Omnichannel: how top acquirers give merchants what they want

-2.png)

Some say that omnichannel commerce is the future of retail, but from the merchant’s point of view, this future is already upon us! The pandemic motivated many businesses to jump on new social platforms, websites, and other virtual touchpoints to reach customers as restrictions came, went, and came again. Periods of isolation and online shopping were followed by frantic socialization and return to in-store...and back online. As unprecedented numbers of people acquired a taste for e-commerce, they began to expect the same experience from their local brick-and-mortar: a seamless continuation of the same fast, convenient and personalized interaction they received through online channels.

Both online merchants expanding into physical stores and traditional retailers establishing an online identity face essentially the same challenges when their customers want to buy, return, give feedback, earn bonuses and receive deals seamlessly across virtual and physical channels. Many companies find that having multiple channels is not enough: they must coordinate as a whole the unexpected and ever-changing ways customers want to interact. And as businesses expand, managing a unified view of customer data collected from disparate channels becomes ever more complicated.

OpenWay, a top digital payment platform provider, shares in this article insights from successful omnichannel players, including its clients, among them leading merchant acquiring companies Nexi and Finaro (now part of Shift4). We will discuss what omnichannel is and how it differs from multichannel, what challenges companies face when making the transition, and what business and technological strategies lie behind a successful omnichannel offering.

Where did omnichannel come from? How is it different from multichannel?

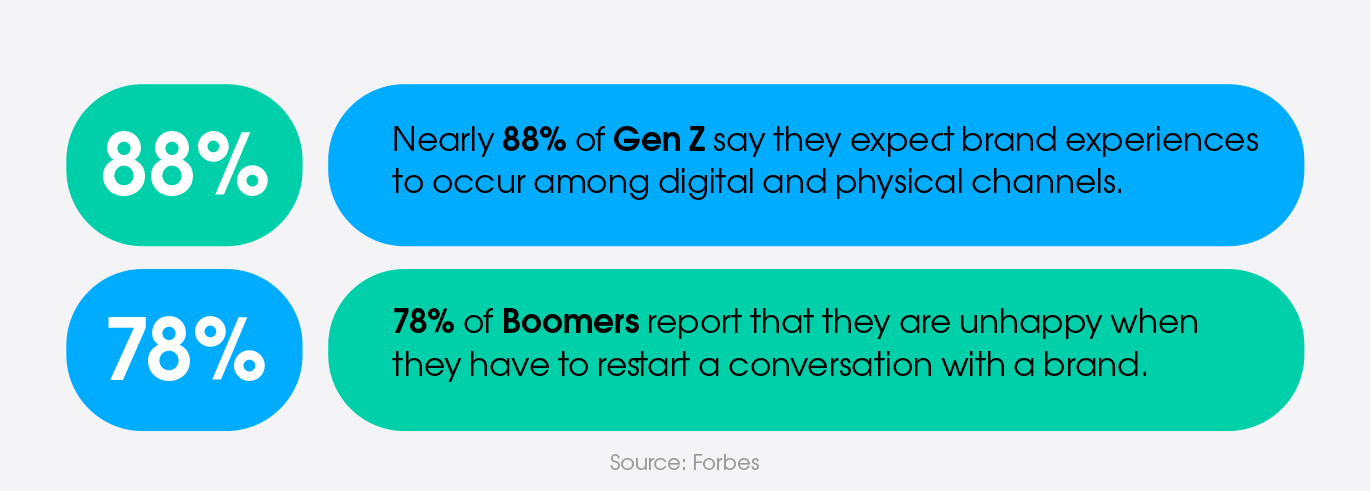

Omnichannel has been around for over a decade. The idea of starting interactions from one point, say, a website, and concluding them at a physical pickup location, is simple and familiar to most people who don’t expect a huge difference between online and physical stores. But when the word “omnichannel” was coined, the average consumer used only two touchpoints per purchase. In 2019, the number of average touchpoints for a consumer was reported to be six. Since the pandemic, many merchants quickly added new offerings to survive and then thrive. Curbside pickup, contactless and mobile wallets, BNPL payment choices online and in-store … the customer journey came to encompass more and more touchpoints across multiple channels.

