Alright, let's not sweat over multi-currency cards and payments

Meet the author

What is Revolut and what are the barriers to its future growth?

Revolut is a fintech startup created in the UK and designed to win customers over from traditional banks worldwide.

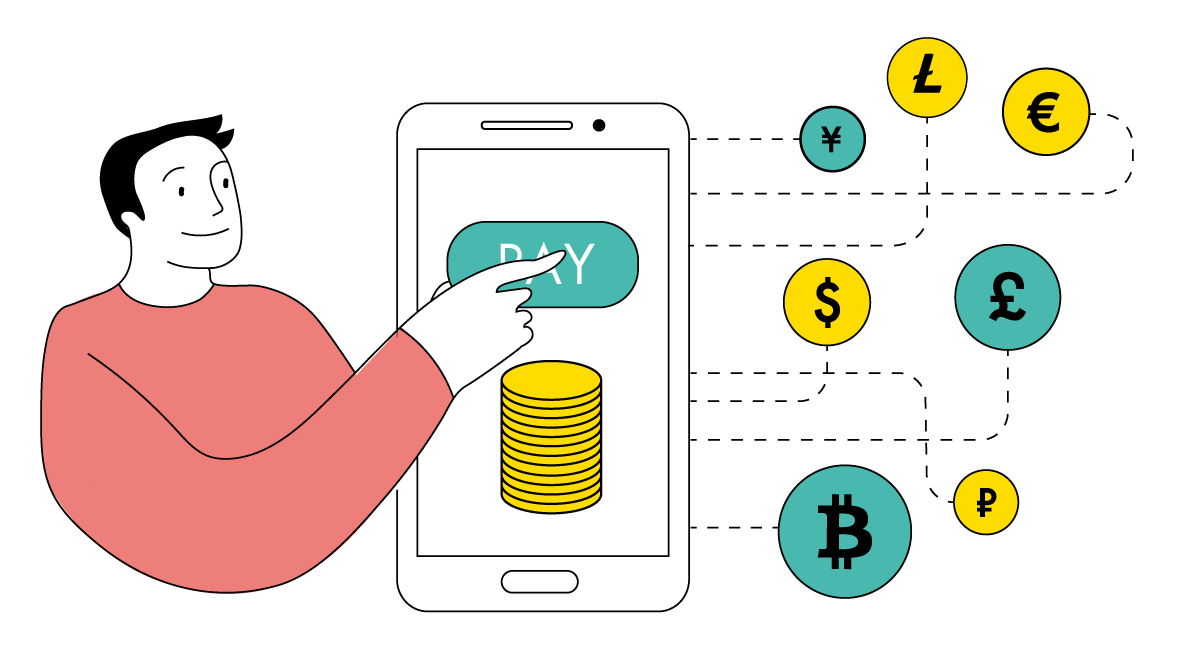

It offers Visa and Mastercard card accounts in dozens of currencies. Its cardholders can transfer money between accounts without bank fees and at a favorable rate. They can also store, spend and exchange cryptocurrency – Bitcoin, Ethereum and Litecoin. Revolut claims that its customers are never burdened with high currency exchange rates for payments or cash withdrawals.

Despite its success, Revolut faces competition. For example, it failed to expand into Russia some years ago. According to Russian banker Oleg Tinkov, it makes no sense for Revolut to open business in this country. There are similar products already – Tinkoff Black cards offer accounts in 30 currencies and favorable exchange rates. By 2019, Tinkoff Bank has issued 10 million debit and credit Mastercard cards, converting them into multi-currency ones per clients’ requests.

At the same time, we still do not see Revolut cards in Russia. Why is this player so successful in a developed market like the UK, while in Russia, where the market is developing, it is not?

An interesting fact. When I ask people why they use Revolut, the answer usually starts with: “Imagine, whenever you travel...” And then something about how great it is when you don’t pay extra for currency exchange when making card payments or withdrawing cash abroad. That is the key point. People do not tell you what Revolut really is. They tell you the problem that Revolut helps to solve.

