Innovative card issuers in Asia and Europe: can your platform outrun theirs?

Table of contents

Digital cards, loans and payments: racing like Olympic athletes

The payments industry is developing rapidly, with its players running with the speed of Olympic sprinters. Promising young newcomers – e-money and digital cards issuers, neobanks, and mobile wallet providers – are increasingly breathing down the necks of experienced athletes, or incumbent banks. What can payments players do to start strong when launching a payment offering, and to consistently show good results in various races?

Like an athlete, a payments player needs a multi-skilled team that can help choose the right strategies and technologies for success. These choices matter long before the start of the competition and long after the first few wins. We at OpenWay have been assisting both incumbent payment leaders and fintech startups to launch payment offerings on Way4, our digital payments software platform, in a matter of weeks, and with a higher product adoption over competitors. We are willing to share some best practices based on our success with payment brands like award-winning digital bank Timo, financial inclusion disruptor SmartPay, CaaS leader Enfuce, cross-border consumer finance giant LOTTE, provider of QR-based touchless credit disbursement solutions Mirae Asset, National Bank of Greece, and others.

The value of running in your own shoes

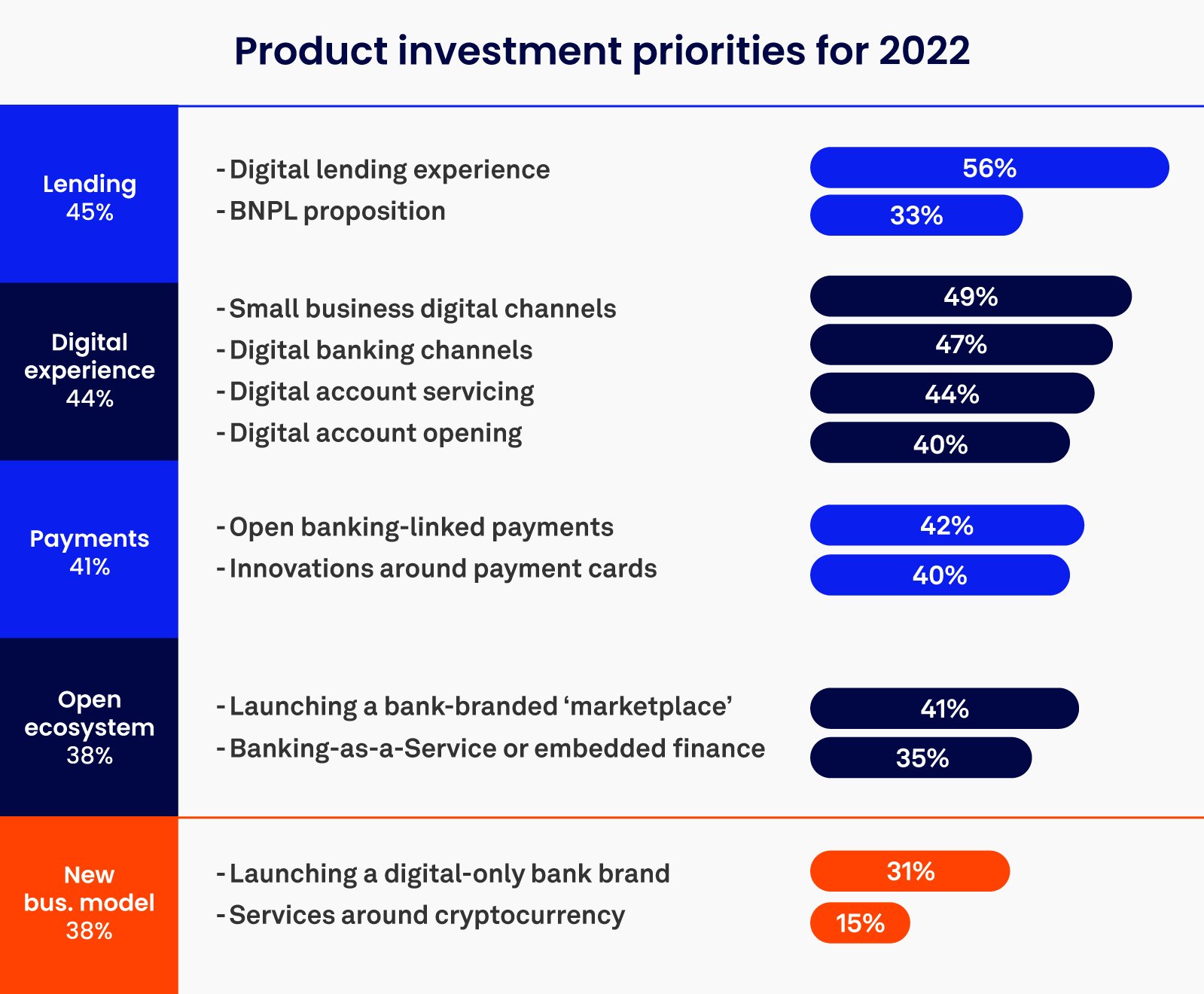

Payment card innovations, digital account opening and servicing, and BNPL are among the top product investment priorities in retail banking, according to Celent's research in 2022. With many similar products entering the market, how should you differentiate yourself from the competition?

Celent’s answer is that “financial institutions must deliver exceptional experiences to their customers, in real-time, and remotely”. It concerns the entire customer experience flow — from onboarding and transaction processing to accounting, personalized offers, and data exchange via APIs.

In terms of technology, this experience requires a 24/7 fully online payment software platform. With a unified front and back office, data processing will encounter no delays. The processing system can analyze all data — both its own and those from integrated systems — and immediately apply all processing rules, so each transaction can be completed according to the optimal scenario. Users can see their data updated instantly, including account balances, transactions, available offers, and service terms.

