Digital wallets: choose the right strategy for your business

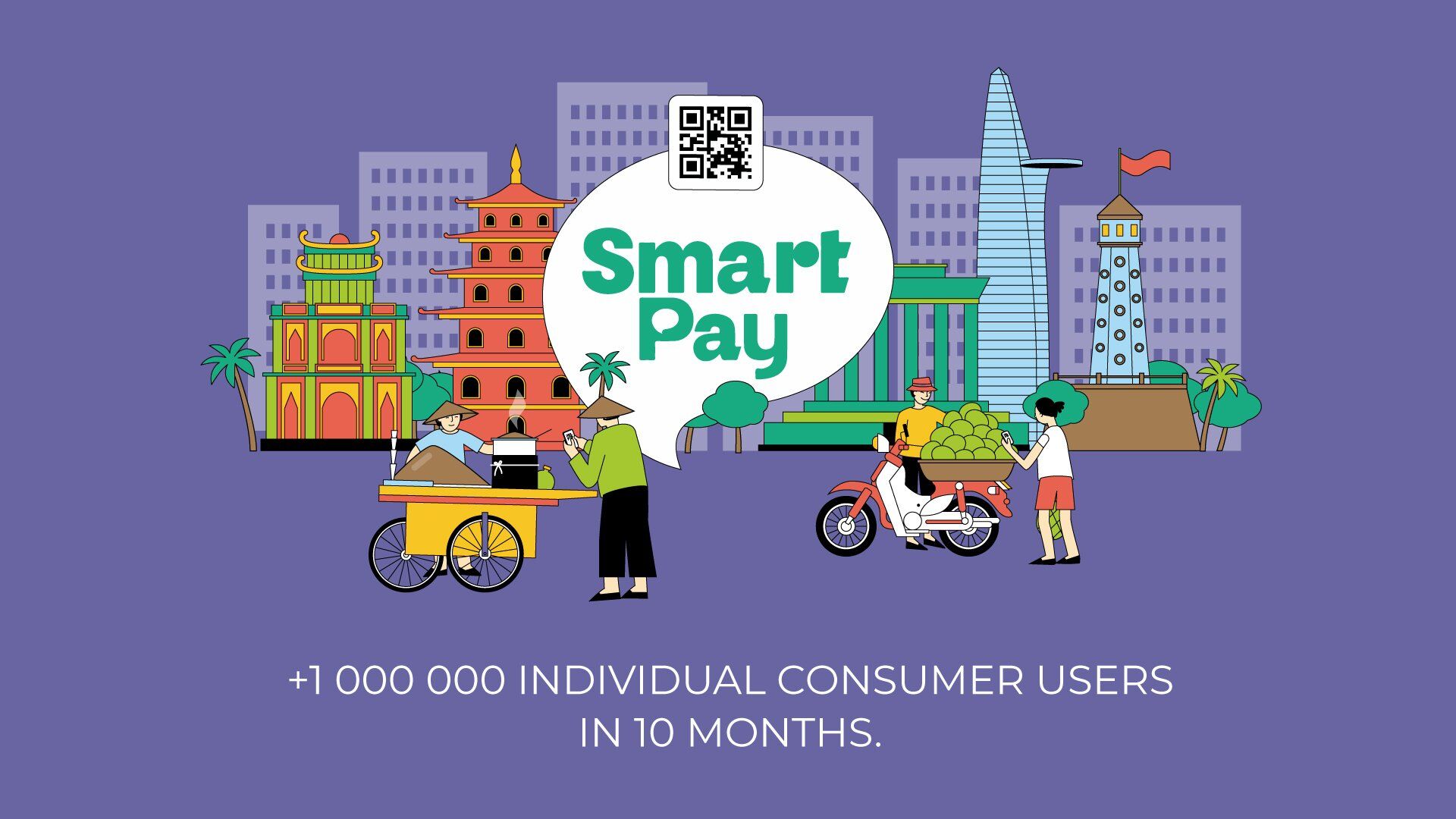

Digital wallets have exploded in popularity during the COVID-19 pandemic. Maybe you’ve been following the success of Venmo, which in two years has grown from 10 million to 40 million users and tripled annual payment volume. In financial year 2021, there were over 25 billion UPI transactions across India, including P2P wallet transfers and P2M QR-code payments. Even financial inclusion wallets like SmartPay have reached close to super-app status, in a mere few years connecting 2,5 million unbanked and underbanked users.

