Enfuce and OpenWay: cloud-based payment innovations

Read the blog based on the joint presentation of Enfuce and OpenWay at MoneyLive Summit to learn about Enfuce’s business-case.

Bridge the Gaps with Smart Partnerships

The gap between what customers expect and what financial institutions are able to provide is growing ever wider. Worldwide, customers are spoiled with choice, used to personalized experiences and relevant content delivered by big tech companies like Google, Amazon and Facebook. So today’s financial services need to be exceptionally agile to be perceived as new and exciting. They also have to be built around compliance with global financial legislation. The payment ecosystem is evolving beyond the ability of many companies to keep up on their own.

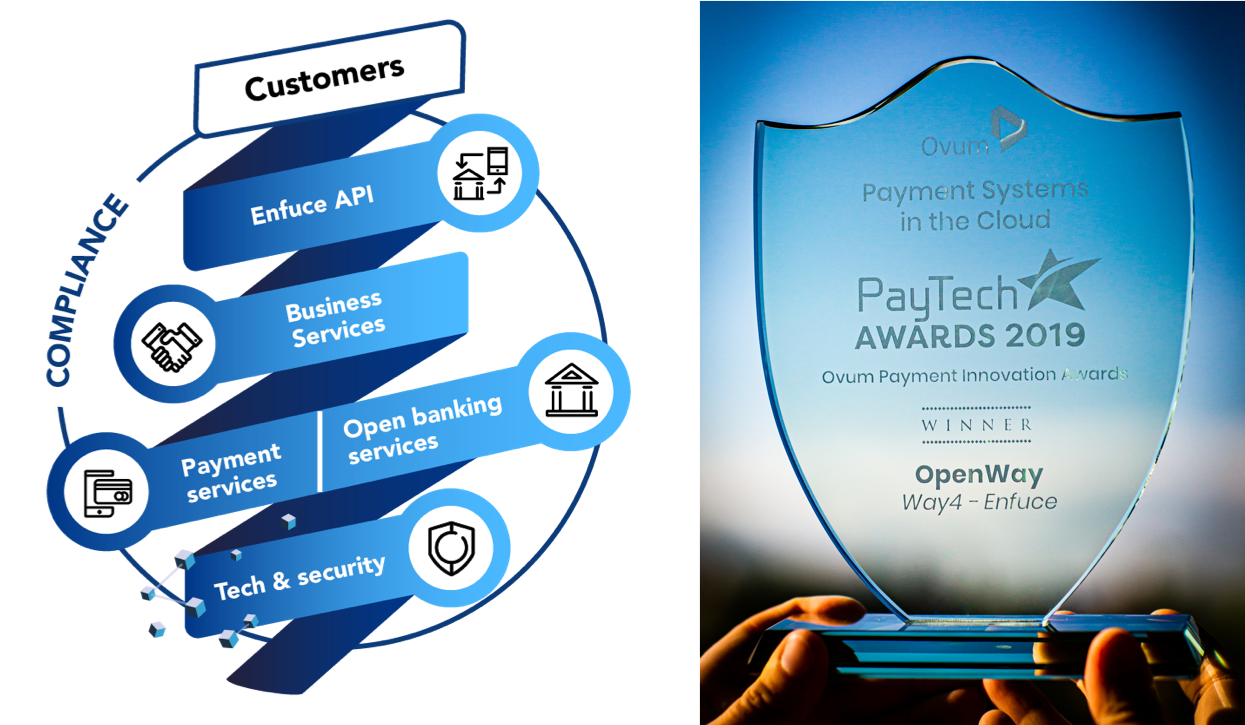

Smart banks and payment processors are bridging the gap by building partnerships with innovative companies who take on the role of flexible collaborators. Take Enfuce, a Finnish scale-up fintech company founded in 2016 who offer payment and open banking services to banks, fintechs, financial operators, and merchants around the world. Their rapid growth from startup to global provider of cloud-based payment services was made possible through partnering with Amazon Web Services (AWS) and OpenWay, a global vendor of digital payment solutions. By running OpenWay’s Way4 payments software platform in the cloud, they provide their clients with a broad range of integrated card schemes and practically every card product available on the market, whether they are pre-paid, debit, credit, or instalments.