Our Way4 platform is the only one in the market with online back and front office, real-time front-to-back reconciliation, and online accounting. This gives our clients significant competitive advantages in the customer experience. This experience concerns both retailers and consumers. For both, it is important that access to the account balance data, loan origination, and purchase completion take only a few seconds – which Way4 makes possible.

The truly online payment experience was a priority for LOTTE Finance, one of the leading credit card companies in South Korea, when they were rolling out their BNPL products in 2021 to enter a new market. Now they are using Way4 for the entire BNPL solution logic, including instalment management, end-to-end transaction processing, interest calculation, and real-time integration with third-party systems for digital identity, scoring, and contract processing.

“It was important for us to find a technological solution that would allow us to implement LOTTE Finance’s best practices in developing lifestyle financial services while taking into account the requirements of large online retailers in Vietnam for a seamless checkout experience. The Way4 platform satisfied all our requirements for solution design and our available use cases,” commented Mr. Kim Jong Geuk, CEO of LOTTE Finance on the service launch.

The fully online architecture also gives a competitive advantage by saving time and cost. The digital lender or bank doesn’t need a separate system to store up-to-date balances or historic data, or initiate frequent front-to-back reconciliations. The data management efficiency was one of the major drivers for Tsesnabank (later rebranded to Jusan Bank) in Central Asia to migrate from BPC’s SmartVista platform to Way4.

“When selecting the new system, we were particularly attracted by the fact that the Way4 architecture unifies the front- and back-office,” shared Balzhan Baisheva, Managing Director of Tsesnabank. “Thanks to Way4, we got rid of a lot of unnecessary duplication, checks and business processes, and freed staff up from routine procedures. Now we have more time and capacity to develop the payment business. Regarding data analytics and business information (BI), the new platform allows us to store, systematize and retrieve customer and transaction data more easily. We can analyze historic patterns and forecast trends in a way that is critical for day-to-day product management, new product development and innovation.”