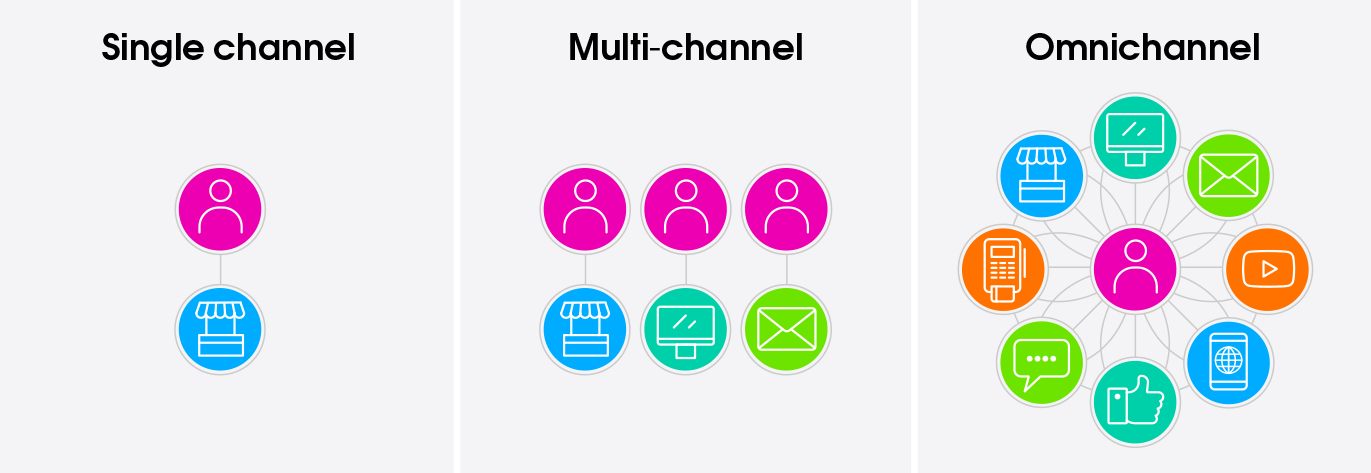

Now more than ever, merchants must consider the various channels their customer journey might include and what they look like from a customer point of view. Even if the destination is the same, is each channel a separate highway, passing through a completely different landscape? If so, no matter how much traffic each highway contains, what we have is multichannel, but not yet omnichannel.

So what is the difference? Multichannel focuses on making each channel as pleasant and attractive as possible for customers, measuring success in terms of engagement such as likes and views, and how conveniently and effectively customers can shop and checkout. Each channel is its own separate customer journey. If a customer wants to switch channels, he or she may need to start again, re-registering at worst and repeating a selection at best.

Omnichannel, on the other hand, is all about an integrated, smoothly fluid customer journey where the customer has a single view of the company and can choose any channel to communicate with a brand. More than one channel can be used to initiate, modify and complete a transaction and the journey will be seamless and consistent, meaning that customers can naturally transition from one platform to another and expect that all their previous interactions with the brand or company are accessible from there. And regardless of the channel used, customers should feel like they are engaging with the same entity at all times.