Revolut-style services are not for everyone. They target a very specific audience: active young people with an entrepreneurial streak, who like to analyze and compare deals. They don’t choose a bank, they choose a tool that can solve their problem.

I don’t think it is a coincidence that Revolut customers think in terms of ‘no-sweat’ solutions. Their focus is on hobbies, families, friends, and work projects. They want to avoid hassle and unknowns when they travel and make payments.

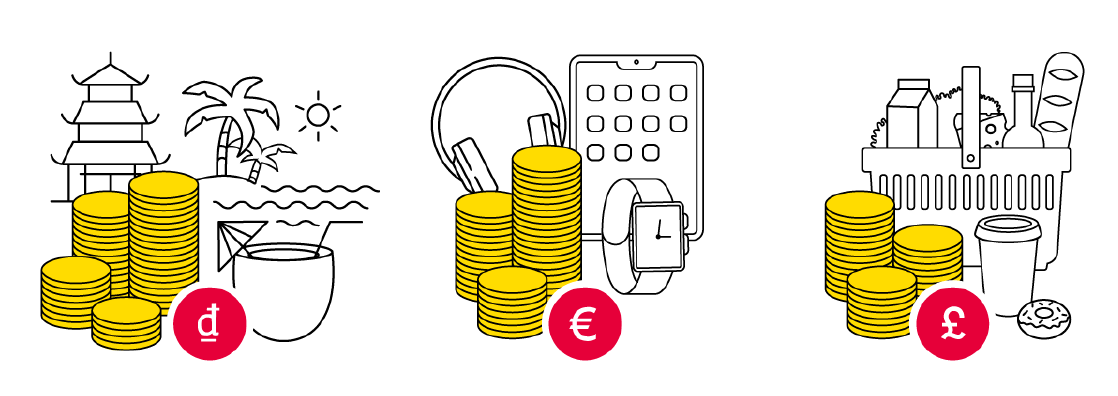

Use case #1: Currency conversion for payments in a trusted payment environment

How is Revolut typically used? My colleague Julian lives in the UK, spends vacations in Southern Europe and buys books online from US-based booksellers. A typical problem occurs when he wants to make payments in euros. Firstly, who wants to pay extra for currency exchange? Secondly, people prefer to know the total transaction amount in their home currency before the purchase, and not a day or two later.

Some European stores allow Julian to pay in GBP (his home currency) and to see the exact amount in GBP too. These stores offer the Dynamic Currency Conversion (DCC) service at POS. As for the American booksellers, they need the Multi-Currency Pricing (MCP) service to allow him to pay in GBP.

A merchant can request DCC or MCP services from their acquirer. Amazon provides such services. The global e-commerce processor Credorax, our client, provides them too. But many merchants still haven’t simplified currency management for their buyers. Buyers are asking their card issuers: “Can you help me?”

If Julian only used a card denominated in GBP issued by a regular UK bank, he would end up paying extra for currency exchange in Europe and would only see the final transaction amount days or weeks later on his statement. Instead, he takes the Revolut card, linked to accounts in multiple currencies. He transfers money from the GBP to the euro account in advance, if he’s planning payments and cash withdrawals abroad. Even if these euro funds are all spent, Julian can instantly transfer more from any other currency account at a low rate.

How long does it take to get a Revolut card? I don’t have one yet, but Julian has recommended it. Apparently, I can get this card delivered to my home in Belgium in four business days – just in time for my next trip abroad.

Revolut’s price list is very simple and fits on a single webpage – even in large font! It’s not like a typical bank price list which people have to download as a PDF to study. If customers are encouraged to order a new card and receive it quickly, then the card fees should be quick and easy to understand.

Use case #2: Traveling and leaving a trusted payment environment

Our team travels all over the world to visit clients. For example, I often go to Nairobi where Equity Bank of Kenya is headquartered. For all my shopping there, it makes sense to have an account in the local currency: M-PESA e-money or Kenyan shillings. But it’s very difficult for me to open an M-PESA account. It requires a local SIM card, for starters. At the same time, I avoid using my regular bankcard, at least not in every store, due to high fraud risks.

So, what can I do?