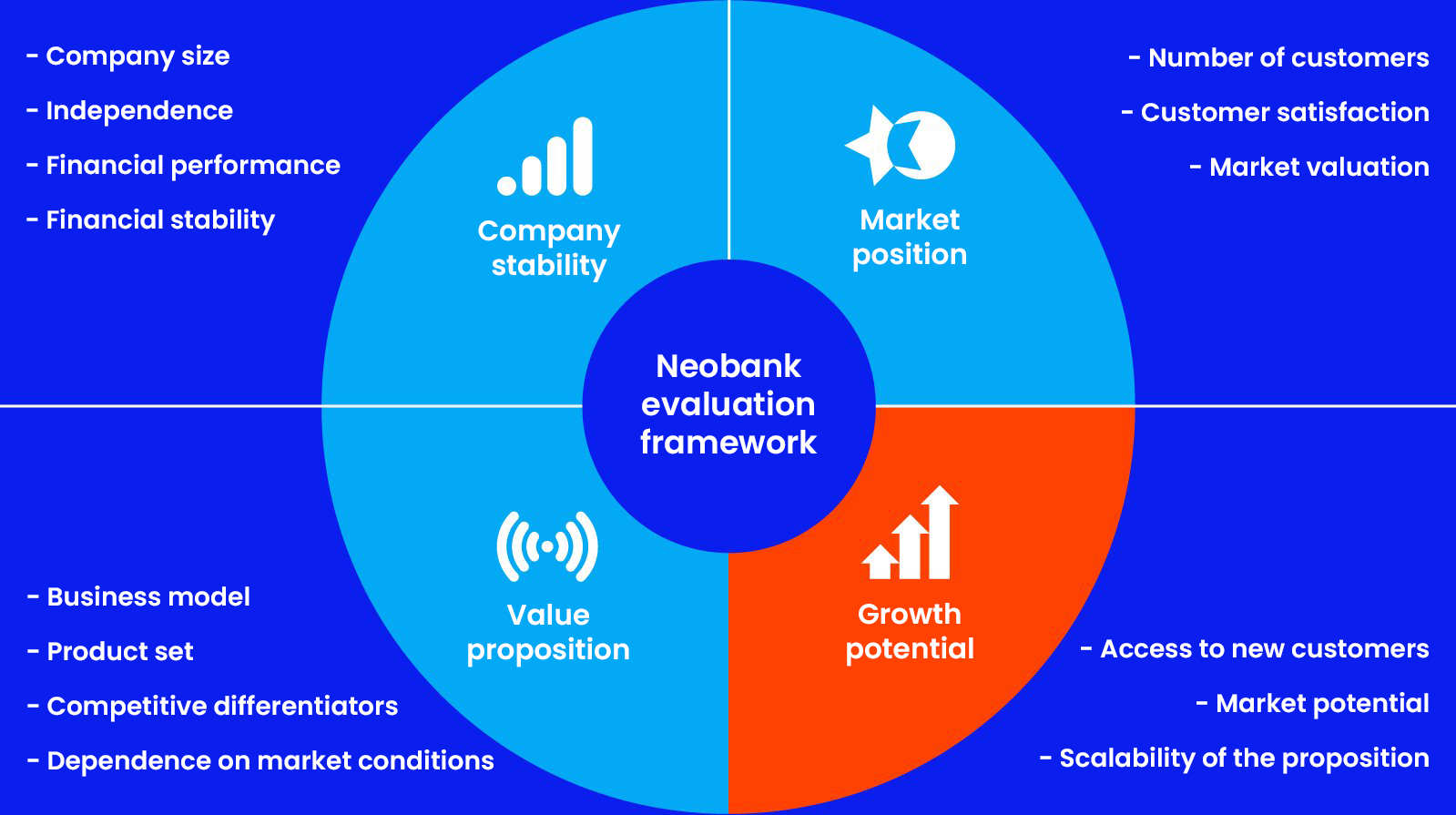

When a payment offering’s market entry is a widely adopted success, end users and data volumes increase. At this point the system must be able to withstand the increased transactional load without compromising the user experience. Scalability of proposition is an important criterion for evaluating a neobank or fintech and its growth prospects, as confirmed by Aite analysts.