Harness the Advantages that Come with the Cloud

For those considering a cloud-based business model, a clear advantage is fast time-to-market and onboarding. These are now at speeds that were considered unachievable until recently. With the Way4 platform, fintech start-ups can get results in days instead of the usual years. Enfuce boasts results that might be called “3-3-3”. In 3 minutes, they enabled a bank to offer a full digital onboarding process to its customers so they can make high-value payments. In just 3 hours, five million cards were migrated from a legacy platform to Enfuce’s, and in just 3 months, Apple Pay was implemented at a large issuer for the first time in its native country of Finland. Other impressive statistics? Enfuce can connect clients to a fully scalable, innovative card issuing service within a week and ensure 99,99% service availability.

Compliance is a key value for both Enfuce and OpenWay. Enfuce solutions ensure compliance with the latest global regulatory standards: PCI DSS, FSA, GDPR, and PSD2. Another requirement of being in a public cloud is high-level security. Public cloud services such as AWS are known for the immense funds they spend to secure their global infrastructure. Cloud-based technology enables Enfuce to provide highly secure services: payment services and open banking through standardized and integrated APIs.

For a while, Hardware Security Modules (HSMs) was the missing piece that could not be run in the cloud, forcing banks and processors to run this essential security component on their premises. OpenWay has closed this gap by partnering with MYHSM, a global provider of Payment HSM as a Service. Now companies using Way4 can run their entire infrastructure in the cloud, including their payment security component.