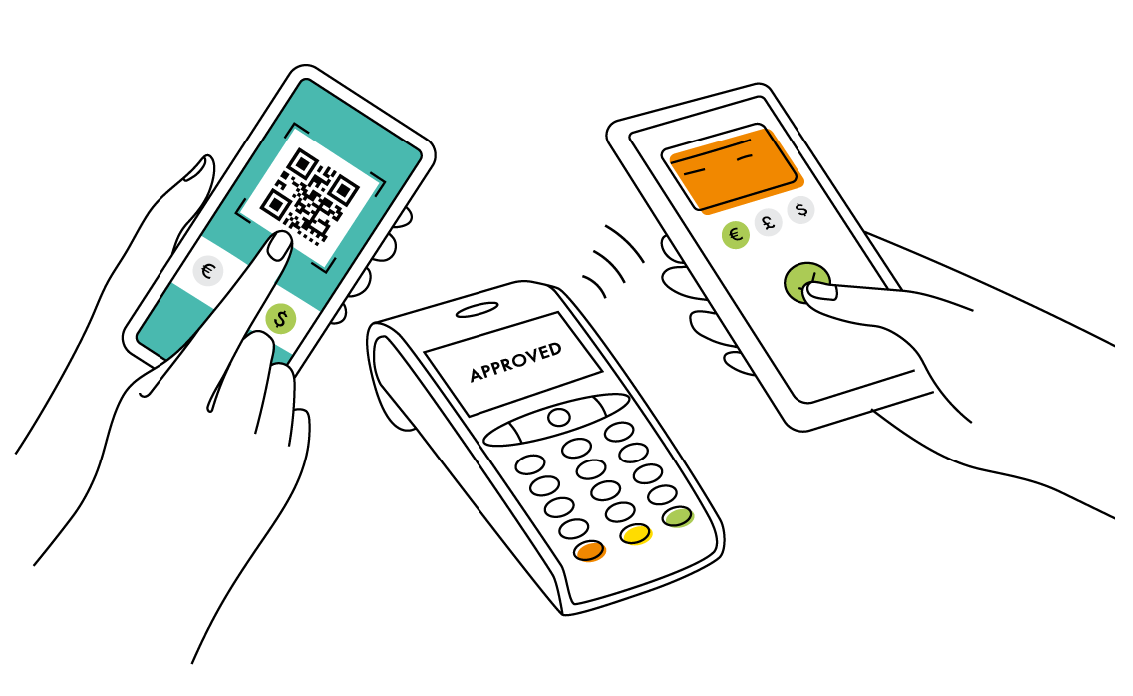

Maybe get a multi-currency card with a Kenyan shilling account? To avoid skimming, I would add this card to my iPhone apps for contactless payments. Apple Pay has not reached Kenya yet, but mVisa has. With these QR code payments my money is safe. In stores that don’t accept mVisa, I would use cash. A multi-currency account supports withdrawals at local ATMs without currency conversion fees.

Use case #3: Savings in foreign currency

In the case of emerging markets, currency exchange rates fluctuate quite dramatically. For example, in Kazakhstan the local currency, tenge, has plunged 20% against the US dollar over the last two years.

The exchange rate for KZT (Kazakhstan tenge) to EUR was chaotic and unpredictable all year in 2015.

Locals, even those who never go abroad, often save money in more stable currencies e.g. euros or dollars. Someone who travels to neighboring China may choose Chinese yuan. Anyway, these savings are often stored at home, and when it’s time to exchange money, many would prefer special foreign exchange kiosks.

Why are banks not popular enough for currency management? Usually, their fees are higher and their opening hours are shorter than exchange kiosks. And when it comes to withdrawals from a bank account, the process is far from quick. In a crisis situation, when people need foreign currency urgently, they can’t wait till their branch opens or stand in a long queue.

So, what can be done to attract those savings to banks?

In Kazakhstan our client Halyk Bank issues multi-currency cards. Even better, it offers to convert existing debit or prepaid cards into multi-currency ones. Imagine, as a customer of Halyk, I’m finally able to move my money between different currency accounts in a second. Currency conversion is now completely self-service, and I am not irritated with the slowness of in-branch withdrawing, exchanging and depositing.