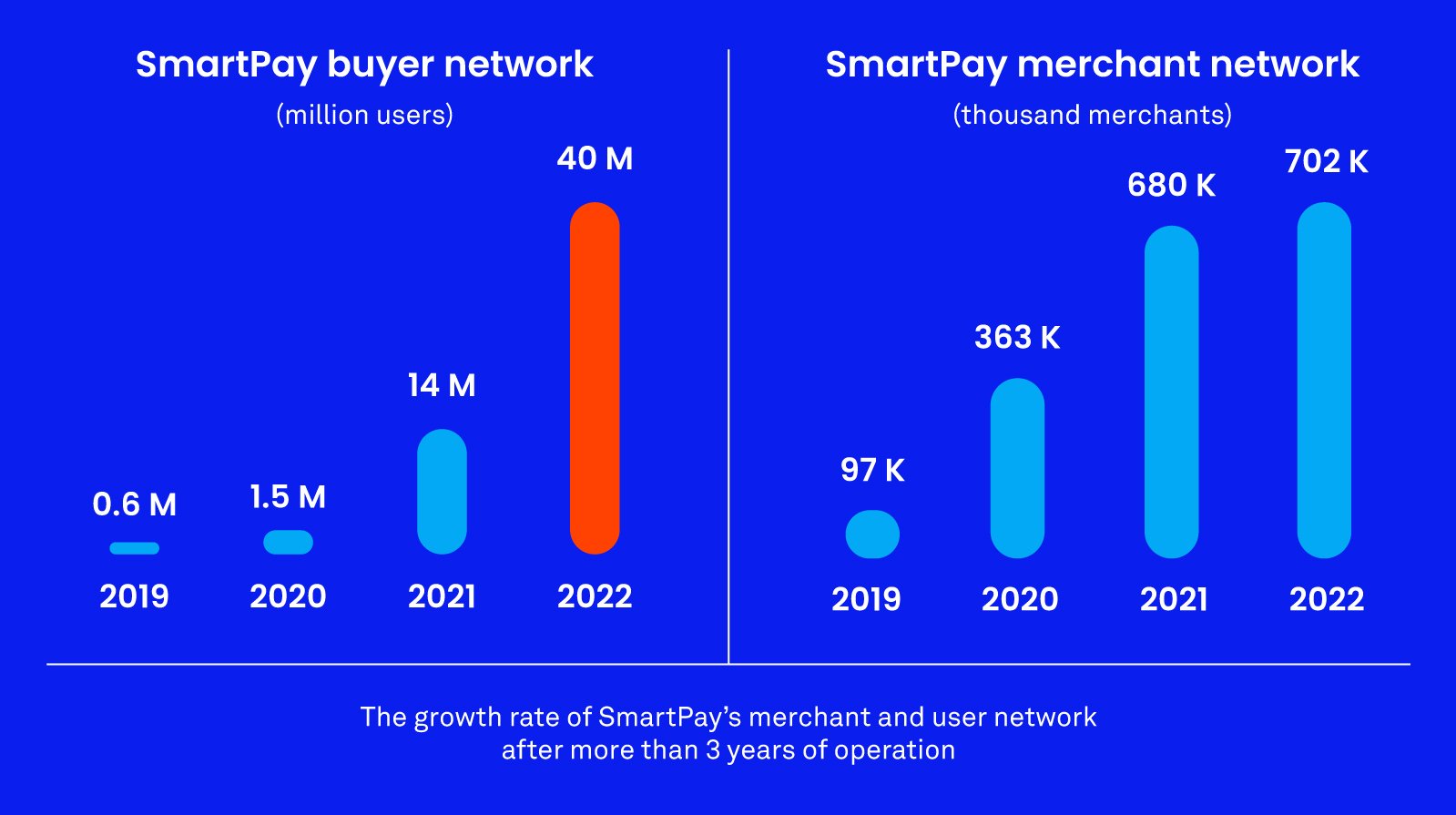

SmartPay, an OpenWay client and a financial inclusion disruptor in Vietnam, boasts record volume growth. After launching their mobile wallet in 2019, they onboarded a million active users in the first year, then a mere two years later grew to 40 million consumers and 700,000 merchants. User account balances, transaction logic, payment processing, instant reconciliation and settlement between users are supported in real time by the same Way4 platform on which they launched the project and which they manage themselves.

But not everyone has had the luck of choosing the optimal infrastructure for their business model and growth right from the start, like SmartPay. We have observed that the lack of real-time straight-through processing and flexibility are typical pain points of actively growing fintechs that have outsourced payment functionality. During a growth spurt, this drawback is especially felt as per-transaction pricing becomes unprofitable. This is when fintechs begin migrating to payment platforms that they can manage themselves.

Sprint athlete Allyson Felix, the seven-time Olympic champion, once found herself in a similar, limiting situation. When she started to plan maternity leave, she asked her sponsor, Nike, for special contract terms that would take into account her impact on her capabilities, training schedule, and so forth. The sponsor was not ready to make concessions, and the athlete stopped cooperating with them. Instead, she partnered with experienced footwear designers willing to take into account Felix’s unique racing needs, foot parameters, and overall vision of how athletic apparel should feel like. As a result, she ran the 2020 Olympics in Tokyo in custom-tailored sneakers, set her next record and became the most decorated female track and field athlete in Olympic history. She boasted to UBS journalists, “And I was like, ‘I did this in my own shoes.’”