Save Costs, Even with Legacy Infrastructure

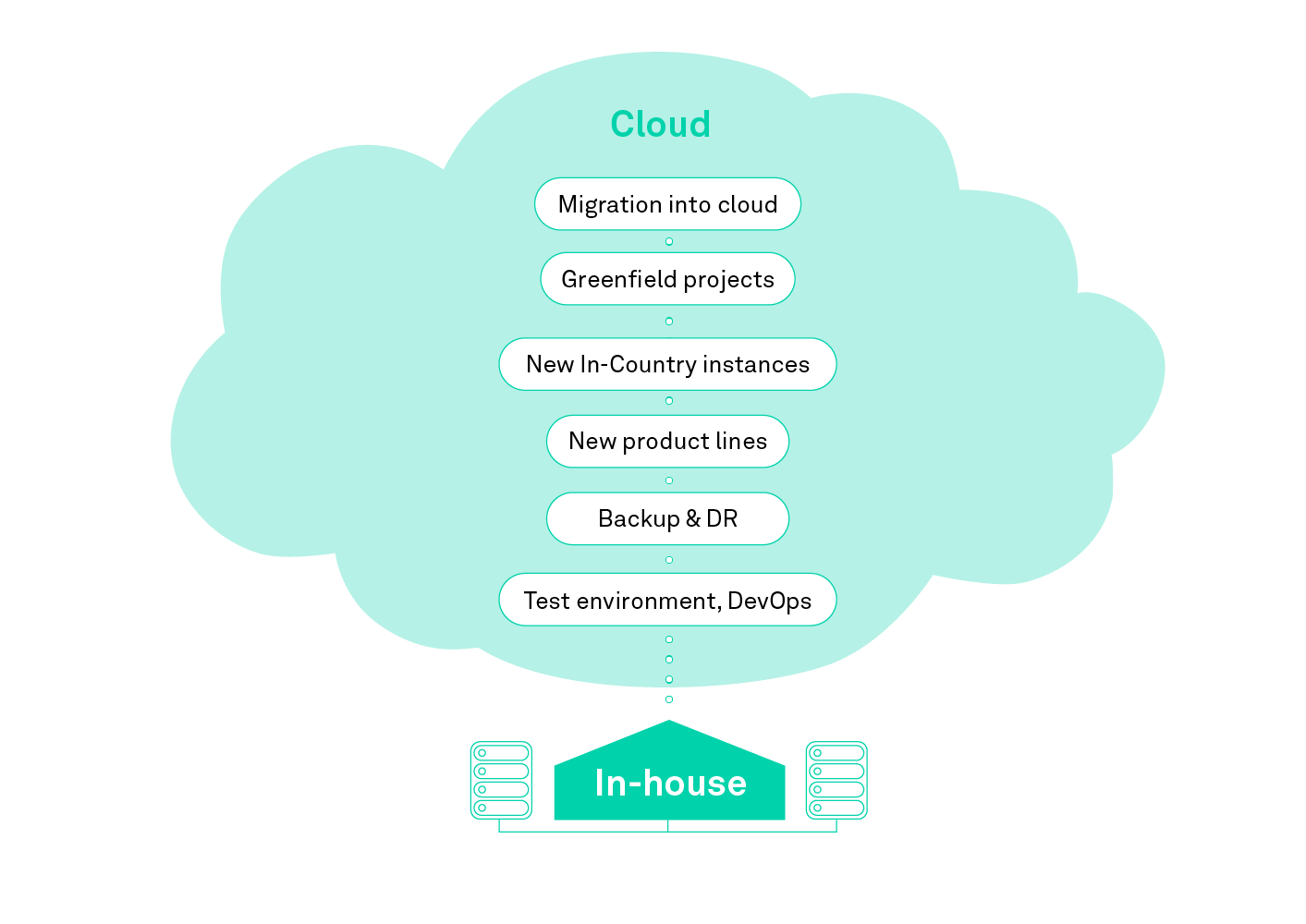

Cloud-native companies like Enfuce are thriving by leveraging the advantages of cloud services. But is a cloud-based solution a realistic option for companies who have a legacy infrastructure in place? According to Gartner, for those moving an existing infrastructure to the cloud, costs increase potentially up to three times before they start making savings at year 2 or year 3.

One way of resolving this is to make sure the cloud pays for itself by generating more revenue. The new products and services implemented in the cloud will create more value and bring more clients, which means scaling up. The goal is to set up a cloud environment that is meeting its own costs. Once that is achieved, companies can start on migration and remove or reduce other costs on the market.

The second strategy is to make the most of the cloud’s scalability. The ability to take capacity on demand, to scale up the amount of processing you need, and to scale it down when you don’t – these are cost-cutting advantages over a data center with idling hardware. To illustrate, Enfuce operates test and stage environments according to business need. They can be shut down for the night and activated again in the morning. By optimizing the use of test and stage environments, they achieve cost savings of 10-30 percent.

Choose the Right Cloud for Your Business

A cloud should be chosen based on the key goal of the organization and what motivates it to move to the cloud. Cloud offerings are now diverse enough that there is a right cloud for almost any kind of business scenario. Large organizations with big enterprise infrastructure might choose a cloud offering from Oracle, particularly if they are using Oracle products already for their enterprise needs. Startups, neobanks and other smaller companies may need more immediate, active cloud services such as AWS, MS Azure, Oracle Cloud and others whose basic services are easy to set up. Another example involves a customer bank who has high transaction peaks in the middle of the month. Enfuce scales up and down processing amounts right along with the changing volumes, so after the peak volume passes, the bank is not charged for any unused capacity.

Finally, a good opportunity for reducing operational and business travel expenses from the start is remote cloud platform launch. OpenWay’s customers can choose to do a 100% remote platform launch and remote migration of existing card, merchant and product portfolios – an option particularly relevant for our times.