Now my Halyk card covers both my payments and savings needs. If the card balance stays above a certain threshold, I earn interest. It’s a win-win for me and my bank.

Use case #4: Corporations benefit too

From time to time clients and partners visit me in our Belgian headquarters, but more often I travel to their offices instead. Not all of my trips are within Europe. There are dozens of countries around the world, from the US to Indonesia, where I go and can’t help worrying about currency exchange. How much cash should I withdraw to pay for a taxi? What conversion rate is used in the hotel where I am staying?

Could my bank help me worry less about travel expense management? Corporate multi-currency cards, with a good exchange rate and low cash withdrawal fees, tick all the boxes. They are convenient for making business purchases in a foreign currency. They allow businesses to save money and also give peace of mind to the traveling employees. It seems too good to be true, but such cards really do exist. Our client Enfuce, a global cloud-based payment processor, is one such issuer.

If the corporate multi-currency card is powered by our WAY4 solution, then it can recognize exactly what I am buying in real-time. It allows payments only for certain product categories and within spending limits which my company defines. The limits can be unique for each corporate card or each department, or the same for all the employees.

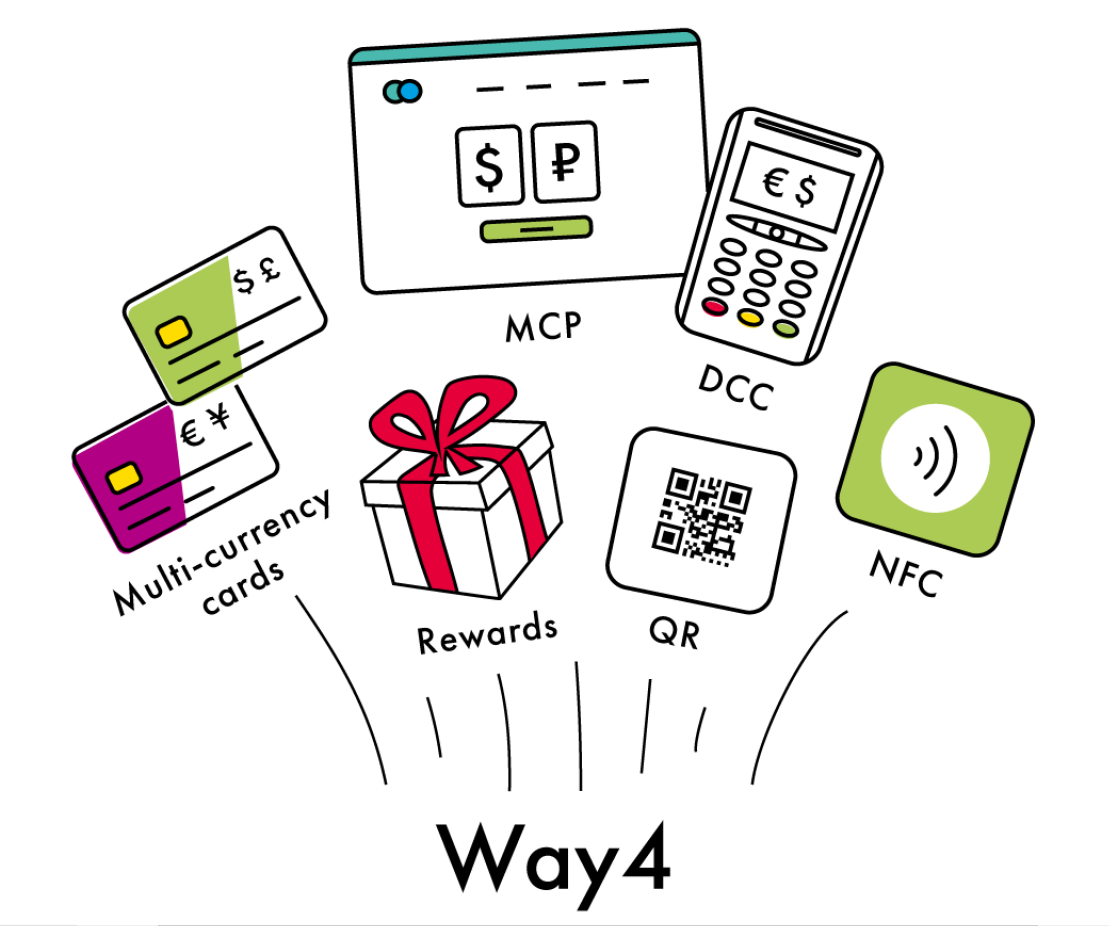

So how does WAY4 help banks address all these use cases?