My game — my rules

Payment startups must engage their target audience right away to effectively differentiate themselves from incumbent players. Just as athletes need cheering spectators to get a second wind, fintechs need a strong, loyal following who can give word-of-mouth and peer-to-peer recommendations to be adopted by the community.

Way4 has been designed so that the payment product setup is as flexible as possible. All aspects of the customer payment experience can be custom-tailored without costly hard coding. This allows the issuer to monetize multiple business models. Here are a few examples of how product setup varies depending on the needs of the payments player.

Many issuers use Way4 to roll out prepaid cards, but the product positioning may be dramatically different for each case.

National Bank of Oman has adapted prepaid cards to the requirements of their customer base. Their Badeel Travel prepaid cards come with fixed exchange rates, and the capacity to convert Omani Rial into nine of the most commonly-used global currencies; namely US dollar, euro, British pound, Swiss franc, Indian rupee, Thai baht, United Arab Emirates dirham, Saudi riyal, and Omani rial.

Banesco Panama, on the other hand, positions its prepaid cards as a social tool for the implementation of government programs for economic relief in the Caribbean region.

Enfuce, the innovative CaaS provider, recently won a government tender in Finland to deliver prepaid cards that will be used to disburse benefits and compensations to hundreds of thousands of Finnish citizens and those residing in Finland. Also, Enfuce and French social enterprise Welcome Place will pilot distribution of Visa-branded prepaid cards to refugees arriving in France.

Thanks to Level-3 data analytics, Way4 can analyze social card transactions in real time and decline them if restricted items are detected in the consumer’s basket, for example, alcohol purchases or gambling expenses. On the other hand, discounts will be applied to subsidized items like medicine or childcare products.

In the case of fleet industry cards, this functionality can be applied to create another set of payment rules: drivers can pay with their business expense cards only at selected gas stations and for predefined fuel types only, and not for purchases outside of their designated route.

In Vietnam, Mirae Asset Finance Company offers credit products as a digital-only experience – loan applications are made via smartphone. When customers want to use the approved loan to make a purchase, they scan the QR code in-store using the MAFC My Finance app, enter the transaction amount, and confirm the payment. Way4 manages customer and merchant information, sets up credit, creates instalment plans and calculates interest, and provides online transaction processing as well as accounting and merchant settlement.

In the same market, LOTTE Finance also offers Way4-powered BNPL products, where onboarding happens instantly during e-commerce checkouts.

Another OpenWay client in Vietnam, Timo, has entered the market as a cloud-based digital bank with a unique human-touch concept. Their onboarding routine is half digital, half human interaction-based. With just a couple of minutes on the digital app and 15 minutes at a Timo Hangout, the onboarding process can be completed securely and conveniently. Timo Hangouts look like trendy, minimalist cafes, for those who crave a light, moderate human touch while enjoying the privacy and convenience of the digital experience. For Timo customers the Hangouts can function as temporary workplaces or a meeting place, which increases the offering adoption.

As we already noted, for National Bank of Oman cardholders, multicurrency cards are a way to pay more profitably while traveling.

For cardholders of Halyk Bank in Central Asia, this functionality often works as a savings instrument. Since the rate of the Kazakh tenge fluctuates strongly and often, clients of this bank prefer to keep part of their savings in other currencies, such as euros, dollars, or yuan. Thanks to real-time processing in Way4, they can easily move their savings from one currency card account to another. The bank can also set up a rule: if the debit card balance in a certain currency stays above a certain threshold, the cardholder earns interest. It is a win-win for both the bank and its customer.

Enfuce has created My Carbon Action, a smart tool for calculating lifestyle carbon footprints from consumption. This not only helps consumers cut their CO2 emissions, but also increases their loyalty to their payment provider brand.

Enfuce will also power Science Card, which will enable customers to fund scientific projects of their choice at leading UK universities through their normal day-to-day payment activities.

These and other ESG services can be bundled with any card product that Enfuce manages on Way4, including debit, credit and prepaid cards.

In Vietnam, SmartPay is attracting SMEs with a mobile wallet ecosystem that supports cost-saving QR-code payments and transfers.

In France, Enfuce and Memo Bank, the first truly independent bank to emerge in France in the last 50 years, are launching virtual and physical cards enabling SMEs to follow expenses directly from their bank account in real time.