Perhaps you’re thinking of an exciting service or product for your fintech startup. Or you’re an established institution who sees an opportunity to deliver additional value-added services to your loyal customer base and attract new clients, perhaps expanding across a larger demographic. We at OpenWay, a top-ranked vendor of the Way4 digital wallet platform, have profiled the most successful digital wallets in different regions around the world and added insights based our own experiences. Read on to learn: what does the market landscape for digital wallets look like? Who are the key players and how did they emerge from their respective niches to become success stories? What starting points and strategies might you choose to develop your digital wallet business?

Table of contents

The digital wallet market in 2021-2022

What is a digital wallet in 2021-2022?

Digital wallets are software-based applications that provide a unified and secure access to stored payment details and passwords, often for different mobile-based payment methods. They can be defined as disruptors of traditional banking, encroaching on banking territory by offering loans, debit and credit cards, and investments. But it would be a mistake to consider them just a glorified online bank app, since they do not have to be tied to any bank account, or even a card rail, for that matter. Besides delivering payment functionalities, wallets store loyalty card information, digital coupons, tickets and boarding passes. They might enable a variety of payment scenarios, including P2P (Peer to Peer), C2B (Customer to Business), M2C (Merchant to Customer), and any combination of these transactions.

Digital wallets also play an important role as an entry point to a variety of financial services for unbanked and underbanked populations. Whereas they may find banking services to be inaccessible or inconvenient, the simple online onboarding with KYC check offered by digital wallets is attractive and manageable. As the unbanked population becomes familiar with digital wallets and use them regularly as consumers or merchants, they become more financially resilient. For example, SMEs may use them to reach more potential customers, generate additional income through services offered through the app, and receive contactless payments without investing in POS terminals.

The McKinsey Global Payments Report 2021 shows huge surges in their use, especially in Asia and Australia. EMEA and both Americas report similar trends. In the US, some 150 million people reported using digital wallets this year instead of cash or cards. According to Juniper Research, digital wallet spend will grow globally from $5,5 trillion to over $10 trillion in 2025.

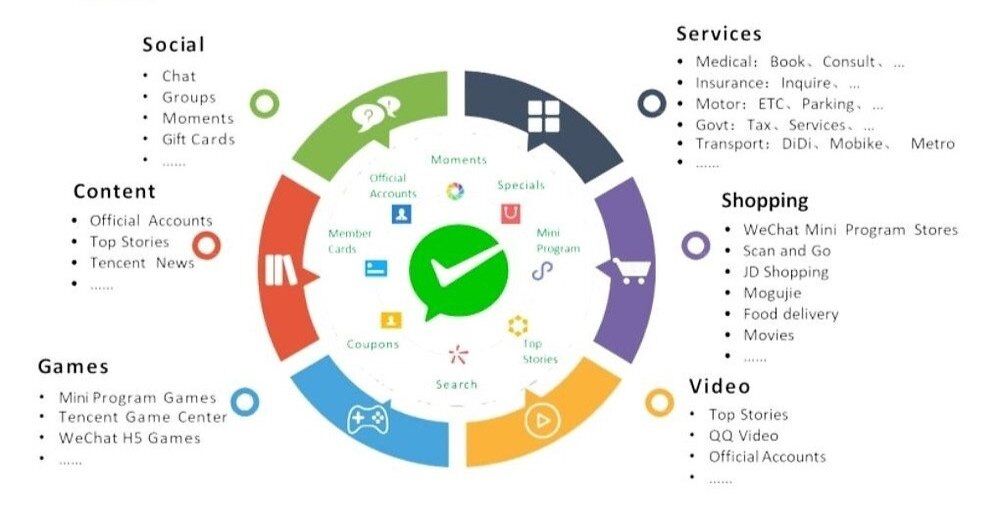

Destination: super app

The shining goal for many digital wallets is to morph into a universal lifestyle super app like WeChat or AliPay in China. These are all-encompassing and self-contained online platforms for a variety of goods and services, communication and marketplace activities, gaming, cryptocurrency storage and spending, and even health, government, and public services. To retain people in their ecosystem and stay relevant for different user profiles in a vast audience, super apps are heavily reliant on the huge amounts of customer data they collect. So naturally, digital wallets are so much more than a front-end solution. The blueprint for a super app has to contain a powerful back end with a dedicated database to store account data and support online transactions, and APIs to connect to external services. Also, as with all ventures based on customer data, regulation can play a make-or-break role. This means the success of Asia’s super apps might not be replicated in the same way in other regions.