It's not a rhetorical question. We’ve recently worked on a large number of multi-currency card projects.

Acquirers such as Credorax use WAY4 to power DCC and MCP, increasing the number of multi-currency merchants in their portfolio. Convenience for buyers results in more sales for the merchant and more revenue for the acquirer.

Issuers use WAY4 to launch multi-currency cards -- most often debit and prepaid ones. Customers can even get a virtual multi-currency card instantly, via mobile app. Banks like this product because all currency-related fees end up with them, instead of with an exchange kiosk. It’s also great to attract new clientele. For example, National Bank of Oman offers prepaid contactless multi-currency cards ‘Badeel Travel’ to any Omani resident.

Technically speaking, we offer issuers two solutions, one more suitable for developed markets and another for developing ones.

Solution #1: Multi-currency card with separate balances

Among our clients who use this solution, those serving European markets have benefited the most. But in emerging markets there are successfully launched projects as well.

With this approach, a customer can open checking, credit, savings or other accounts in many different currencies, with just one card to access and manage them all. Typically, the bank stores accounts in the core banking system, and the card resides in WAY4.

When this card is used for payment, WAY4 authorizes funds from one of many accounts. By default, the account currency matches the merchant currency, but the bank can allow customers to reconfigure the card logic. For example, during a trip in Indonesia, the cardholder might want to always use the payroll account in GBP instead of an account in local currency. There could be purchases from American online store or money transfers to friends in Paris. In each of these scenarios, our system routes the transaction to the account pre-defined by the customer.

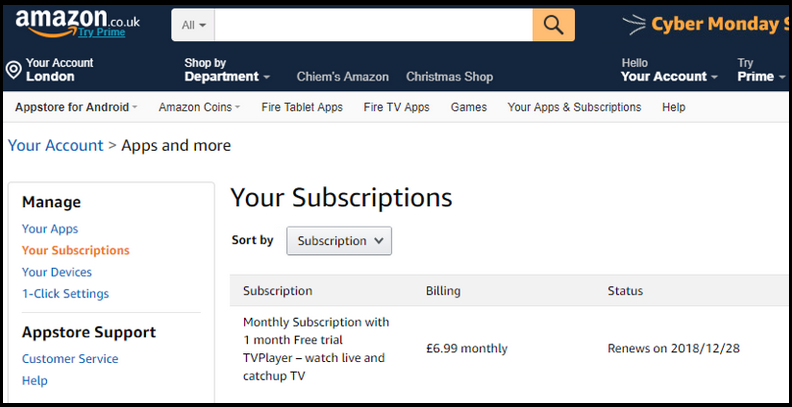

Subscription management is what I consider a ‘multi-currency pitfall’. Although I mostly buy goods priced in euros, I use several subscription services on Amazon UK, which requests payments in GBP. It would make sense for my card to detect the subscription currency automatically and charge the corresponding account. OpenWay is developing the solution that will help consumers like me.

With the new functionality of multi-currency cards, my Amazon UK subscription payments will be taken from my GBP account, while other subscriptions, such as Apple store purchases, from my euro account. My mobile app will display all subscriptions as a single list or grouped by the account currency. I need this feature badly, because right now I usually only remember the subscription after it is paid. It would be great to have the opportunity to review, cancel or reassign the payment to another account.

Solution #2: Multi-currency card with one shared balance

Based on our clients’ experience, this solution works best for developing markets, where accounts and cards are usually managed in the same WAY4 system.