How Way4 Enables Digital Payments in the Cloud

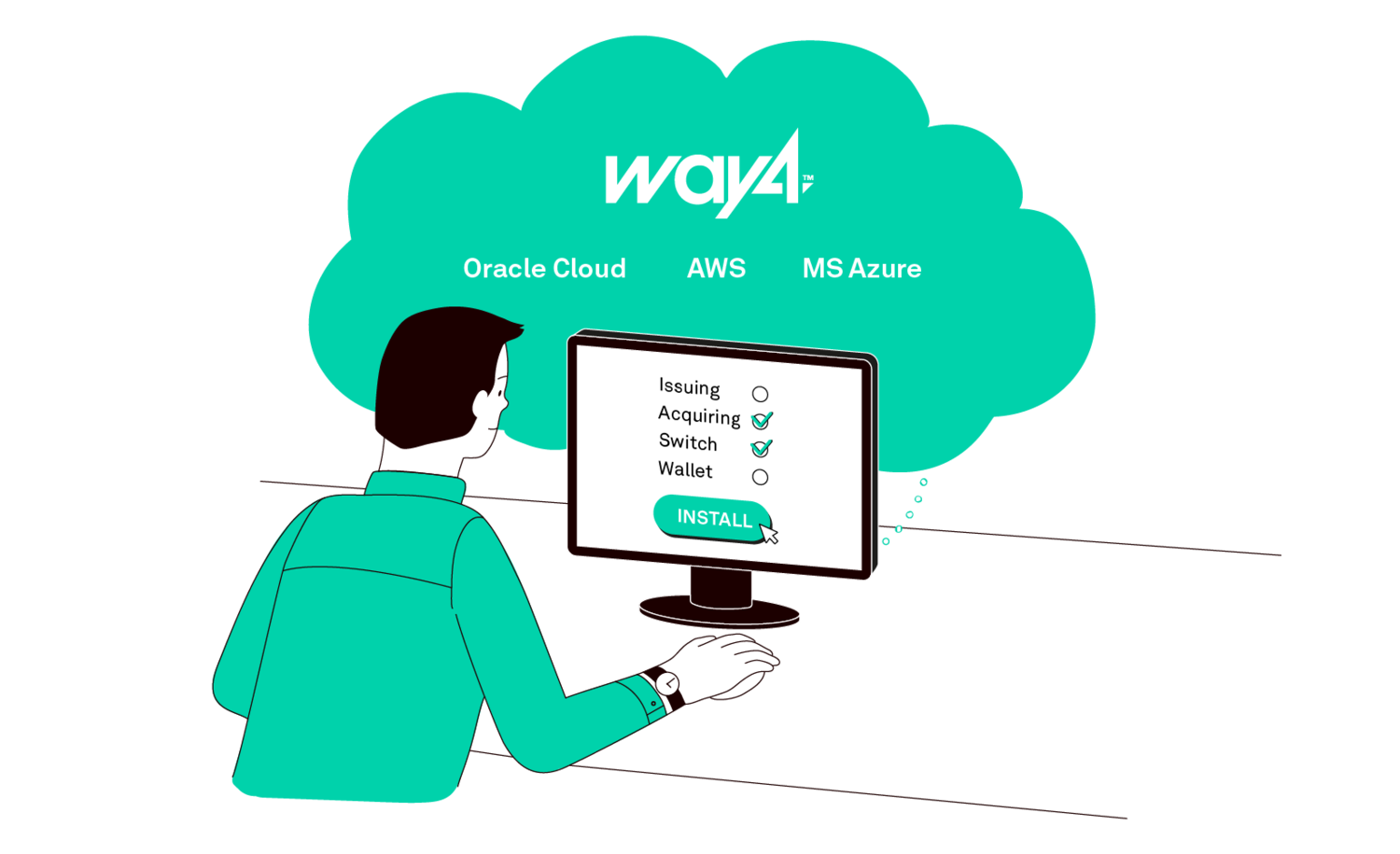

OpenWay’s award-winning collaboration with Enfuce is a fully scalable, cloud-based, secure environment for full processing services that covers all issuing. But also available on the Way4 platform in the cloud are acquiring, switch, and a wide range of other payment services and solutions.

As a partner to both fintech startups and established giants in the payments industry, OpenWay’s approach can be said to be ”Do it yourself or collaborate”. There are three business models for working with Way4 in the cloud, whether private or public. Companies can run Way4 on their own. Or they can use Way4 with managed services, where OpenWay provides support that handles the deployment, testing and operations. The third option is to choose a third-party cloud processor who uses the Way4 cloud platform, such as Enfuce.

It is clear now that the cloud is ready and proven for payments. A lot of the historical issues are going away, and with companies now even offering hardware security module (HSM) services in the cloud, prospects are brighter than ever before. With the right partners, financial institutions can become technologically up-to-date, align themselves with mandatory legal and operational requirements, and safeguard their biggest asset, their data.

What’s Next?

Is your company working to secure its future in the digital payments ecosystem? Read more about the Way4 digital payments platform and Enfuce cloud-based services through newly released business cases, best practices, and more.

Courtesy

This case-study was prepared by OpenWay in collaboration with Enfuce.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network Int. and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.