One notable success story outside of Asia is South Africa’s VodaPay Super App, which was designed in collaboration with AliPay by Mondia Digital and its digital payments company Mondia Pay. Besides its typical digital wallet features, it also integrates other Mondia Digital custom content platforms with the app, such as a free mobile health portal for maternal, neonatal and child needs, and allows third-party developers and businesses to easily join the super app through downloadable sub-applications.

Where did successful digital wallets in the market come from?

Digital wallets have been evolving from these typical markets:

E-commerce: the most obvious development path for the largest digital wallets like AliPay, PayPal and Rakuten, these were first developed to make online checkout easier by storing consumer payment card details and allowing them to be used quickly and securely. From there, they evolved into payment aggregators providing access multiple cards, bonus points, QR, contactless, and other payment functions. They are highly convenient and secure, and can also fill the gap when traditional payments are absent, a role also played by P2P payment wallets. Some well-known e-commerce wallets have rapidly achieved super app status. Alipay, the world’s largest mobile payment platform, is now widely used in-store as well as online.

P2P payments: these mobile money solutions were developed by mobile network operators to overcome the challenges of transferring money without a bank account. Their influence in regions like Africa with high mobile phone penetration is considerable. According to Stripe, in 2019, 49% of Kenya’s GDP was processed through M-Pesa. 93% of Kenyans have access to mobile payments. Other services are being added to these wallets, such as e-commerce.

POS payments: developed first with in-store contactless payments in mind such as NFC and QR payments, these have evolved to include other features such as online retail and loyalty programs. Examples are the "Big Pays", such as Apple Pay, Google Pay, and Samsung Pay. Interestingly, although many banks have used Big Pays as intermediaries for tokenization services, others have decided against dependency on a third-party provider with its fees and have chosen to roll out their own HCE wallet solutions. OpenWay has helped several banks to launch Android-based wallet solutions, among which are Eurasian Pay from Eurasian Bank, i-Bank Pay from National Bank of Greece, and OshadPay from Oshadbank.

Social media and messenger platforms: also called social commerce, these wallets evolved from simple P2P features on popular messaging and social media platforms to become their own e-commerce and lifestyle apps. Advantages are high user bases right from the beginning — WeChat has 1,1 billion monthly active users, for example — and no merchant checkout process. WeChat Pay and Line Pay are influential players in China. Facebook, in addition to its existing Facebook Pay, has just launched Novi, a digital wallet that allows users in Guatemala and US to send money via Paxo stablecoin.

Cryptocurrency: crypto wallets have always offered a secure way to buy, store, and trade cryptocurrencies, but recently the focus for some have been on payment services and attracting high-profile partners. BitPay, for example, allows 12 cryptocurrencies to be turned into dollars and loaded into its BitPay Prepaid Mastercard. The BitPay Card can be loaded to Google Wallet and can be used for spending anywhere. Interestingly, BitPay has recently partnered with Verifone to allow online and in-store purchases to be made in 11 BitPay-supported cryptocurrencies directly via the BitPay Wallet app without converting to fiat currency.

Will merchants accept your wallet?

Whether your digital wallet’s chosen niche is located in a saturated market or one with poor digital infrastructure, its success will depend on how willing merchants are to accept it. It is worth asking yourself how well your organization’s strategy addresses the incentives and barriers to digital wallet acceptance. Let’s look at the list:

Reasons merchants want to accept digital wallets:

-

Consumer demand is high. Not just in Asia anymore, but across all global regions, the pandemic has accelerated demand for digital payments. Obviously, merchants want to be in touch with their consumer’s preferences, especially those of Gen Z and millennials.

-

Reduced transaction fees. Wallets are typically closed-loop ecosystems and the costs of H2H transactions are lower for providers compared with transaction fees charged by international payment schemes. This, in turn, can substantially lower fees for merchants.

-

Easier to deliver a good consumer experience. Reduced friction for shoppers will encourage spending.

-

Access to untapped markets via value-added services. A digital marketplace offering personalized customer views will make sure that merchants can give new products and services visibility to those who will buy them. Value-added services on a digital platform can drive m-commerce through cross- and up-selling, such as promotions for merchants and loyalty programs, as Alipay is well known for.