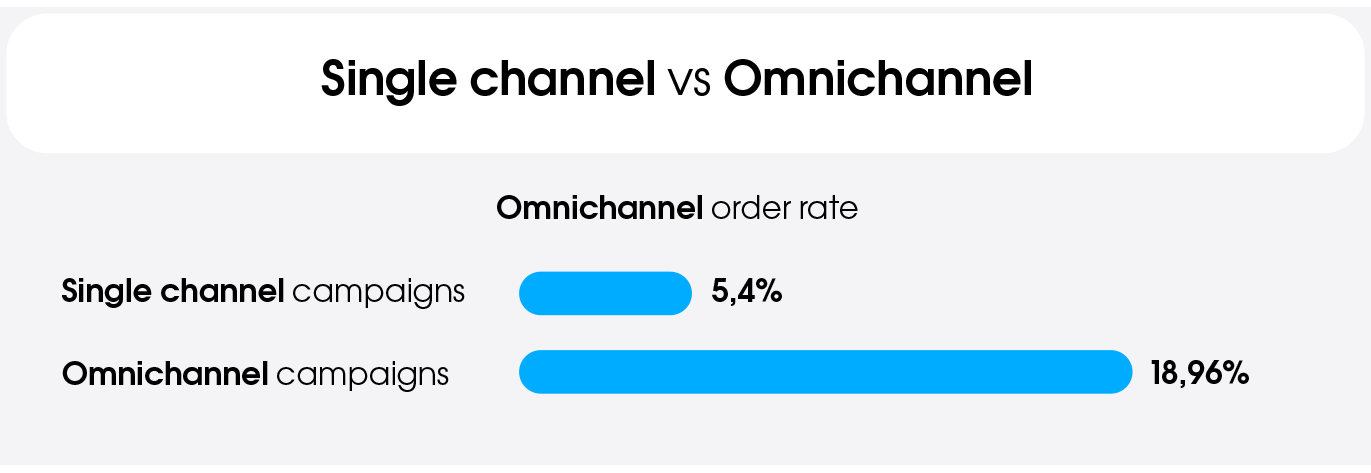

So that’s the customer view of omnichannel. What about the merchant’s? From their perspective, it starts with a consistent customer identity – recognition of a customer’s device, an ID or token, needed for cross-platform customer data management and security. Omnichannel is all about seamless payments, for which the where, the when and the how are entirely up to the customer. And more often than not, this is what people expect. According to one study, 90% of customers expect their interactions to be consistent across all channels. And even before the pandemic, a study revealed that single-channel campaigns showed a 5,4% engagement rate, while omnichannel campaigns enjoyed 18,96%.

What challenges stand in the way of true omnichannel?

It might be said of omnichannel that “if it was easy, everyone would be doing it”. Although the pandemic succeeded in driving many businesses to a multichannel approach, several factors prevent them from becoming truly omnichannel.

1. Separate online and offline operations, disparate POS and e-checkout systems. The data coming from separate online and offline systems are siloed, inconsistent, and cannot be used across various channels and platforms. For example, customers starting their transactions online cannot continue offline, and vice versa.

2. Consumer privacy and security issues increase as more and more parties process data. Omnichannel depends on huge pools of data collected from digital channels such as social media, chat, mobile apps and websites. For all this to make any sense, merchants must depend on tokenization and a secure, cross-platform customer identity management system. However, if customers see inconsistencies in the way a retailer’s online platform processes their data, such as unexpected requests for login or problems during onboarding and ID verification, they may opt out. According to one survey, nearly 92% of consumers had uninstalled a retail app over privacy concerns.

3. Difficulties in consolidating data, inheritance of different legacy systems. As merchants expand, they may acquire new platforms and channels that cannot be fully reconciled with existing ones, each with its own type of data, implementation and support. Onboarding, multi-currency, risk rules and special services may be handled by separate systems, meaning there is no unified conversion and integration of data. But this integration is essential for consumers to get unified access to their payment methods, preferences, history and social media accounts in a seamless experience.

What are the components of a successful omnichannel strategy?

1. Deliver a unified and coordinated digital performance.

No matter how diverse the company’s touchpoints and engagement points may be, it must be able to adapt and unite diverse elements. For this, a unified digital model and set of business rules should apply to all digital and physical channels, and account for the specifics of each and their combinations during a customer journey. If digital capabilities cannot meet this challenge, customers may become frustrated and clog the system with attempts to resolve an issue, raising the number of transactions and cost per transaction.

In the time leading up to the pandemic, OpenWay client Nexi wanted to focus on creating a better experience for merchants by rolling out various services like personalized dynamic pricing, and speeding up time-to-market for other new acquiring services. It decided to replace a variety of legacy acquiring systems with a single, flexible omnichannel platform where its million-merchant acquiring portfolio could thrive on a unified system. OpenWay’s Way4 acquiring platform was successfully implemented in 9 months, even though at the time the pandemic was well underway, and the company is now migrating two million merchants.

“Way4 addresses our need for fast time-to-market and large target volumes. The system architecture allows us to centrally manage all our operations, launch innovations and sustain transaction volume growth. We enjoyed a wonderful collaboration and built friendships with OpenWay's incredible engineers. No virus can beat great teamwork!"

Along with unified and coordinated digital performance of various technological platforms, the teams responsible for them must also make sure that internal and external communications are streamlined. Various teams may be handling different components of a single customer journey both online and offline, encompassing logistics, order processing, delivery as well as onboarding and account management. Management of these business processes involves maintaining a highly flexible and efficient workflow. Teams must understand the specifics of each channel and apply insights gleaned from customer data to deliver the experiences expected from them. Communication between marketing, sales, customer service, and other departments must be optimized, and external communication must be unified and coordinated between teams so that the customer receives a clear, consistent message at all times.

2. Collect and effectively use customer data to understand behavior.

More than ever, merchants need to know not only how much their customers are interacting with each channel and through which devices, but what the impact of each interaction is overall. Not only should they have access to a fully integrated tech stack capable of getting the necessary data, they may also need additional tools for deep data analysis. This includes processing of Level 3 data, data streaming, CRM tools, and acquiring profitability tools. Market research can reveal customer values and priorities, what channels they prefer, at what point they cross over to another channel and why. Cross-platform customer identity management, mentioned earlier, can help make sure that all the disparate behaviors are tied to specific customers, enabling profiles to be developed. It is important that data collection and analysis is done regularly and in a timely manner. According to one study, 60% of customer identity data is no longer relevant after two years.