How local insight speeds up cross-border racing

In 1994, the Olympic Games were held in Lillehammer, Norway, in extremely cold conditions. And in 2020, Tokyo met its athletes with a heatwave. Training programs for athletes must take into account the conditions in which they will compete. The entire support team from sports doctors to fashion designers must look for ways to help acclimatize athletes to new weather conditions.

Digital banks and fintechs need similar support as they expand beyond their domestic market to a new geography. Gaining access to new customer bases is an important factor in a neobank or fintech’s growth, according to Aite analysts.

OpenWay’s insights have proved to be useful for those entering new markets, thanks to our project experience in 83 countries and multiple regional hubs in different continents. For example, most recently, our support in launching their consumer finance products in Vietnam was requested by the South Korean brand LOTTE and by the Japanese brand JACCS.

“We believe that to become a leader in a new market and keep your leadership, we need to work with trusted leaders,” noted Mr. Taniguchi Noboru, General Director of JACCS International Vietnam Finance Company. He also added: “it was critical for us – the high quality of the Way4 platform, fast time to market, successful experience of OpenWay globally and locally, excellent client service, and high operational efficiency.”

When entering new markets, it is important to consider investments that are related to compliance and regulatory requirements. According to Celent, “compliance activities consume a considerable portion of available IT resources for banks.” Our clients save resources since Way4 already supports a large number of regional standards and protocols, for example: SEPA payment rails in Europe or Sharia-compliant loans in MENA.

“What we value from Way4 and OpenWay is the expertise in managing ledgers in different countries, the payment conditions, and the connectivity to schemas. And I think it’s said so often that one should always focus on one’s own strength and try to find partners that can sort of add to their strength, and together, make it more,” commented Markus Melin, COO of Enfuce, in his video interview at OpenWay Club 2021.

Enfuce is based in Finland, with offices in the UK and Latvia, and a growing B2B customer base in multiple geographies.

Be the first by learning from the best

Designers of top brand athletic shoes rely on science in various fields. They stay ahead of developments in moisture-wicking fabric, and which insoles orthopedists have identified as the most ergonomic, and which cushioning softens the load on the joints as much as possible. In parallel, they collaborate with top athletes to match scientific achievements with Olympics-related challenges.

Our engineers, who have designed and continue developing Way4, similarly involve clients in creating our innovations roadmap. We conduct workshops and brainstorming one-on-one with the client. We have also since 2013 been holding OpenWay Club, an annual C-level forum gathering for OpenWay customers and other key digital payments market leaders for industry insights and joint creation of new business models.

OpenWay Club’s value to us and our clients is so high that even in 2021 during the pandemic, the OpenWay Club event in Croatia was attended by our clients, partners, and other payments experts from many world regions.

“I think there are several very positive outcomes. One of the most important has to do with the presentations that we saw here, to be able to compare the strategy that we have for growth in the coming years to other players, and to see whether it is in line with market trends. I believe that this is essential,” commented Jaime Martínez, Business EVP of Banesco Panama, in his interview at OpenWay Club 2021.

By proactively gathering insights from our clients in different regions, we are able to develop the most innovative roadmap and meet planned milestones. It explains, for example, how Way4 came to be a pioneer among white label digital wallet software. It also helps Way4 and OpenWay gain gold medals in industry ratings, such as Aite Matrix: Payment Processing Platforms and Ovum Decision Matrix.

Our clients have leveraged our innovative roadmap to be the first to cross many finish lines and collect trophies themselves. Just a few examples:

-

In 2018 National Bank of Greece was awarded for the Best Card Management System Project at the Bite Awards

-

In 2019 Enfuce and OpenWay jointly won a PayTech Award as the Best Payments Solution for Payment Systems in the Cloud

-

In 2020 Nets and OpenWay won a Paytech award as the Best Consumer Payments Initiative, for their Universal Digital Lending Platform, and this happenned a few years before BNPL became a sought-after and trendy payment option in many regions

-

In 2022 Timo won the Vietnam Technology Excellence Award for Payments Software by delivering a smart, savvy customer lifestyle experience with a human touch

-

In 2022 Enfuce won the Best Corporate Cards Initiative at the PayTech Awards

“The centralization of our card business on Way4 enables us to operate more efficiently, react to new market trends quickly, and be more competitive in the open banking environment,” commented NBG’s Sector Head of Cards Division, Pericles Papaspyropoulos on their award.