-

Reduction of costs. When wallets are laid over real-time infrastructure, costs are reduced for the merchant and transactions are processed faster.

-

Security. Cash handling is associated with risks such as theft and fraudulent currency.

Why merchants hesitate to accept digital wallets:

-

API requirements, API differences. According to Juniper Research, integration costs for multiple wallets are significant and difficult for merchants. Choosing the right platform and API for easy integration of third parties is critical if a wallet is going to attract merchants to its digital ecosystem.

-

Competition between wallets in a fragmented space. The wallet market is fragmented geographically and technologically, and is crowded with many options. Merchants must decide which wallets they will support and which they will not.

-

Integrating contactless and remote payment functionalities. Juniper Research forecasts that contactless and e-commerce payments will account for 50% of total wallet spend. Many merchants can’t take on any complex hardware integration. In this scenario, QR code payments and support for offline merchants will play a big role. For example, a key point for UnionPay’s digital wallet adoption was the ability to work offline. Card terminals, on the other hand, saw slow adoption because they required a phone line to work.

-

Poor, slow internet connection and unstable infrastructure. Without good public infrastructure, a digital wallet solution needs to be stable and run on low internet bandwidths. OpenWay’s Way4 Wallet has tackled this problem with a stable system, real-time transactions and high availability systems that takes over if a primary system goes down. The solution uses the scaling capacity of the cloud in response to increases in load.

Identify your wallet niche and launch strategy

So what kind of niche will your wallet start from, and what strategy will you combine it with? Here are some successful approaches from OpenWay clients and other players in the digital wallet space.

1. Start with a compelling service for merchants and grow the ecosystem by adding new roles slowly

With this strategy, you show merchants that you are firmly on their side and build up a loyal base. Wallets with well-defined, personalized interfaces for different merchant roles can be invaluable for streamlining workflows within an organization. For example, OpenWay’s Way4 Wallet provides several wallet interfaces. A cashier interface provides basic functions around payment acceptance, refunds and transaction history. Managers get a merchant portal for access to settings, KYC level management, analytics, and other convenient features. So much more than a POS solution, it gives merchants control over and insights into their payment flow.

2. Provide an open-banking/PSD2 partnership service

The business strategy of the likes of Plaid and Tink, you provide the technology that serves as the connecting point for a number of partners such as banks, third parties and technology providers, wooing them via superb APIs and rich, categorized data offerings.

3. Target the unbanked and underserved segment

Financial inclusion wallets are emerging in many regions since the COVID-19 pandemic has made mobile money solutions a more attractive proposition for merchants. OpenWay client Miza in Libya offers POS-based services and also an e-wallet account that allows customers to make transfers through their smartphone from a prepaid balance, taken either from a bank account or a direct cash deposit via a Miza agent or office. The wallet has other features bundled with it such as email and messaging portals. SmartPay, another OpenWay client, created an entirely new digital payments ecosystem for micromerchants and the unbanked from scratch. Both consumers and merchant users can open accounts quickly, pay and accept payments by QR code, and access microcredit based on their credit history through the same mobile app. Now the SmartPay’s clients headcount reaches 2,5 million individual users and 500 thousand clients.

How does Way4 Wallet support wallet operators as they grow? Wallet operators on Way4 can use it to manage accounts and reporting even without installing a core banking option. It also can support card issuing, should a wallet operator decide to add card-based financial products.

4. Launch the wallet as a complement to a traditional bank card offering

Although this is not purely a wallet strategy, banks can tokenize their issued cards and partner with a Big Pay provider to achieve wallet functionalities in their banking app, or they can launch a wallet under their own brand. OpenWay has seen through over 30 tokenization projects for a variety of clients, including Mastercard Payment Transaction Services, Victoriabank, and Azericard.

5. Create your own digital brand or neobank

Some have gone the way of Goldman Sachs and launched their own digital bank offering, competing with neobanks in the same space while capitalizing on their existing customer relationships. Others have launched a neobank from scratch. Way4 supports such clients, not just with wallet functionality, but with a powerful card and account management back office with flexible multi-currency and account hierarchy management features.

6. Launch the wallet as a connecting player on top of a national payment switch

By connecting everyone, the national payment switch already handles all domestic transactions. A wallet completes this already interconnected ecosystem, adding value to customers, addressing the needs of the unbanked and saving merchants the cost of fees and other costs of dependency on international payment schemes.