Collecting and processing client data is a headache for many acquirers, but especially for those in the tourism and fleet industry. To support omnichannel acquiring, they have to simultaneously deal with two issues: processing mobile payments and performing real-time, in-depth analysis of customer and purchase data during the online transaction. For example, merchants may need to check at the time of purchase whether a corporate client is allowed to buy a certain type of product, such as fuel, food, or something else. Disallowed transactions should be rejected on the fly. The payment processing system must analyze both Level 2 and 3 data in real-time and adjust the authorization algorithm accordingly while supporting international payment cards and mobile payment applications. Especially in the fleet industry we see companies turning to more sophisticated payment platforms to keep up with their data needs: for example, Benzina ORLEN decided to change its processing platform to Way4 to increase payments efficiency and flexibly launch new-generation payment services.

“At Benzina ORLEN, we strive to offer the best payment services to our B2C and B2B customers at our filling stations. That’s why it is important for us to partner with the leading experts in the payment field. OpenWay provides one of the best payment solutions in the world, and has experience in large digital transformation projects in Europe.”

3. Based on the data, map service journeys with design thinking.

So, we have done a great job collecting and analyzing the data. Now we need to work further to collate it into defined end-to-end customer journeys. Although identifying the most frequently used touchpoints is important, it would be a mistake to channel all company resources to improving them without understanding what role they play in the overall customer journey. For example, despite the popularity of online self-service, customers may prefer live customer service given a certain recurring set of factors. By ignoring this and stubbornly steering people to digital-only options, a merchant might frustrate customers and lower overall satisfaction. For example, British Telecommunications discovered that 52% of surveyed customers wanted to speak to a customer service representative during a crisis or problem, and 24% during a routine task. Mapping the specific customer journeys of different customer profiles will help merchants offer the right channels during the right points of each journey. Moreover, since omnichannel is increasingly cross-border as well as cross-platform, ethnographic research may be necessary to analyze specific behaviors and preferences of various segments. Once a new customer journey has been developed, design thinking and rapid testing with customer groups will help make any needed adjustments and roll it out quickly.

One company that has taken the mapping of new customer journeys seriously is Finaro, previously Credorax and now part of Shift4. This company grew from a local start-up into a leading cross-border payment provider, an acquiring merchant bank, and a payment processing provider operating in 32 countries, including Europe, United States, and Asia, processing about $9 billion last year. One key to Finaro’s success is its quick rollout of new services, with a well-aligned creation, testing, and adjustment process for everything from customer onboarding, new payment methods, merchant currency pricing, conversion rate optimization tools, risk management, and more. Before the company shot to success it migrated to Way4 from a legacy platform. Way4’s unique, flexible online acquiring back office helps Finaro quickly and efficiently implement complicated processing rules, experiment with innovative services, and collect and process a variety of real-time data while providing uninterrupted processing.

4. Give customers convenient control over payment methods.

More than ever, convenience is the most important factor for customers when choosing a payment method. Convenience is the trump card, taking precedence over shopping local, which opens the door to global e-commerce and cross-border. SMEs do well here to prioritize the payment experience for increasingly sophisticated customers used to paying how they want and when they want. According to advisory firm Aite Group, it “expects to see crossborder and cross-channel commerce continue to grow, with buy online, pick up in store expanding to smaller merchants; marketplaces offering more sophisticated services to micromerchants regardless of location; and consumers demanding anytime, anywhere access to all of it”.

What combination of factors makes a certain payment method desirable and convenient depends on the customer and the overall experience. Cash, check, bank transfers, debit and credit cards, mobile wallets, Buy Now, Pay Later, prepaid cards…all these options are important to various generations of customers in a variety of situations. Flexibility of mobile payment options has been shown in studies to be important to the majorty of young millennials, senior millennials, Gen Xers and even baby boomers.

Among OpenWay clients are many acquirers who started their business with one segment or channel, then expanded to encompass others in accordance with the expanding payment needs of their merchants. For example, Halyk Bank chose to migrate to the Way4 platform while it was becoming the leading POS acquirer in its region. Then, the bank launched e-commerce acquiring on the same platform, and when it had become the top e-commerce acquirer, it launched QR payments for SME. The speedy launch and success of these merchant offerings was greatly facilitated by its new digital payments platform, which uses single set of data and business rules. Another example of an acquirer who was quick to provide merchants with a much-needed payment option was LOTTE Finance, a South Korean leader in credit cards who decided to enter the Vietnamese market.