Why agility matters before, during and after the race

Since our client’s projects are innovative, there may be a high degree of uncertainty within the project. To handle this, OpenWay has come up with a unique holistic approach, which, according to Forbes, “can increase your chances of success when delivering complex digital transformation projects in fast-changing environments.”

From the very start of the project, we work with our client to clarify the goals and form the project and the team, the solution blueprint, the MVP and a detailed scope. OpenWay experts implement the project together with the client stage by stage. We can handle the delivery in an entirely remote mode, or with our team working on client’s premises. If the client is ready for agile project management, we implement innovative projects in agile.

During and after the delivery, our experts keep transferring the knowledge of Way4 system and of the industry in general to the client’s team. OpenWay Academy offers online and in-person training.

One example of the effectiveness of our project management methodology is how Way4 was implemented for Timo digital bank in Vietnam. We helped them launch an award-winning API-based digital banking offering in just 4 months on AWS.

Another example from the acquiring side is our project with Nexi, a large pan-European payment processor serving over a million merchants and consolidating all related operations on Way4. It took us only 9 months to launch this client’s new acquiring system with unique dynamic pricing models, centralized clearing and settlement, and payment schemes certification. Notably, it was achieved in 2020 in the face of stringent pandemic restrictions.

“We enjoyed a wonderful collaboration and built friendships with OpenWay's incredible engineers. No virus can beat great teamwork!” stated Giuseppe Dallona, CIO of Nexi.

Our clients can also apply for a service that we call the “core team”. Designated OpenWay engineers can work closely with the client team, on-site and remotely for the entire project duration, to enable and speed up knowledge transfer and the overall efficiency in delivery. Our joint team can plan agile sprints together and detect various delivery obstacles and find solutions in a timely way.

It is “flexible enough to work with people on our site, and come to a result. In the end we have a few deadlines, and you need to follow those deadlines. You need to make sure that everything is up and running. And that’s for me is one of the key factors why we took the decision to go with OpenWay,” commented on OpenWay’s team Wim Pardon, Chief Product Officer at Truevo, in his video interview at OpenWay Club 2021. Truevo is a disruptive multinational fintech.

Start fast and don't slow down

A high speed of migration and launches from scratch is possible for our clients due to a whole range of factors. This is the Way4 system itself, and our project management methodology. In addition, to launch their project even faster, our clients can receive product configuration pre-sets that are based on best practices and can be modified quickly to each client’s business model. These are known as Way4 Issuing Start and Way4 Acquiring Start.

When it’s time to diversify their revenue, our clients turn on new Way4 features. An issuer can transform into a CaaS player or wallet provider, step into merchant acquiring, or select other payment domains.

Major releases of our system come out twice a year. For each new functionality, we give clients guidance on how to apply it in their business. They receive our periodic digest of new Way4 features and can request a consultation with their dedicated OpenWay experts.

If your company has already progressed beyond the ranks of amateur runners and would like to compete in the payments industry on an Olympic level, regularly taking your place on the podium, please reach out to the OpenWay team. Let’s see if Way4 and our payment project delivery expertise can accelerate your business!

Get instant access to the Way4 brochure by filling out the form below:

About the author

Rudy Gunawan is the Managing Director of OpenWay Asia, the top-rated vendor of the Way4 digital payment software platform. He has been active in the payment industry for 20 years, serving as a consultant to businesses in the Middle East and Asia Pacific. In his current leadership role at OpenWay, he oversees the company's operations in Asia while promoting the board's strategic initiatives.

Rudy, who started his career as a process and technology consultant, is focused on people, innovation and corporate strategy. His passion is converting technology and ideas into better, everyday use.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network Int. and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.

Learn more: analytic reports, news and case studies

-

“IT Strategy and Priorities in Retail Banking, 2022: Accelerating Away from the Pandemic”. Report by Celent. March 23, 2022. Accessed April 10, 2023.

-

“The Customer Engagement Imperative in Financial Services”. Webinar by Celent. July 14, 2021. Accessed April 10, 2023.

-

“Neobanks: The Bumpy Road to Profitability”. Report by Aite-Novarica Group. December 10, 2020. Accessed April 10, 2023.

-

“Enfuce and Science Card launch revolutionary card to fund life-changing science through day-to-day payment activity”. Press-release by Enfuce. March 21, 2023. Accessed April 10, 2023.