For example, Reserve Bank of India manages UPI a countrywide payment system that is connected to 3rd party payment players like Paytm, PhonePe and Mobikwik who have their own wallets as well as to its own on-device wallet . Whereas 3rd party wallets use account-to-account rails and QR technology, RBI’s project uses USSD technology as is targeted mainly for feature phones . The difference in technologies and rails for similar wallet projects in the same market and using the same national payment switch is extremely interesting, and time will tell which wallet will prevail.

7. Launch your wallet as a compliment to an e-commerce, social media or cryptocurrency business

You may already have a loyal following that could be easily onboarded to your wallet solution, why not use a wallet to boost existing business and monetize the existing loyal customer base? And by providing an easy interface for using cryptocurrency to fund transactions, a cryptocurrency wallet can provide value-added services that go well beyond secure storage.

8. Add a wallet feature to an existing digital offering

Perhaps the easiest way of getting your feet wet, you can add a solid wallet feature like Buy Now, Pay Later to your existing offering, taking advantage of your established customer base and giving them what they want. Based on its success and leveraging data from this step, you can organically add more features to your product later.

Choosing the right partner

Way4 Wallet by OpenWay covers the whole wallet solution end-to-end — from support for account issuing and merchant acquiring at the back-office level, to the customer-facing mobile app with your custom user interface connected via API integration. Whether you are a bank or a neobank ready to launch your digital platform, a fintech processor or PSP, you can develop your own trajectory of development and capture a foothold in the wallet market.

With Way4 Wallet’s flexibility and modularity, your strategy can evolve as gradually or rapidly as you want. Start out small while gaining familiarity with local settlement and regulations, and monitor local markets to make sure the right payment methods are being supported and accepted. Operators can keep their user experience foremost while developing personalized services and attracting third parties. Become the center of a new ecosystem of products, services, activities, and retain your customers through value-added services!

How does Way4 Wallet address the challenges of digital payment acceptance?

Security. The Way4 wallet platform gives access to certified technologies for customer authentication (biometrics, facial, OTP, SCA), PA-DSS compliance, GDPR compliance, and 3-D Secure 2.1. It can be made compatible wth the KYC standards of any country, and introduces several KYC levels through back-office checks and integration with third-party government services. While non-KYC users get access to basic wallet features and lower limits, KYC users enjoy extended functionality and less limitations. The wallet provider can set up the KYC procedure and different identification levels. Customers may upgrade their KYC level by scanning ID, linking the bank card or visiting the wallet provider’s office in-person. The online KYC option lets their customers skip a visit to the branch, thus cutting their operational costs.

Smooth digital onboarding. Getting the onboarding right is crucial, especially in a competitive market, because consumers expect digital interactions to be flawless from the very start. Also, if your wallet has a smoother, easier onboarding process, consumers will see that switching providers is not difficult. They will find it easier to shop around to find the best option for their payment needs. Here, merchants can differentiate themselves from the pack by offering a superb experience.

Personalized experience. Way4 Wallet supports various roles and functionalities through multiple customizable interfaces, both with basic features and for connection to a variety of value-added services.

API management and support. We offer both our own front-end solutions and REST API for third-party applications. A great API adds great value to your business by increasing your time-to-market. You may also choose to monetize it by providing it as paid services to different partners, onboarding new customers faster and bring in more and more partners into your ecosystem. Way4’s API is always compliant with the latest standards in the payment and financial industry.

Analytic tools. Handle correctly the all-critical resource that fuels digital wallets — customer data. These will give insights into how a customized user experience affects spending. Way4 Wallet shows transaction history and analytics directly in the app.

Cloud-agnostic solution. Way4 Wallet is one of the only wallet solutions on the market that can work on any cloud, making it a seamless addition to your overall cloud strategy.

Flexibility, scalability. Designing and releasing your wallet is easier than ever before. Way4 Wallet is an end-to-end modular solution that lets you start from an MVP (standard interface design and set of features), adding gradually to functionality and customizing the user interface as you go. Thanks to this, time-to-market is quick: it takes only 2-4 months to launch the basic wallet solution.

Reliability. With Way4 Wallet’s high availability system, plus its scalability in response to fluctuating loads, your service will be running even during peak transaction times like Black Friday.