“It was important for us to find a technological solution that would allow us to implement LOTTE Finance’s best practices in developing lifestyle financial services while taking into account the requirements of large online retailers in Vietnam for a seamless checkout experience. The Way4 platform satisfied all our requirements for solution design and our available use cases.”

How can your company offer omnichannel acquiring?

Make sure your company has the right culture. Omnichannel places new demands on the organization’s various teams. Various groups must learn to operate according to a new, agile, journey-oriented, cross-functional model that focuses on customer satisfaction, all while optimizing their own part, whether it is operations, product development, back office, compliance, or security. This requires close coordination across the organization.

Have the right technological foundation for the seamless experience needed for omnichannel. Merchants need a payment service provider who can enable omnichannel commerce and help them avoid fragmentation of payments. For this, they need:

-

An omnichannel platform that holds the customer’s entire history of interaction with the merchant and gives customer service representatives a holistic view of all channels, routes and interactions on the customer journey, allowing them to intercede, direct or interact as necessary.

-

A strong online back-end that handles and processes requests from self-service portals and websites, collecting and storing data where they are quickly accessible to a variety of advanced analytics tools.

-

A unified payment platform that reduces redundant systems. Each legacy payment platform may have its own system for its operations, security processes, and regulatory compliance. McKinsey notes that these systems include platforms for processing each type of payment, which includes checks, ACH, wires, cards, payments from non-bank organizations and real-time payments. By eliminating the redundancy and providing VAS such as payment tracking, data analytics and other features, a modern payment platform improves operational efficiency and reduces an organization’s expenses. It also offers a single view of payments activity, an essential part of the omnichannel view of the customer journey.

If your organization is ready to offer omnichannel and need a solid acquiring platform, we invite you to consider Way4. Our clients Nexi, Finaro, Raiffeisen’s Regional Card Processing Centre, Equity Bank, Banesco Panama, Lotte Finance, and others have chosen Way4 for providing their merchants with omnichannel, made possible on a single platform with a unified set of rules and data. The platform also is the only one on the market to provide an online flexible acquiring back office — meaning that acquirers can implement various business rules and have all data available to them in real time. Way4 has enjoyed successful use cases in a variety of payment business models involving POS, e-commerce, mobile payments, digital wallets, national payment systems, instant payments and instant settlements, BNPL, cross-border payments, fleet solutions, and others. It has also been proven to support acquiring businesses handling from thousands to millions of merchants within a single installation. It runs both on-premise and in the cloud, and is also available as an SaaS quick-launch solution that can be deployed in a couple of months.

What’s next?

If you want to learn how OpenWay solutions can support your acquiring business, please contact us. Our team will be happy to analyze your requirements and select the best option for your organization.

Learn more: analytic reports, news and case studies

-

May 27, 2022. “APIs Drive Omnichannel Growth by Connecting Real-Time Transaction Data Across Channels”. PYMNTS.com, Accessed July 6, 2022.

-

Vikas Kokhra, November 4, 2021. “Modern Customers Expect An Omnichannel Experience, And Marketers Need To Rise To The Occasion”. Forbes. Accessed June 6, 2022.

-

November 8, 2021. “Omnichannel payments: The time has (finally) come”. Finextra. Accessed July 6, 2022.

-

Greg Kilhstom. May 18, 2022. “Delivering a Seamless Omnichannel Customer Experience”. Forbes. Accessed July 6, 2022.

-

Jun-Hwa Cheah, Xin-Jean Lim, Hiram Ting, Yide Liu, Sara Quach. “Are privacy concerns still relevant? Revisiting consumer behaviour in omnichannel retailing”. Journal of Retailing and Consumer Services, Volume 65, March 2022, 102242. Accessed July 27, 2022.

-

McKinsey and Company. “Customer First: Personalizing the Customer-Care Journey”. Number 2, January 2019. Accessed July 20, 2022.

-

Heikki Väänänen. February 28, 2022. “The Three Pillars of Omnichannel Success”. Forbes. Accessed July 6, 2022.

-

Briedis, Holly, Gregg, Brian, Heidenreich, Kevin, Liu, Wei Wei. McKinsey & Company. April 30, 2021. “Omnichannel: The path to value”. Accessed Jul 6, 2022.

-

Ginger Schmeltzer, Ron van Wezel. December 2020. “Payments Modernization in Retail Banking”. Aite Group LLC.

-

Aite Group, January 2021. “Top 10 Trends in Retail Banking & Payments, 2021: Seizing Opportunities to Transform”.

-

Jorge Amar, Julia Raabe, Stegan Roggenhofer. February 1, 2019. “How to capture what the customer wants”. McKinsey & Company. Accessed July 27, 2022.