For example, I splash out on an expensive purchase – a smart fridge. Maybe I don’t have enough euros in my account. In this case, WAY4 can get the remainder from my accounts in other currencies, depending on their balances and what account priority was set up.

When paying from another account, the purchase currency and account currency might not be the same. That is why our system can grant an overdraft on the account of the default currency – our client, Almanit Bank, chose this setting for their project. Or, the overdraft can apply to all the multi-currency accounts associated with a card, the option chosen by Halyk Bank.

On the other hand, you can configure WAY4 to always make payments from the default currency account, and if there are insufficient funds, to simply reject the transaction. For example, a resident of Finland works for a Swedish company and often goes to Vietnam for vacation. His basic expenses are in euros, so even though his salary is paid in Swedish krona, he mostly makes payments in euros. His account in Vietnamese dong is used only during his vacations and never for his daily expenses at home.

Issuing revenue options

Currency conversion represents a stable revenue stream from multi-currency cards. It can be a fixed percentage from the transaction amount, or a fee embedded in the currency exchange rate – WAY4 supports both settings.

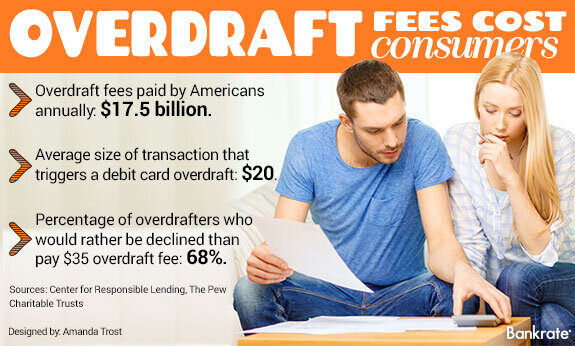

Multi-currency cards are usually debit or prepaid products, but some of our clients choose to grant their cardholders an overdraft to cover insufficient funds, and the overdraft interest serves as an additional revenue source.

Wallets and loyalty – one sweet bundle

If I am using a multi-currency card, I obviously want to manage it in a convenient way, preferably without visits or calls to my bank. Our WAY4 mobile wallet comes in handy, displaying all the card’s currencies and balances. The cardholder can transfer money between currency accounts, make purchases, change settings, and view the transaction history. When the card account accrues interest, it is shown in the app as an extra motivation to keep this deposit untouched. Apart from currency management, consumers use WAY4-powered mobile wallets on daily basis for authentication, payments and transfers, bonus point management and many other banking activities. The app even allows them to link cards issued by other banks.

Since the WAY4 wallet is white-labeled, our clients use it as they see fit. Each bank decides for itself which partners to connect via API in order to expand the wallet menu. For example, consumers can use our app to pay for parking or bike rentals, movie tickets or a museum membership, train tickets or shares. I use this service with my Belgian bank, and it is so much more convenient than searching all over my car for a parking card. Each time the app makes my life easier, my loyalty to this bank grows.

Loyalty programs complement all kinds of multi-currency cards, whether it’s retail or corporate customers, shared or separate balances. For example, cardholders of Almanit Bank get cashback for transactions in any currency, accrue bonus points and can use points towards payments too. WAY4 analyzes the total turnover for all the currency accounts, converts the bonus into the default currency and pays it in that currency. Of course, it’s also possible to calculate and add a bonus to each account separately, in its corresponding currency. But we noticed that the latter option is not usually attractive to banks.

NFC, QR, tokenization

My idea of using a multi-currency card within Apple Pay and mVisa apps came from the live projects already launched by our clients. Our system handles the account authorization for NFC and QR payments just as for other transactions, by using tokens instead of card numbers.

Also, WAY4 can issue a separate virtual card to each currency account with an adjustable limit for Internet purchases, and these cards can be tokenized too. This could be handy if my family travels abroad while I stay home. They could use my multi-currency funds without actually taking my physical card.

To sum up

What did I want to say by telling all these stories? With WAY4, our clients do much more than Revolut and other currency exchange-oriented competitors. If you have a multi-currency project in mind, maybe we should talk. Let’s identify the core customer need in your market and devise a solution together. Your customers won’t have to sweat over multi-currency payments.