-

“JIVF Selects OpenWay to Become a Consumer Finance Leader in Vietnam”. Press-release by OpenWay. March 13, 2023. Accessed April 10, 2023.

-

“Enfuce awarded contract by the State Treasury of Finland and Kela to deliver modern prepaid disbursement cards”. Press-release by Enfuce. February 22, 2023. Accessed April 10, 2023.

-

“SmartPay President shared about the journey to help small businesses go far in retail innovation”. SmartPay’s interview for CafeF. February 2023. Accessed April 10, 2023.

-

Laker, Benjamin. “Four Steps To Delivering Complex Digital Transformation Projects In Fast-Changing Environments”. Forbes. January 24, 2023. Accessed April 10, 2023.

-

Bleach, Tom. “Visa, Enfuce and Epassi Collaborate to Support Refugees in France”. The Fintech Times. January 4, 2023. Accessed April 10, 2023.

-

“LOTTE Finance and OpenWay Introduce New BNPL Service to Vietnam”. Fintech News Network. October 22, 2021. Accessed April 10, 2023.

-

“Vietnam’s Best Digital Banking Platform: OpenWay and Timo win at the Vietnam Technology Excellence Awards”. The Asian Business Review. October 2022. Accessed April 10, 2023.

-

“Universal Digital Lending Platform by Nets and OpenWay Recognized as “Best Consumer Payments Initiative”. Financial IT. September 22, 2020. Accessed April 10, 2023.

-

“Pleo and Enfuce Win the Best Corporate Cards Initiative at the PayTech Awards”. Fintech Finance News. July 1, 2022. Accessed April 10, 2023.

-

Dumasia, Joy. “Memo Bank chooses Enfuce to launch the first expense platform integrated into a bank account”. IBS Intelligence. February 11, 2022. Accessed April 10, 2023.

-

“Truevo: SME Acquiring in Europe Using Way4 SaaS”. Truevo’s video interview at OpenWay Club 2021. February 19, 2022. Accessed April 10, 2023.

-

“Enfuce: Launching Card-as-a-Service with OpenWay”. Enfuce’s video interview at OpenWay Club 2021. February 10, 2022. Accessed April 10, 2023.

-

Schou, Solvej. “Run the World (Girls): Alumna Natalie Candrian Sprints to the Top as Head of Product Design for Saysh, Olympic Track Star Allyson Felix’s Woman-Centric Lifestyle Brand”. ArtCenter College of Design. February 7, 2022. Accessed April 10, 2023.

-

“Banesco and OpenWay: Building the Future of Digital Payments in Latin America Together”. Banesco Panama’s video interview at OpenWay Club 2021. January 27, 2022. Accessed April 10, 2023.

-

“Mirae Asset Finance Launches Miraeasset Credit in Vietnam”. Press-release by OpenWay. December 01, 2021. Accessed April 10, 2023.

-

Dumasia, Joy. “Enfuce launches My Carbon Action in AWS Marketplace”. IBS Intelligence. October 1, 2021. Accessed April 10, 2023.

-

“OpenWay Named Best-in-Class Global Vendor of Payment Processing Software Platforms”. Press-release by OpenWay. 2021. Accessed April 10, 2023.

-

“How SmartPay Built a Financial Inclusion Wallet from Scratch”. Case study by OpenWay. November 13, 2020. Accessed April 10, 2023.

-

“Nexi Transforms Its Merchant Acquiring Business With OpenWay’s Way4 Platform”. Financial IT. October 13, 2020. Accessed April 10, 2023.

-

“National Bank of Oman launches Badeel prepaid cards to non-customers”. ZAWYA.com. July 16, 2019. Accessed April 10, 2023.

-

“National Bank of Greece Strengthens Market Leadership with Way4”. Celent. June 13, 2018. Accessed April 10, 2023.

-

“Enfuce and OpenWay: Cloud-Based Payment Innovations”. Case study by OpenWay. July 2019. Accessed April 10, 2023.

-

Graves, Ginny. “Olympic Clothing Designers Try to Beat the Cold with Technology”. Scientific American. February 6, 2018. Accessed April 10, 2023.

-

“OpenWay is a Leader in Wallet Solutions”. Press-release by OpenWay. 2017. Accessed April 10, 2023.

-

“Tsesnabank Invests in the Future with Way4”. Case study by OpenWay. December 2015. Accessed April 10, 2023.