2021.

-

McKinsey & Company, 2021. Accessed August 26, 2021. Merchant acquiring: The rise of merchant services.

-

OpenWay, 2020. Accessed August 26, 2021. Merchant acquiring platform: Strategies for challenging times.

-

OpenWay, 2021. Accessed August 26, 2021. Webinar on digital wallets: From financial inclusion to multi-functional ecosystems.

-

OpenWay, 2021. Accessed August 26, 2021. Webinar: How to launch payment innovations in the cloud. Strategies and technologies.

-

OpenWay, 2020. Accessed August 26, 2021. Instalment payments: Finding the right strategy for the next wave of payments.

-

Visa, 2017. Accessed August 26, 2021. Optimizing merchant acquiring profitability.